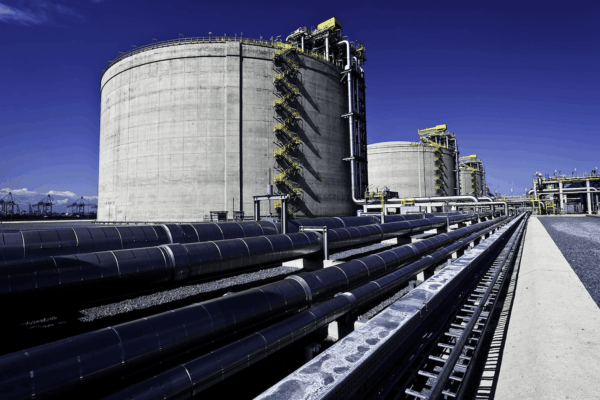

Oil & Fuels

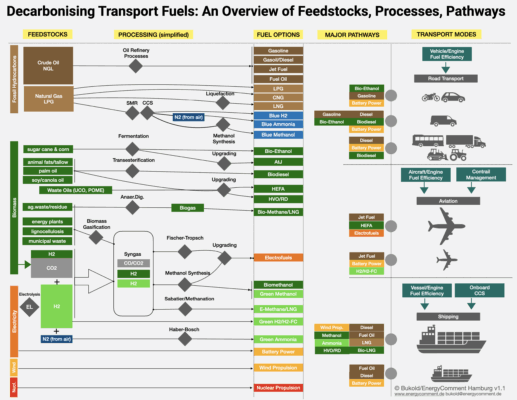

Fossiles Öl • LNG • Biokraftstoffe • E-Fuels • Elektromobilität News • Trends • Fakten • Statistiken

Older Posts → Blog

Forschungs- und Beratungsbüro in Hamburg seit 2008

Analysen, Kommentare und Policy Paper zu den nationalen und internationalen Trends im Ölmarkt und in den Kraftstoffmärkten.

Unser Angebot richtet sich vor allem an NGOs, Policy-Maker und Unternehmen (🇩🇪 🇬🇧🇳🇱)

Aktuelle Schwerpunkte:

