In unserem neuen Langzeitprojekt FUEL.TRACKER.2050 verfolgen wir den Ausstieg aus fossilem Öl in Deutschland, der EU und weltweit.

Schwerpunkt ist die Ölnachfrage im Verkehr: Road, Air und Sea. Wie entwickelt sich der Fuel Mix in diesen Sektoren? Welche Optionen gibt es? Wie steht es um die Emissionen, Kosten und die verfügbaren Mengen?

Wir analysieren und verfolgen die gesamte Fuel-Palette: Fossil Fuels (inkl. CCS, Upstream-Emissionen, Raffinerien), Biofuels, Wasserstoff, E-Fuels/H2-Fuels, LNG/E-Methane sowie Trends in der Elektromobilität.

Start: April 2024

NEWS & ANALYSEN

-

Ammoniak als Shipping Fuel – eine Übersicht

Welche Rolle kann Ammoniak als Low-Carbon Fuel in der Seeschifffahrt spielen? Das potenzielle Marktvolumen wäre enorm, aber die Unwägbarkeiten sind genauso groß. Es gibt eine ganze Reihe von Kandidaten, die fossile Fuels ersetzen wollen. Noch…

-

Dieselskandal bei Schiffsmotoren

Jetzt hat auch der Schiffsmotorenbau einen Dieselskandal, der im Umfang an die jahrelangen Manipulationen bei VW erinnert. Der führende japanische Motorenbauer IHI musste einräumen, seit über 20 Jahre den Kraftstoffverbrauch und die Emissionswerte von mindestens…

-

Elektromobilität und der fossile Ölverbrauch – Basiszahlen und methodische Probleme

Anfang dieser Woche erschien der „Global EV Outlook 2024“ der Internationalen Energieagentur (IEA). Er liefert auf 174 Seiten eine globale Bestandsaufnahme. Elektromobilität ist der derzeit realistischste Pfad für den Ausstieg aus fossilen Kraftstoffen im Straßenverkehr.…

-

Methanemissionen in der Nordsee

Nach wie vor werden illegale Klimaemissionen in der Nordsee nur symbolisch geahndet. Die britische Neo Energy emittierte auf ihren Offshore-Anlagen mindestens 1200 Tonnen Methan über eine Gasfackelanlage, die nicht brannte, direkt in die Atmosphäre. Die…

-

Wasserstoff: Zum Jagen tragen – eine Bestandsaufnahme für Nordwesteuropa

Die IEA veröffentlichte in dieser Woche ihren aktuellen „Northwest Europan Hydrogen Monitor 2024“. Er zeigt, wie weit Grüner Wasserstoff (aus Grünstrom) und Blauer Wasserstoff (Erdgas plus CCS) bisher vorangekommen sind. Die Region umfasst 10 Länder,…

-

Dekarbonisiertes Ammoniak: Fuel und Carrier für die globale Energiewende

In zwei Artikeln stelle ich Ammoniak als möglichen Baustein der globalen Energiewende vor. Der erste Teil präsentiert Basisdaten zum heutigen Ammoniakmarkt und skizziert mögliche neue Anwendungsbereiche. In nächsten Artikel geht es dann um die Chancen…

-

Ölpreis – Kurzkommentar

Brent Crude fällt zum Handelsstart leicht auf 90 Dollar je Barrel. Da die Preise in Erwartung des iranischen Angriffs schon letzte Woche gestiegen sind, gilt jetzt: „Buy the rumor, sell the fact“. Trotzdem wachsen die…

-

Methanol: Ane Maersk im Hamburger Hafen

Heute lief die „Ane Maersk“ im Hamburger Hafen ein. Sie ist der weltweit erste große Containerfrachter, der mit „Grünem Methanol“ angetrieben wird. Maersk hat insgesamt 24 Containerfrachter bei asiatischen Werften bestellt, die mit Dual-Fuel Engines ausgestattet…

-

CCS-Projekt Porthos: Teurer als geplant

Porthos (NL), eines der fünf großen CCS-Projekte in Europa, wird deutlich teurer als erwartet, meldet das NRC Handelsblad. Statt 0,5 Mrd. wird es demnach mindestens 1,3 Mrd. Euro kosten, das von Rotterdamer Raffinerien und Industriebetrieben…

-

New Report: The Dirty Dozen – The Climate Greenwashing of 12 European Oil Companies

Our new report on the climate ambitions of oil companies in Europe, commissioned by Greenpeace (Vienna). Executive Summary 1. What contribution does Big Oil make to the energy transition and to curbing climate emissions? After…

