Summary

- In the first five months of 2025, electric cars (EV) accounted for 22% of the automotive market. That is only one percentage point more than in 2024.

- Growth forecasts for 2025 have to be revised slightly downward. Global growth in the EV market is currently expected to be 25%, a total of 21.8 million new vehicles.

- Political headwinds in Washington are expected to cause the U.S. EV market to shrink slightly this year.

- China remains at the centre of electric mobility, accounting for 60% of global EV sales. On average, more electric cars than combustion engine cars are expected to be sold in China this year.

Main Points

- How is the market for electric cars performing in 2025?

- To paraphrase an old joke from the Soviet era, the situation can be summed up in one word: ‘Good.’ Or in two words: ‘Not good.’ The global market is growing, but more slowly than expected just a few months ago, mainly due to U.S. policies.

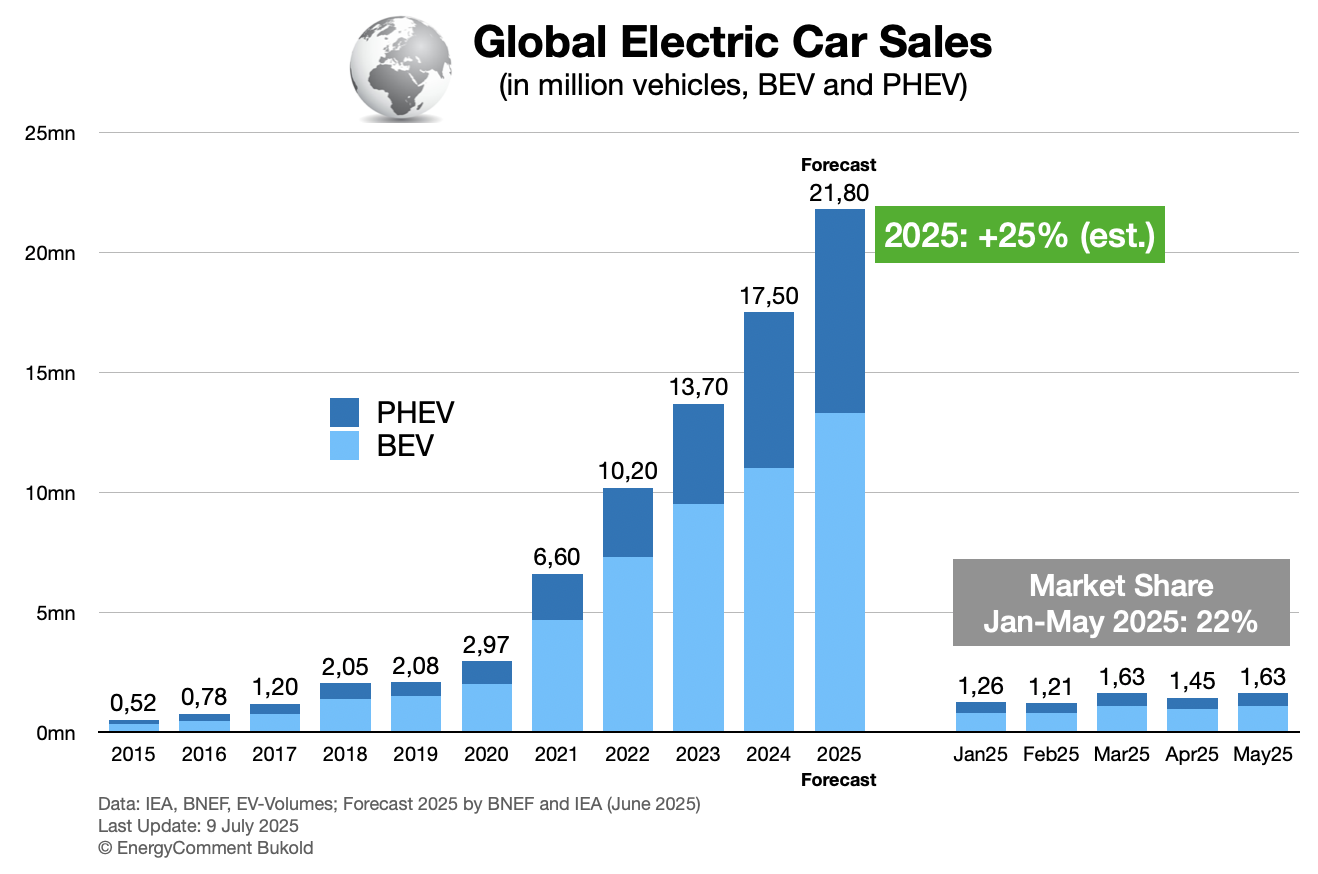

- Global

- In the first five months of 2025, 7.2 million EVs were sold. This corresponds to a market share of 22%. Last year, the market share was almost as high at 21%. At least May 2025 performed slightly better with a market share of 25%.

- Forecasts for the year as a whole are being scaled back. Previously, over 22 million new EVs were expected. Now the figure is more likely to be 21.8 million (BNEF, IEA). This represents growth of 25% compared to 2024.

- The structure has changed little. BEVs still account for two-thirds of new EV sales, with the rest accounted for by plug-in hybrids, which also include EREVs. These extended range electric vehicles (EREVs) are a particularly popular variant of plug-ins (PHEVs) in China. A small petrol engine can be used as a power generator to recharge the battery when needed. This increases the range, but the energy balance is rather poor. The additional costs of fossil fuel technology are offset by the smaller battery.

Figure: Global Electric Car Sales 2015-2025 (BEV/PHEV)