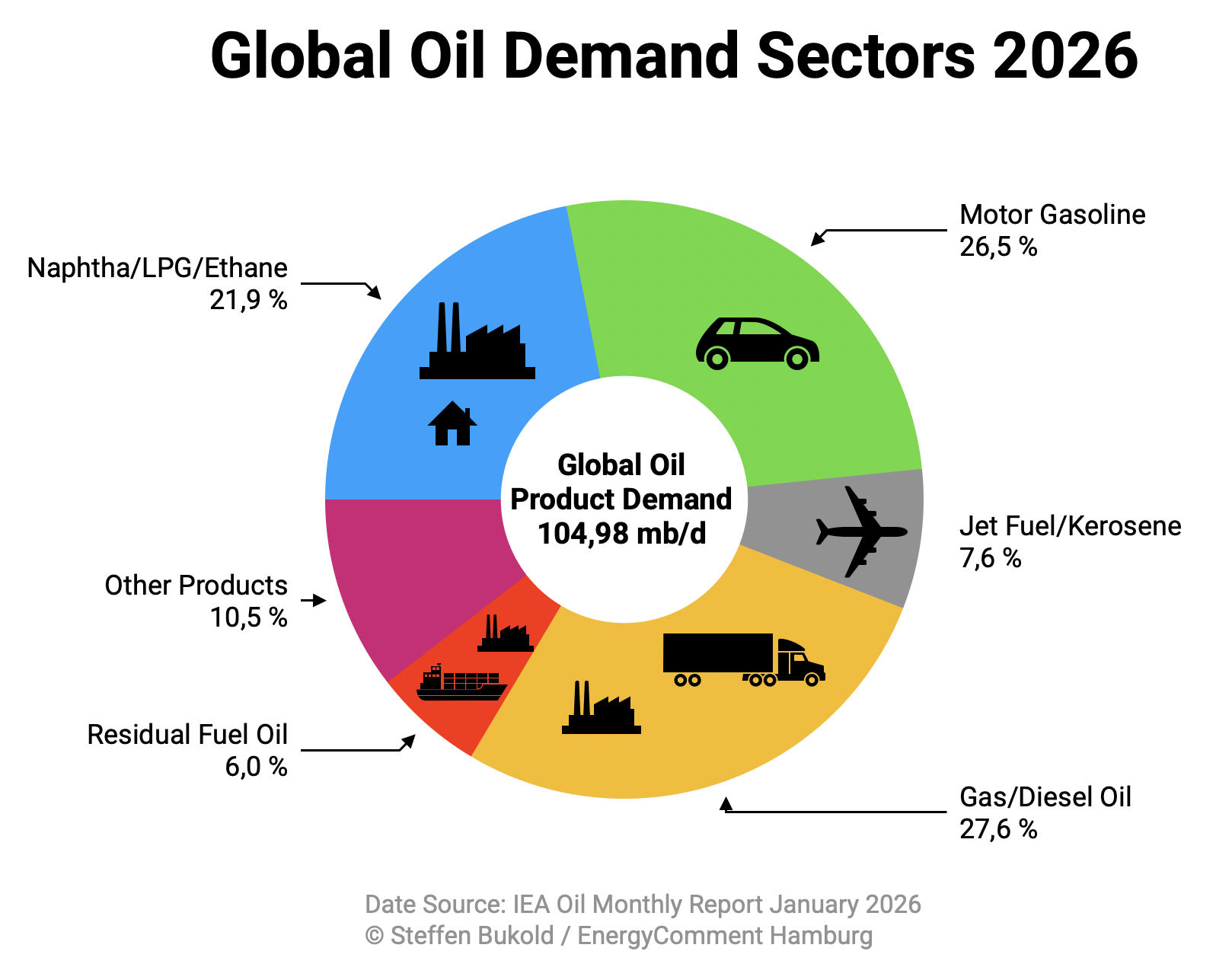

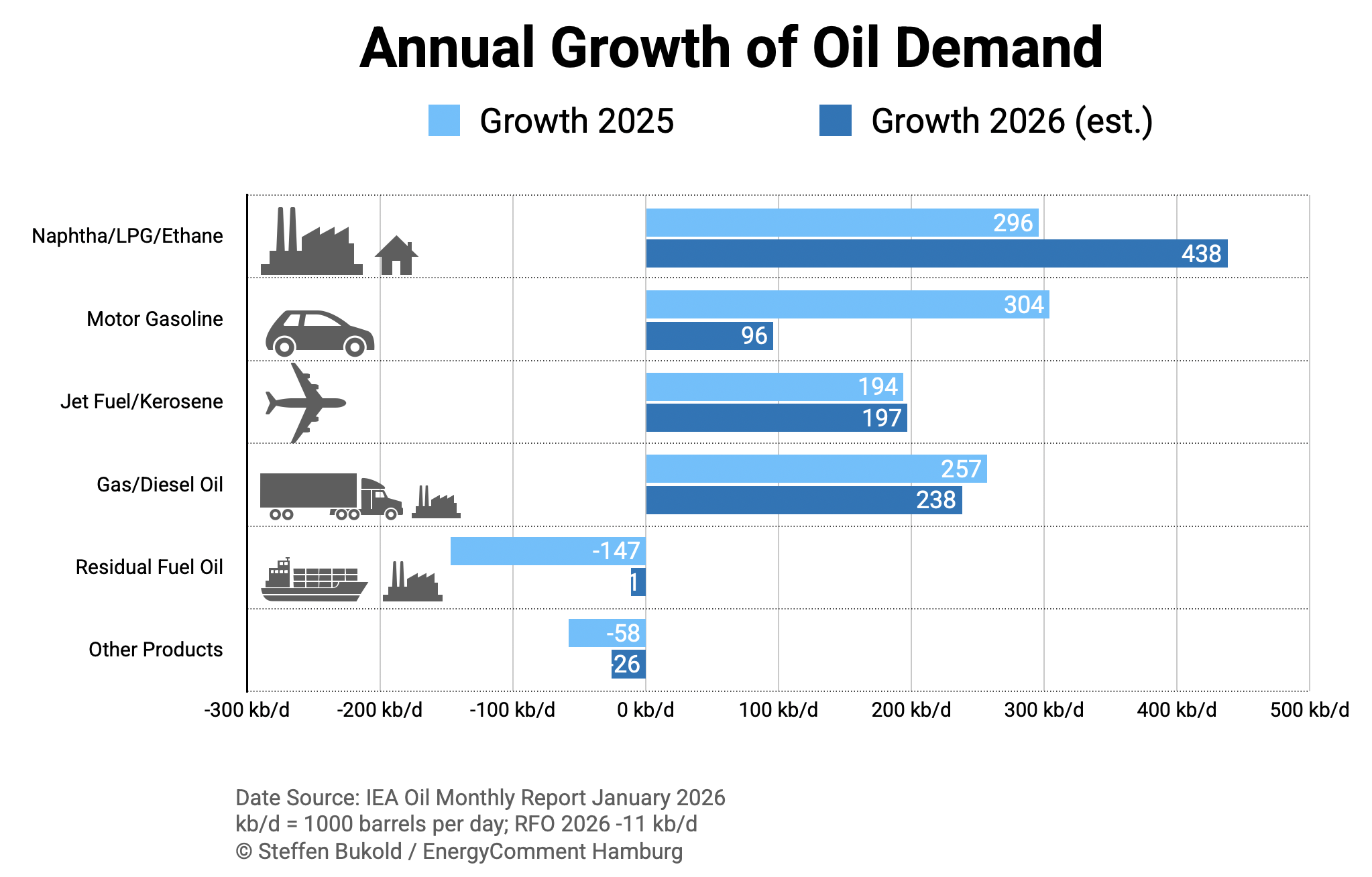

- Dekarbonisierung fossiler Ölmärkte, insbesondere im Straßen-, See- und Luftverkehr.

