Blog

-

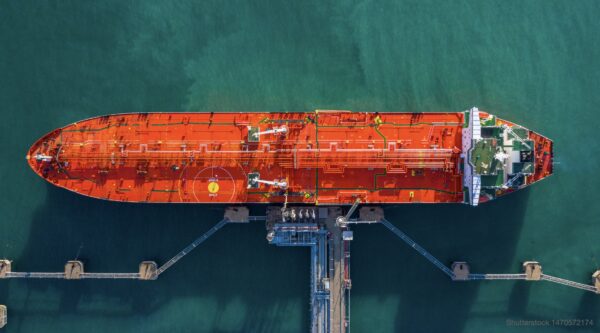

Ammoniak als Shipping Fuel – eine Übersicht

Welche Rolle kann Ammoniak als Low-Carbon Fuel in der Seeschifffahrt spielen? Das potenzielle Marktvolumen wäre enorm, aber die Unwägbarkeiten sind genauso groß. Es gibt eine ganze Reihe von Kandidaten, die fossile Fuels ersetzen wollen. Noch ist unklar, wer sich durchsetzen wird. Die Reeder stehen damit…

-

Dieselskandal bei Schiffsmotoren

Jetzt hat auch der Schiffsmotorenbau einen Dieselskandal, der im Umfang an die jahrelangen Manipulationen bei VW erinnert. Der führende japanische Motorenbauer IHI musste einräumen, seit über 20 Jahre den Kraftstoffverbrauch und die Emissionswerte von mindestens 4200 großen Schiffsmotoren manipuliert zu haben. Etwa die Hälfte der…

-

Elektromobilität und der fossile Ölverbrauch – Basiszahlen und methodische Probleme

Tags: ElektromobilitätAnfang dieser Woche erschien der „Global EV Outlook 2024“ der Internationalen Energieagentur (IEA). Er liefert auf 174 Seiten eine globale Bestandsaufnahme. Elektromobilität ist der derzeit realistischste Pfad für den Ausstieg aus fossilen Kraftstoffen im Straßenverkehr. Insofern spielt sie auch in unserem Projekt Fuel.Tracker.2050 eine wichtige…

-

Methanemissionen in der Nordsee

Nach wie vor werden illegale Klimaemissionen in der Nordsee nur symbolisch geahndet. Die britische Neo Energy emittierte auf ihren Offshore-Anlagen mindestens 1200 Tonnen Methan über eine Gasfackelanlage, die nicht brannte, direkt in die Atmosphäre. Die Fehlfunktion blieb 7 Monate (!) lang unentdeckt. Die Geldbuße der…

-

Wasserstoff: Zum Jagen tragen – eine Bestandsaufnahme für Nordwesteuropa

Tags: WasserstoffDie IEA veröffentlichte in dieser Woche ihren aktuellen „Northwest Europan Hydrogen Monitor 2024“. Er zeigt, wie weit Grüner Wasserstoff (aus Grünstrom) und Blauer Wasserstoff (Erdgas plus CCS) bisher vorangekommen sind. Die Region umfasst 10 Länder, darunter Deutschland, Benelux, Frankreich, Norwegen und UK. Addiert man die…

-

Dekarbonisiertes Ammoniak: Fuel und Carrier für die globale Energiewende

Tags: AmmoniakIn zwei Artikeln stelle ich Ammoniak als möglichen Baustein der globalen Energiewende vor. Der erste Teil präsentiert Basisdaten zum heutigen Ammoniakmarkt und skizziert mögliche neue Anwendungsbereiche. In nächsten Artikel geht es dann um die Chancen von dekarbonisiertem Ammoniak in der Seeschifffahrt. Ammoniak ist ein Thema…

-

Ölpreis – Kurzkommentar

Tags: ÖlpreisBrent Crude fällt zum Handelsstart leicht auf 90 Dollar je Barrel. Da die Preise in Erwartung des iranischen Angriffs schon letzte Woche gestiegen sind, gilt jetzt: „Buy the rumor, sell the fact“. Trotzdem wachsen die geopolitischen Risiken und damit auch die Ölpreisrisiken seit dem 7.…

-

Methanol: Ane Maersk im Hamburger Hafen

Heute lief die „Ane Maersk“ im Hamburger Hafen ein. Sie ist der weltweit erste große Containerfrachter, der mit „Grünem Methanol“ angetrieben wird. Maersk hat insgesamt 24 Containerfrachter bei asiatischen Werften bestellt, die mit Dual-Fuel Engines ausgestattet sind, also Methanol oder konventionelles Fuel Oil nutzen können. Das…