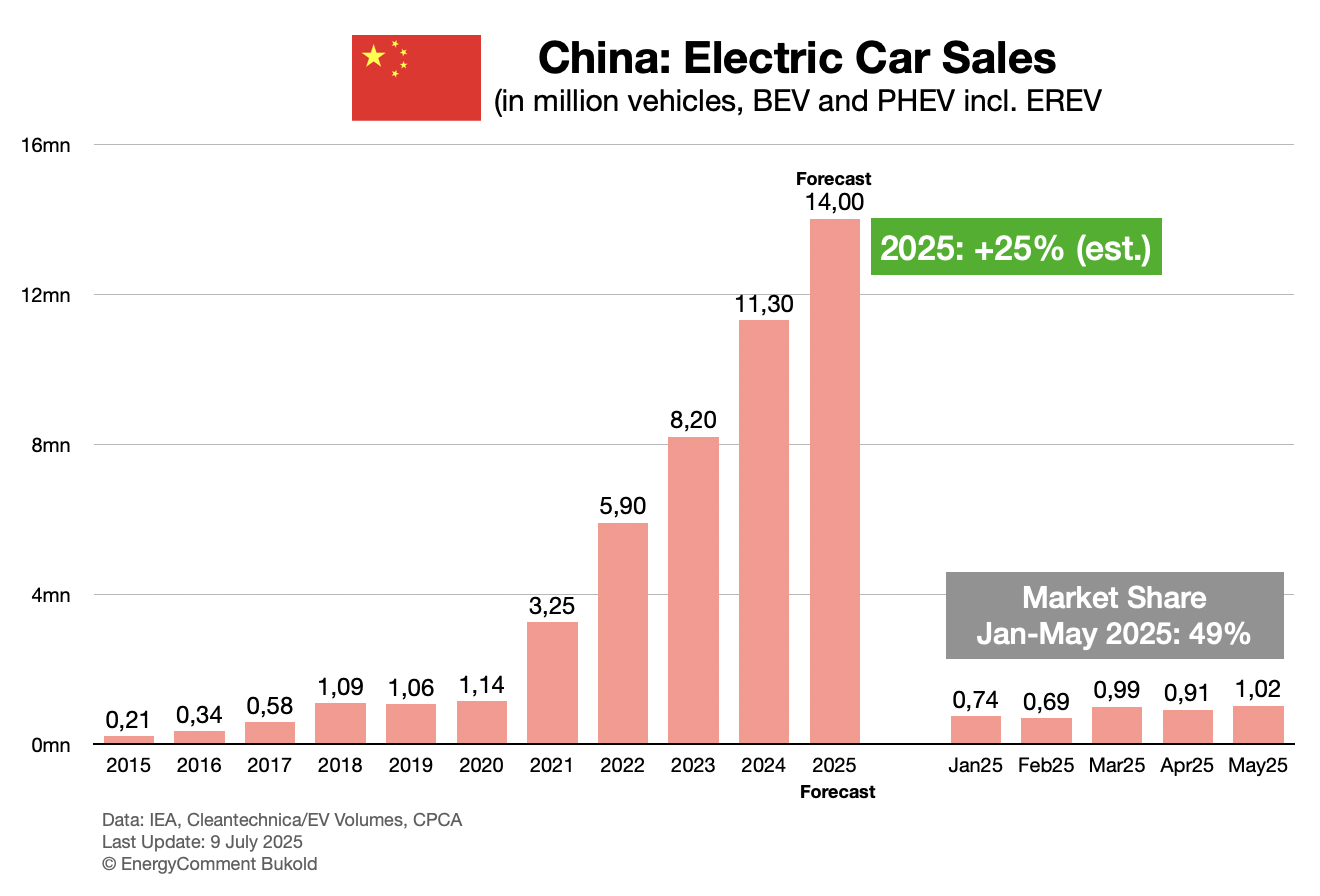

- China

- China is by far the largest EV market, with a 60% share of the global market. Thanks to strong political support and fierce price competition, it is growing at a similar rate this year as in previous years.

- The IEA expects over 14 million EV sales for the year as a whole. That would be an increase of 25%.

- In the five months from January to May 2025, 4.3 million new EVs entered the market. That is a market share of 49% in China.

- In May 2025, the 1 million mark for new EVs was exceeded for the first time. The 1.02 million EVs sold correspond to a market share of 53% in the Chinese car market.

Figure: Electric Car Sales in China 2015-2025 (BEV/PHEV)