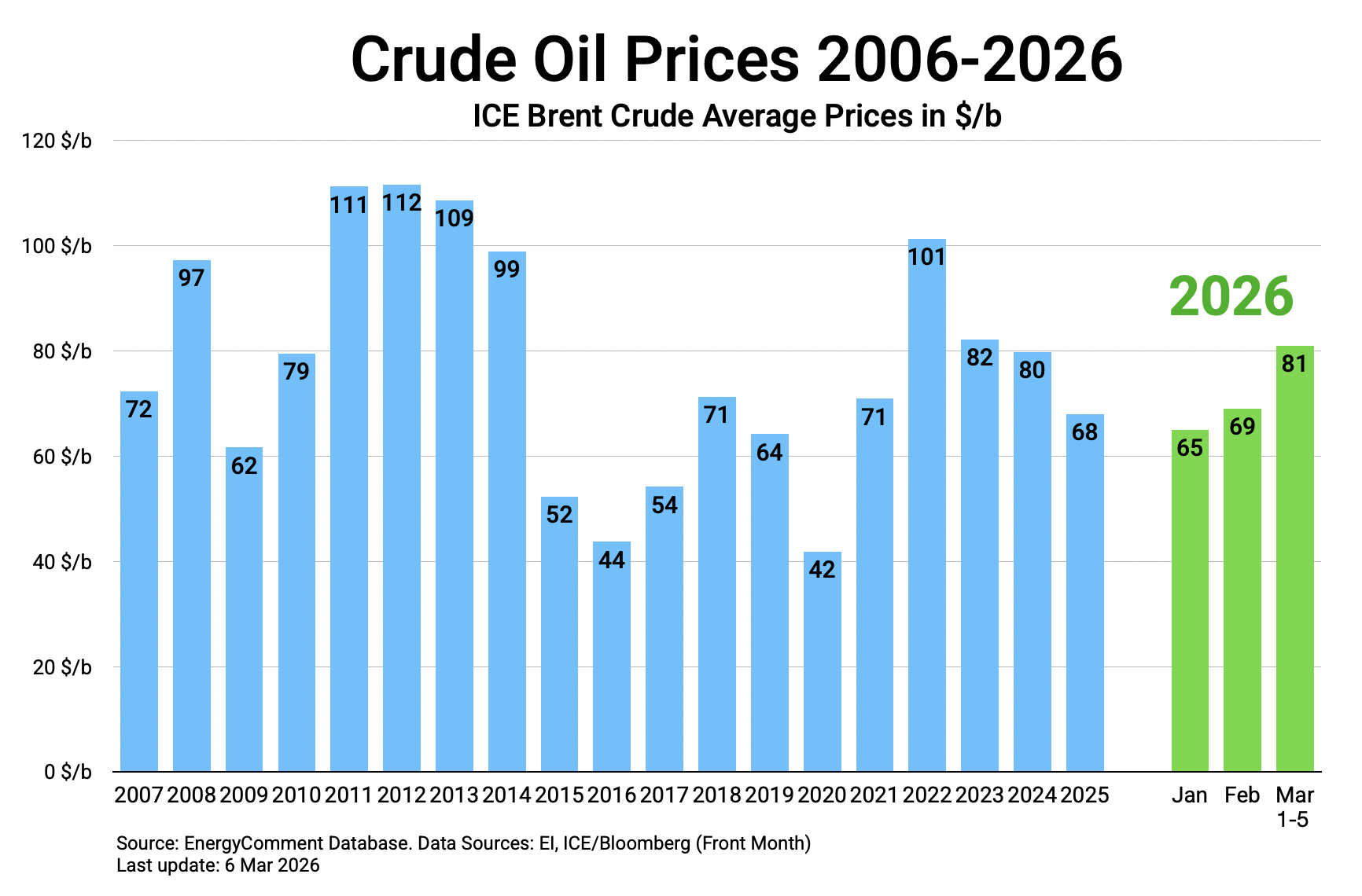

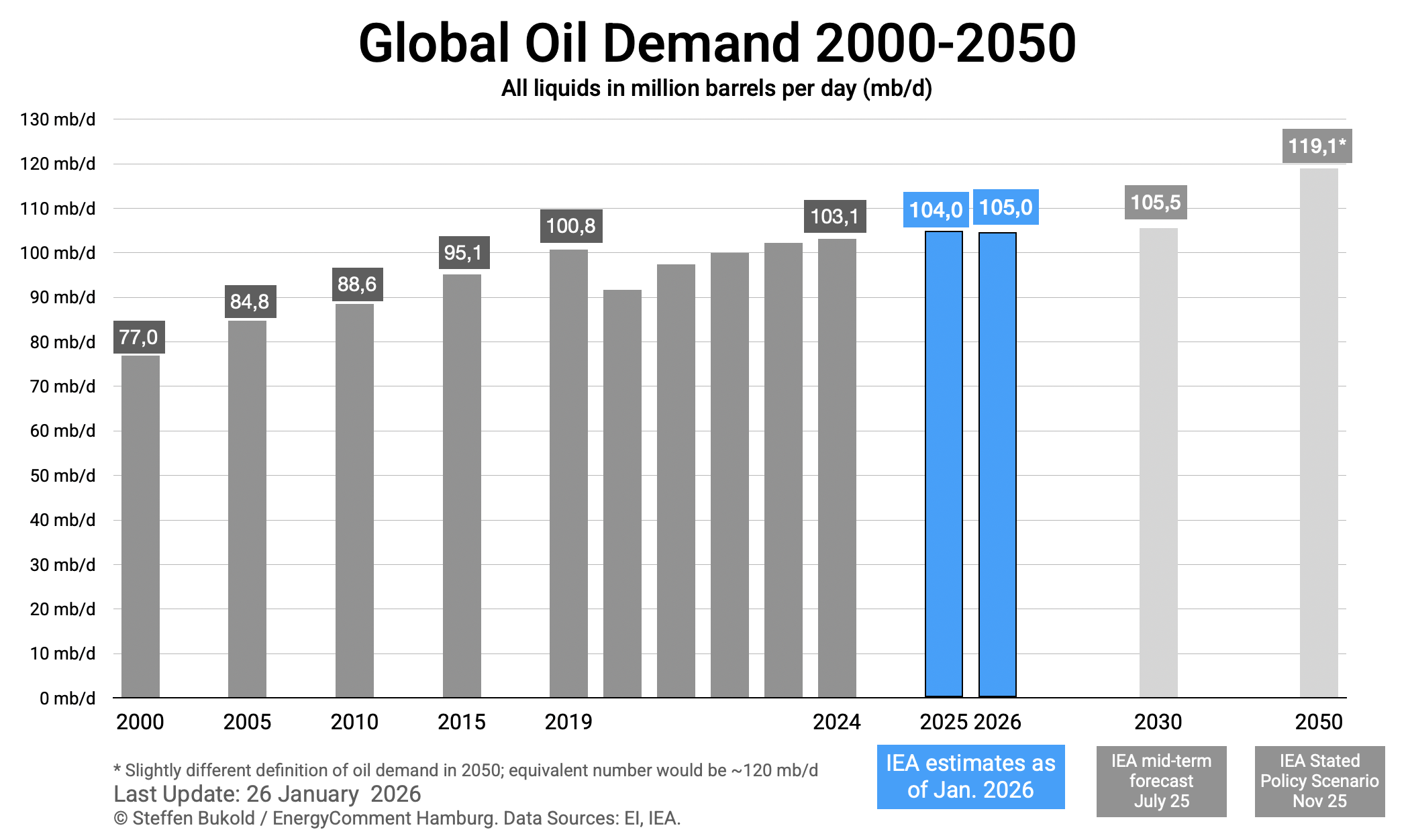

- Internationale Ölmärkte und Ölpreise

Kontakt: Dr. Steffen Bukold Tel. (+49) 040.20911848 bukold@energycomment.de