-

Ölwende nicht in Sicht: Globaler Ölverbrauch steigt 2023 auf Rekordhöhen

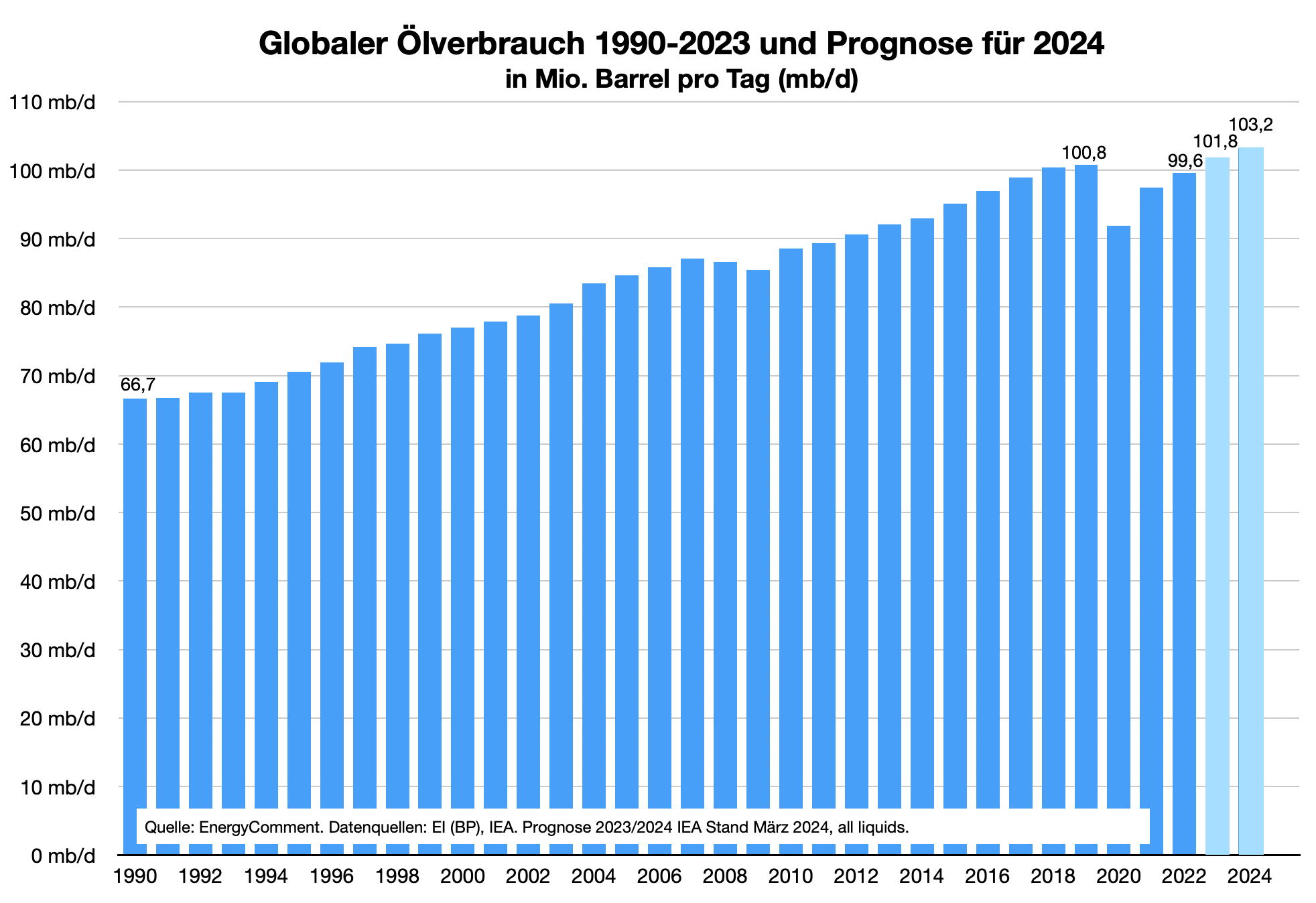

Der globale Öldurst springt in diesen Sommermonaten von einem Rekord zum nächsten. Für den Juni schätzt die IEA den Verbrauch auf 103 mb/d (Mio. Barrel pro Tag). Die nächsten Monate könnten noch höher liegen. Im…

-

Studie: Methanemissionen in deutschen Erdgas-Lieferketten

Deutschland steckt mitten in einem gaspolitischen Neuanfang. Jetzt werden die Weichen für die zukünftigen Gasimporte gestellt. Gleichzeitig wird immer deutlicher, in welchem Umfang die Methanemissionen der globalen Gasversorgung das Klima schädigen. Die Studie verbindet beide…