-

CCS-Projekt Porthos: Teurer als geplant

Porthos (NL), eines der fünf großen CCS-Projekte in Europa, wird deutlich teurer als erwartet, meldet das NRC Handelsblad. Statt 0,5 Mrd. wird es demnach mindestens 1,3 Mrd. Euro kosten, das von Rotterdamer Raffinerien und Industriebetrieben bereits abgeschiedene CO2 wenige Kilometer vor der niederländischen Küste in…

-

New Report: The Dirty Dozen – The Climate Greenwashing of 12 European Oil Companies

Our new report on the climate ambitions of oil companies in Europe, commissioned by Greenpeace (Vienna). Executive Summary 1. What contribution does Big Oil make to the energy transition and to curbing climate emissions? After the record year of 2022, in which many oil companies…

-

Ölwende nicht in Sicht: Globaler Ölverbrauch steigt 2023 auf Rekordhöhen

Tags: ÖlnachfrageDer globale Öldurst springt in diesen Sommermonaten von einem Rekord zum nächsten. Für den Juni schätzt die IEA den Verbrauch auf 103 mb/d (Mio. Barrel pro Tag). Die nächsten Monate könnten noch höher liegen. Im gleichen Maße steigen die Klimaemissionen. Noch immer ist keine Trendwende…

-

Studie: Methanemissionen in deutschen Erdgas-Lieferketten

Deutschland steckt mitten in einem gaspolitischen Neuanfang. Jetzt werden die Weichen für die zukünftigen Gasimporte gestellt. Gleichzeitig wird immer deutlicher, in welchem Umfang die Methanemissionen der globalen Gasversorgung das Klima schädigen. Die Studie verbindet beide Herausforderungen. Welche Länder können den wachsenden LNG-Bedarf Deutschlands decken? Und…

-

Studie: Der LNG-Boom in Deutschland

Tags: LNGLNG: Liquefied Natural Gas (Flüssiges Erdgas). Vor einem Jahr nur in Fachkreisen bekannt, heute die wichtigste Stütze unserer Gasversorgung. Unsere Überblicksstudie, erstellt im Auftrag von Green Planet Energy, gibt auf 50 Seiten einen umfassenden Überblick: Wie funktioniert die LNG-Technik? Wie groß ist der LNG-Markt? Wer…

-

Paper: Ölverbrauch in Deutschland 2017-2022

Tags: ÖlnachfrageDas Paper beschreibt die Ölnachfrage in Deutschland und Europa in den Jahren 2017 bis zum September 2022. Im Mittelpunkt steht die Frage, wie sich die deutsche Ölnachfrage seit Kriegsbeginn (24. Feb. 2022) im Vergleich zu anderen europäischen Ländern und im Vergleich zu Europa insgesamt entwickelt hat. Die…

-

Studie: Oil Profits in Times of War

An EU-wide analysis of higher margins on the sale of diesel and petrol since the beginning of the Ukraine war A few days after the launch of Russia’s war against Ukraine on Febru- ary 24, there was a massive increase in gas station prices in the…

-

Neue Studie: Klimaschäden durch Erdgas

Tags: Erdgas & KlimaIm Auftrag von Green Planet Energy eG haben wir die jüngsten internationalen Studienergebnisse zum Thema „Klimaschäden durch Erdgas“ zusammengetragen und ausgewertet. Im Mittelpunkt stehen dabei die Methanemissionen, die spätestens seit der COP26 („Methan Pledge“) stärker wahrgenommen werden. Auch die EU-Kommission legt in diesen Tagen Vorschläge…

-

Internationaler Überblick: Ölpreise, Gaspreise und Kohlepreise

Tags: EnergiepreiseDer Chart zeigt die Entwicklung der wichtigsten fossilen Energiepreise weltweit: Bei Öl reicht das Global Marker Oil Brent aus der Nordsee. Beim Erdgas muss (noch) zwischen den Preisen in den USA, Westeuropa und Fernost (LNG Spot) unterschieden werden. Bei der Kohle beschränken wir uns auf…

-

Methanemissionen russischer Gasimporte

Vor kurzem hat das UBA eine bislang wenig beachtete Studie über Vorketten-Methanemissionen der deutschen Erdgasimporte vorgelegt (5). Überraschendes Ergebnis: Sie scheint die Klimabelastung russischer Erdgasimporte massiv zu unterschätzen. Die Zahlen liegen um den Faktor 5-7 unter den Ergebnissen vergleichbarer internationaler Studien. Zugegeben, angesichts der historisch…

