Kategorie: Ölkonzerne

-

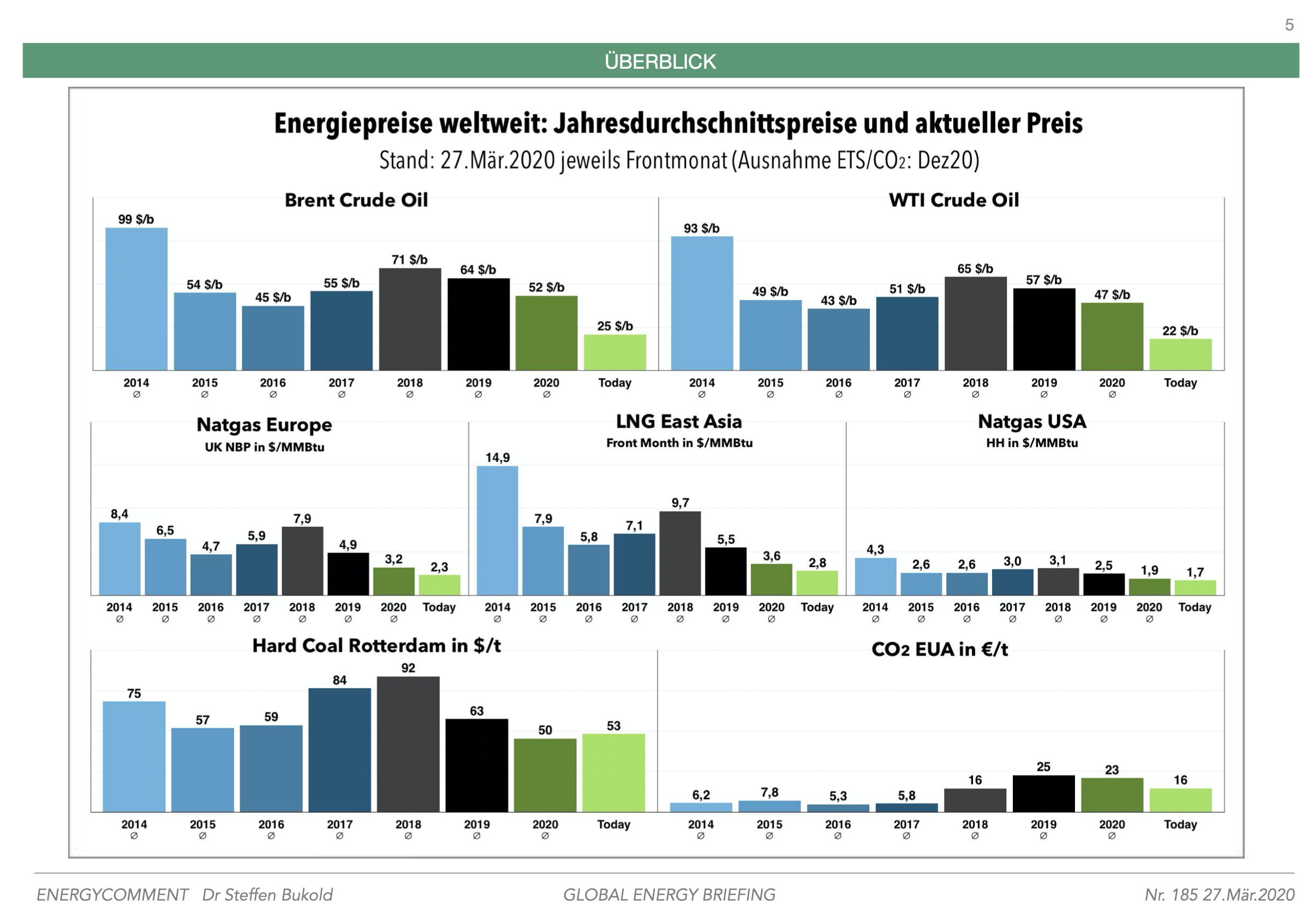

Global Energy Briefing – März 2020 (Nr.185): Die globalen Energiemärkte – Schwerpunkt Öl

Unser aktueller Newsletter informiert Sie auf 41 Seiten über alle wichtigen Trends und Preise in den internationalen Energiemärkten. Natürlich stehen die Folgen der Corona-Pandemie im Zentrum, vor allem der Kollaps…

-

Global Energy Briefing Nr.184 (Feb.2020): Internationale Energiemärkte und Klimastrategien von Big Oil/Big Gas

Unser aktueller Newsletter informiert Sie auf 37 Seiten über alle wichtigen Trends und Preise in den internationalen Energiemärkten im Februar. In dieser Ausgabe stehen Öl, Gas, Kohle und Elektromobilität im…

-

BP in 3Q19: The American Heritage & Beyond

The British-American supermajor delivered as expected, after a string of advance warnings one month ago. Most attention was directed at the profit numbers. Can Big Oil maintain its reputation as…

-

Italian oil&gas major ENI in turbulent times (#BigEnergy100)

Busy days for Italian oil and gas giant Eni ranging from good to not so good news. Eni is a second-tier supermajor with 1.9 boe/d oil and gas production and…

-

Saudi Aramco: Net profits of $111 billion

Saudi Aramco published its financial numbers for 2018. They dwarf even the largest Western and Chinese oil majors in some respects: Net income 2018: $111.1bn (+46% year on year) Revenues…

-

Oil majors in transition: Shell to bid for Dutch Utility Eneco

Oil & Gas Major Royal Dutch Shell and Dutch pension fund PGGM formed a consortium to take over Dutch utility Eneco. Eneco Eneco is owned by 53 Dutch municipalities. In…

-

Global Energy Briefing No.169: Big Oil in Transition? The Path to Decarbonization (English Edition)

Oil and gas account for more than half of global energy-related greenhouse gas emissions. International oil companies are now under pressure to demonstrate the sustainability of their portfolio and adapt…