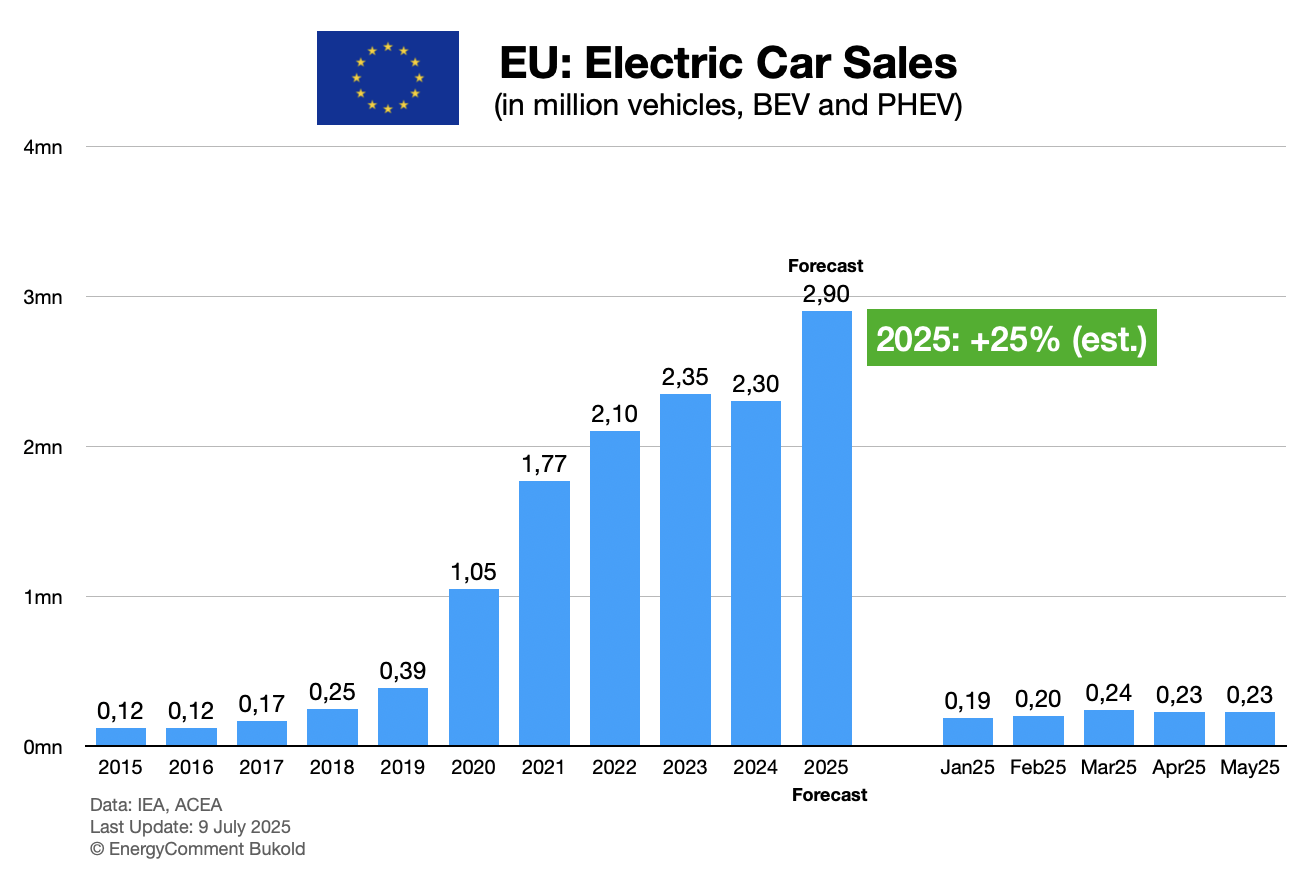

- EU

- In the European Union, too, the figures for January to May show a significant increase. This applies to both BEVs (+26%) and PHEVs (+15%) year-on-year. However, this is partly just a catch-up movement after the crisis in 2024.

- The figures currently point to an increase of 25% in 2025, perhaps even towards 35%, if the second half of the year meets the high expectations.