-

Die aktuelle Lage im Gasmarkt – Szenarien und Optionen (Thesen)

Tags: ErdgasmarktDie deutsche Debatte über die Gaspreiskrise schwankt bislang zwischen kurzfristigen Entschärfungen (z.B. Verbraucherschutz, EEG-Umlage senken) und langfristigen Lösungen (Ausbau der Erneuerbaren Energien). Aber dazwischen klafft eine breit strategische Lücke in der deutschen Erdgaspolitik. Hier einige Thesen und Anregungen: (1) Wenn der Winter mild/normal bleibt, bleiben…

-

Studie: Grüner vs Blauer Wasserstoff: Ein Vergleich der Klimaeffekte und Kosten (Sep./Jan.2021)

Tags: WasserstoffDas Thema Wasserstoff hat in diesem Jahr weiter an Fahrt aufgenommen. Doch wie soll der Markthochlauf einer Wasserstoffwirtschaft ablaufen? Welcher Pfad verspricht die besten Ergebnisse beim Klimaschutz, bei den Kosten und für neue Arbeitsplätze? Im Auftrag von Green Planet Energy (Greenpeace Energy eG) haben wir…

-

Methanemissionen und Blauer Wasserstoff

Tags: MethanemissionenDie globale Öl- und Gasproduktion und der Transport der Energieträger bis zum Verbraucher sind mit hohen, extrem klimabelastenden Methanemissionen verbunden. Die Mengen wurden in den letzten Jahren immer weiter nach oben revidiert. Das belastet auch die Klimabilanz von Blauem Wasserstoff. Deutsche oder europäische Wasserstoffproduzenten können…

-

Wasserstoff im Klimaschutz-Sofortprogramm

Tags: WasserstoffWas muss direkt nach der Bundestagswahl in knapp vier Wochen geschehen, wenn die politisch vereinbarten Klimaziele erreicht werden sollen, also Klimaneutralität bis 2045 und Reduzierung der Emissionen bis 2030 um 65% gegenüber 1990. Die Berliner Institute Agora Energiewende, Agora Verkehrswende und die Stiftung Klimaneutralität schlagen…

-

Überblicksstudie: Der Öl-Report 2021

Der Öl.Report 2021 – Zielsetzung Klimaneutralität ist ohne den Ausstieg aus fossilen Energieträgern nicht möglich. Das gilt für Kohle, Erdgas und Erdöl in gleicher Weise. Fossiles Öl ist noch immer der wichtigste Energierohstoff der Welt, auch in Deutschland. Der komplexe Ausstieg aus der Ölwirtschaft braucht jedoch…

-

Global Energy Briefing Nr.194: Die aktuelle Situation auf den internationalen Energiemärkten

Die aktuelle Ausgabe unseres Newsletters informiert Sie über alle wichtigen Trends und Preise auf den internationalen Energiemärkten. Das Jahr 2021 begann ungewöhnlich lebhaft. Rekorde, wohin man blickt: – Die LNG-Preise in Fernost verzehnfachten sich nach dem Tief im …

-

GEB193 – H2 Edition: Wasserstoff – Preise, Kosten, Emissionen

Tags: WasserstoffIn der zweiten Ausgabe der „H2-Edition“ unseres Global Energy Briefing dreht sich erneut alles um das Thema Wasserstoff. Schwerpunkte dieser Ausgabe (42 Seiten) sind Preise, Kosten und Emissionen der Wasserstoffproduktion (Grün/Blau). Interessiert an einem Abonnement…

-

GEB192 – H2 Edition: Wasserstoffmärkte und Wasserstoffpolitik

Tags: WasserstoffIn unserer ersten Ausgabe der „H2-Edition“ des Global Energy Briefing dreht sich alles um Wasserstoff. Schwerpunkte sind zwei Aspekte der aktuellen Entwicklung: Wasserstoffpolitik und Wasserstoffmärkte (34 Seiten). Interessiert an einem Abonnement unseres Newsletters? Hier finden…

-

Grün oder Blau? Wege in die Wasserstoffwirtschaft 2020 bis 2040

Das Thema Wasserstoff hat in diesem Jahr weiter an Fahrt aufgenommen. Berlin und Brüssel wollen Milliardenbeträge für die Förderung von H2-Projekten zur Verfügung stellen. Doch wie soll dieser Markthochlauf einer Wasserstoffwirtschaft ablaufen? Welcher Pfad verspricht die besten…