Ältere News im → BLOG

Tag Cloud

Ammoniak (2) Benzin (1) Big Oil (2) BP (1) CCS (2) Diesel (2) Elektromobilität (1) Energiepreise (1) Eni (1) Equinor (1) Erdgas & Klima (1) Erdgasmarkt (1) Goldwind (1) Investitionen (1) Kraftstoffmärkte (1) LNG (2) Maersk (1) Methanemissionen (4) Methanol (1) MOL (1) Nordsee (1) PKN Orlen (1) Porthos (1) Raffinerien (1) Repsol (1) Russland (1) Shell (1) Shipping (3) TotalEnergies (1) UBA (1) Wasserstoff (6) Wintershall Dea (1) Öl&Klima (1) Öl&Umwelt (1) Ölembargo (1) Ölnachfrage (2) Ölpreis (1)

CHARTS

Globaler Ölverbrauch 1990-2024 (Last Upd. 18. März 2024)

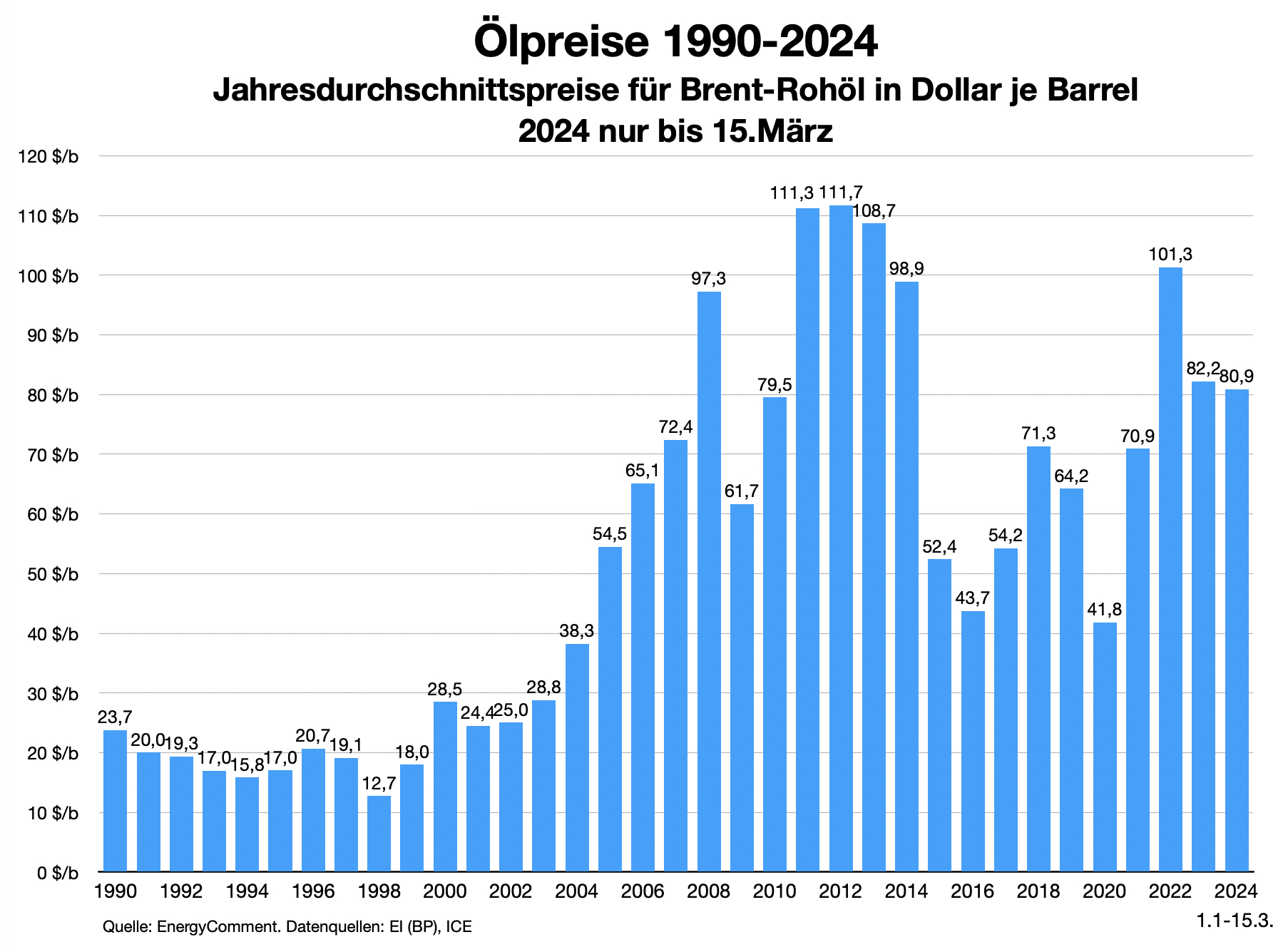

Ölpreise 1990-2024 (Last Upd. 18. März 2024)