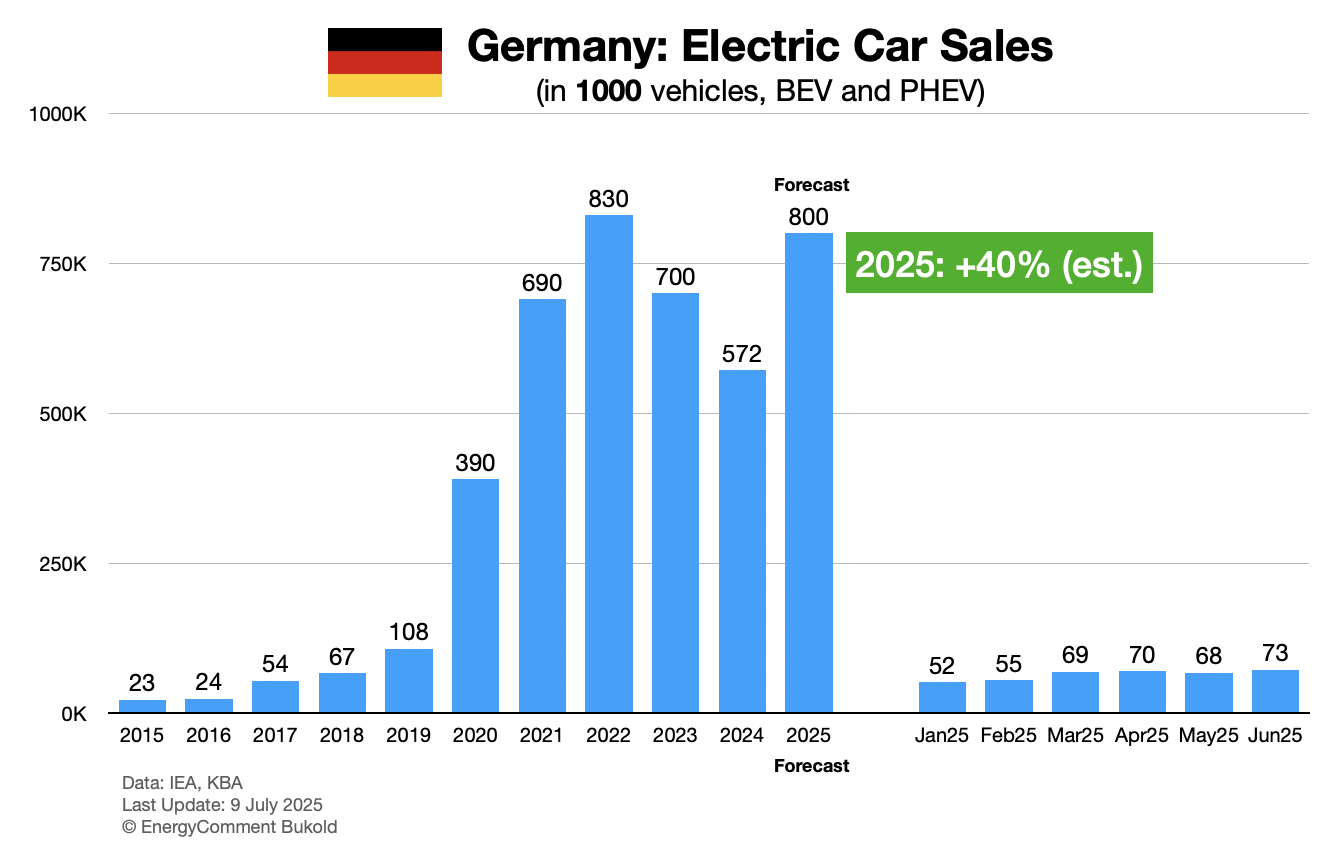

- The trend is particularly strong in Germany, the most important EU car market. Here, the figures for January to May point to annual growth of around 40% to 0.8 million EVs. However, this is also following a very weak previous year.

Figure: Electric Car Sales in the EU 2015-2025 (BEV/PHEV)

Figure: Electric Car Sales in Germany 2015-2025 (BEV/PHEV)

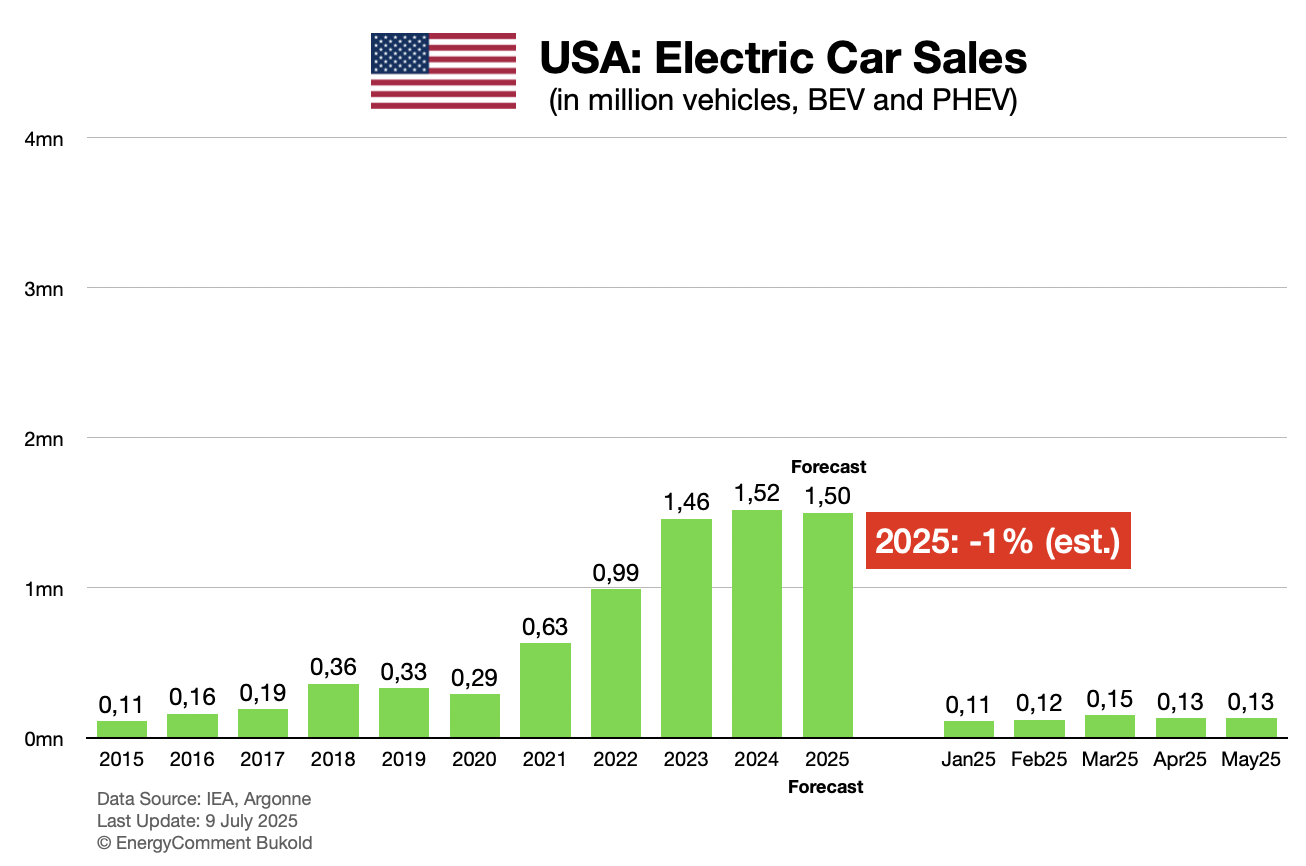

- USA

- The disappointing development in the American EV market continued in the first months of the new Trump administration.

- In the first five months of 2025, an average of 126,000 EVs were purchased per month. Last year (12 months), the average was 130,000 vehicles. So the market is shrinking. The annual balance currently points to a slight decline.

- The outlook has clouded considerably. The EV market faces numerous hurdles: the elimination of purchase subsidies, new regulatory brakes, the unclear development in California, the image crisis of the Tesla brand and, of course, the foreseeable high tariff barriers. Relatively low fuel prices are also causing buyers to hesitate.

Figure: Electric Car Sales in the U.S. 2015-2025 (BEV/PHEV)

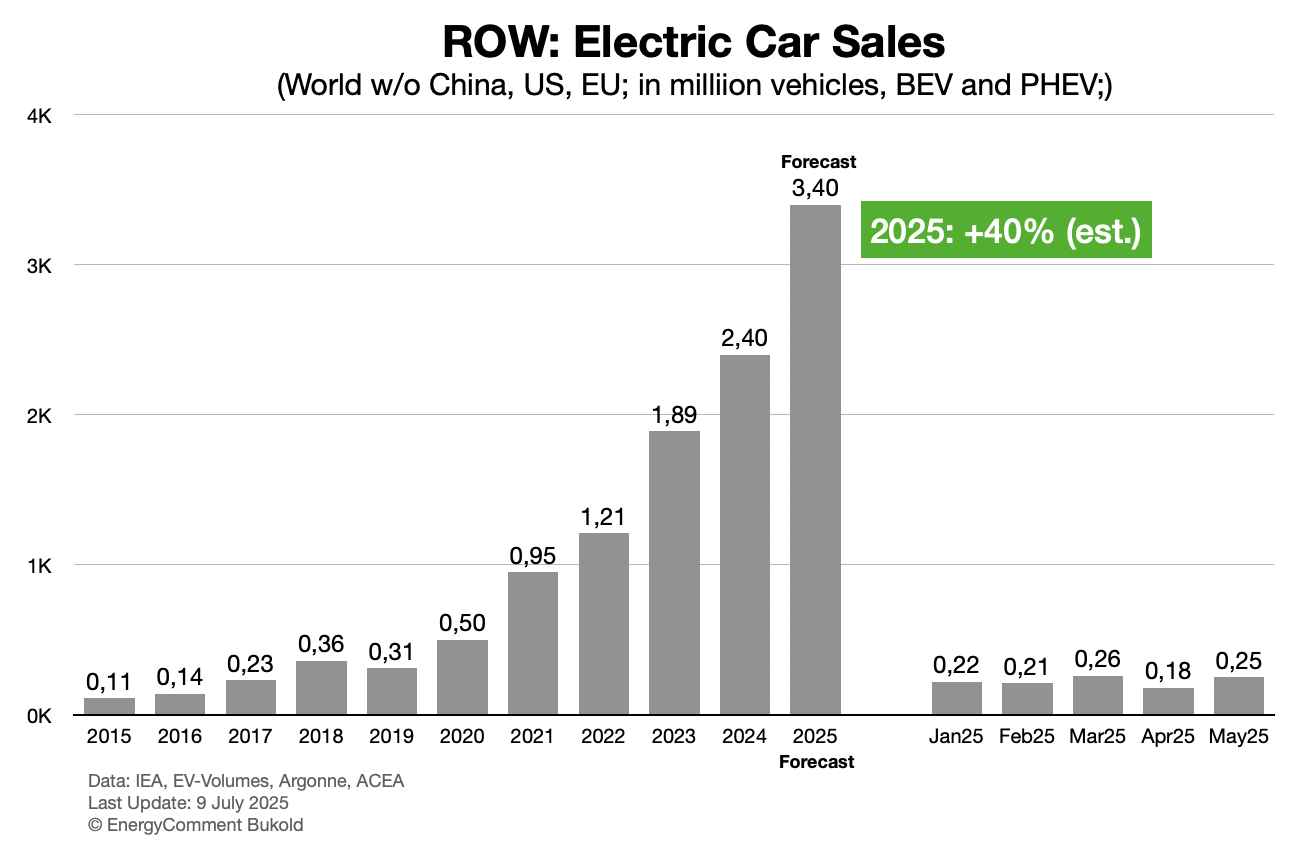

- RoW (Rest of the World)

- In the rest of the world (excluding China, the EU and the USA), things are going well overall, albeit with major regional differences. However, the volumes are still manageable. The entire group of countries sells roughly as many EVs as the EU and has a global market share of around 15%.

- Strong growth in important markets such as the UK contrasts with a still stagnant market in Japan. India also remains below expectations in the passenger car sector (4-wheelers).

- The figures for 2025 so far point to strong growth of around 40% for the year as a whole.

Figure: Electric Car Sales in the Rest of the World 2015-2025 (BEV/PHEV)

Sources

- IEA, BNEF, Argonne, KBA, ACEA, EV Volume (see charts for further details).

Your Comment

- Please use our contact form

Comments

3 Kommentare zu „The global electric car market in 2025 (July update)“

[…] Ventes de voitures électrifiées dans l’UE 2015-2025 (BEV/PHEV) // Source : Energycomment.de […]

[…] in all, there is little reason to change the previous global forecasts for the year as a whole. At the moment, the figures for 2025 continue to point to a stable increase […]

[…] market share in China, reports Reuters, citing new figures from SCI. They are following in the footsteps of electric cars, which already account for over 50% of new sales in […]