What volumes of fossil oil and other fuels are consumed in maritime shipping? What is the volume trend and what progress is being made in terms of decarbonization?

1. Total Volumes in 2024 and 2025

Fuel consumption in international shipping has been rising significantly since 2023. Bunker sales (marine fuel sales at seaports) have returned to pre-Covid levels.

🔴 In 2024, consumption by international maritime shipping (vessels >5,000 GT) increased by approximately 4.0% from 233.1 to 242.4 million tonnes. Additional traffic due to risks in the Red Sea and disruptions at the Panama Canal were primarily responsible for this.

🔴 In the first three quarters of 2025, consumption was 1.6% above the corresponding prior-year period. This exceeded the level from 2019. Bunker sales data from 17 major seaports demonstrate this.

This data does not capture the fuel consumption of LNG carriers, which obtain their fuel through the boil-off gas from their cargo. However, this market segment also grew at comparable rates in 2024, at 2-3% per year and continued this path in 2025.

2. Fuel Mix

2.1 Bunker Ports

The bunker sales of major ports provide timely and detailed data on the structure of fuel consumption.

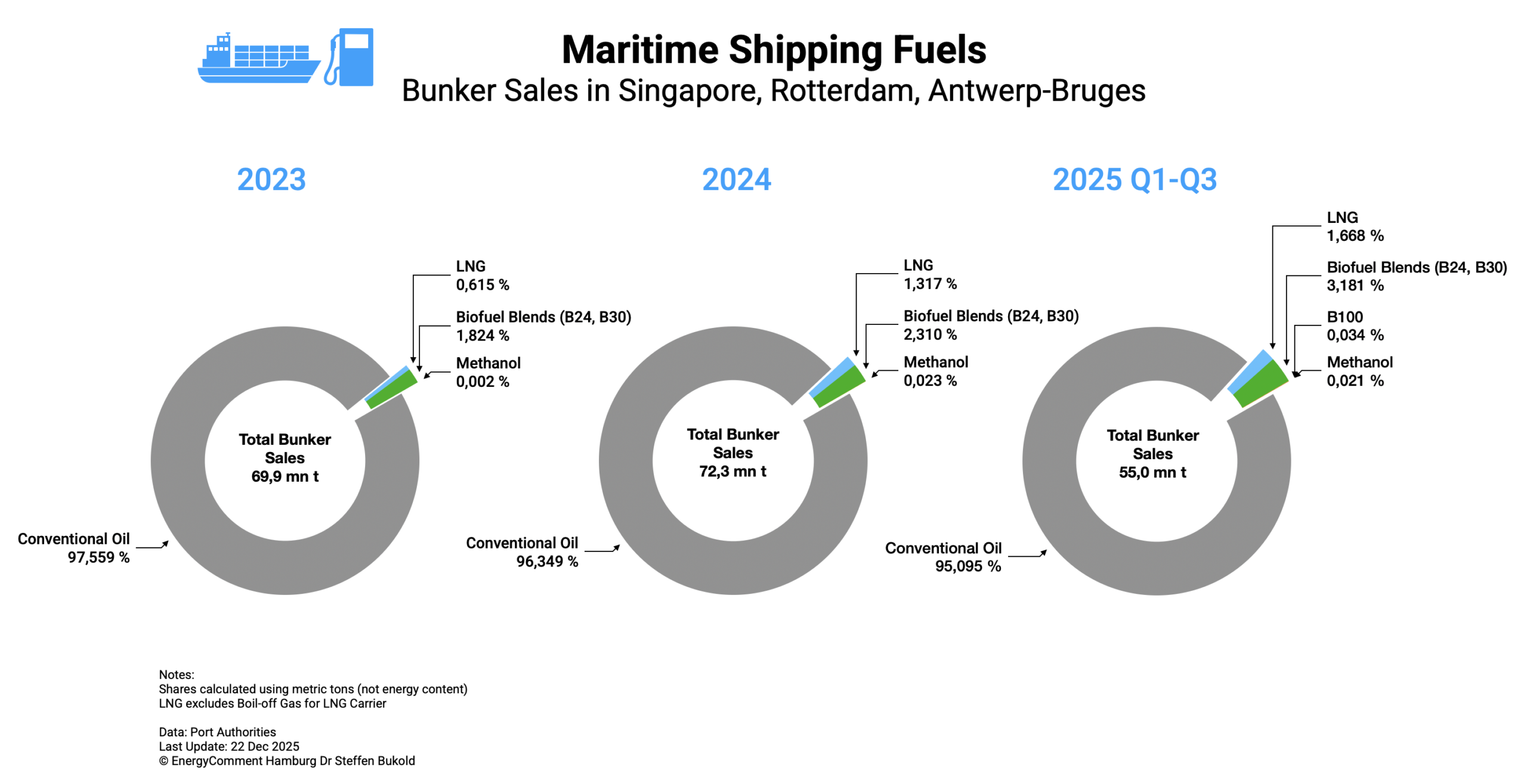

In the first and second charts, we show bunker sales (sales of marine fuels) in Singapore, Rotterdam, and Antwerp-Bruges. This captures approximately 30% of global bunker volumes.

Singapore is by far the world’s most important bunker port. Nearly 23% of global bunker sales were handled there last year (54.9 million tonnes). Rotterdam ranked second with 9.4 million tonnes, followed by Fujairah (UAE, 7.5 million tonnes), Zhoushan (China, 7.3 million tonnes), and Antwerp-Bruges (Belgium, 6.5 million tonnes). Our sample thus captures No. 1, No. 2, and No. 5.

2.2 Fuel Mix 2023-2025

🔹 Oil

🔴 The following chart shows that the share of fossil oil fuels (fuel oil; gasoil/diesel) has declined slightly in recent years: from 97.6% in 2023 to 95.1% in the first three quarters of 2025.

🔹 LNG

This shift is not synonymous with decarbonization as the share of fossil natural gas (LNG) rose from 0.6% (2023) to 1.7% (2025) of bunker sales.

While LNG produces approximately 20% less CO₂ than fuel oil for the same propulsion energy in the ship engine, there are methane emissions in the supply chain (WTW) and in the engine. The energy expenditure for liquefying natural gas to LNG is also very high (approximately 8% of feed gas).

🔴 On balance, the climate benefit of LNG compared to fuel oil is at best minimal, but in many cases near zero or even negative.

It is important to note that LNG already plays a considerably larger role as marine fuel than bunker sales data suggest.

For 2023, the IMO database, which accounts for approximately 90% of the global fleet, shows a share of 93.52% for fossil oil (HFO, LFO, diesel/gasoil). Non-oil fuels in 2023 consisted almost exclusively of LNG (12.9 million tonnes). The remainder consisted of biofuels (0.4 million tonnes), LPG 0.25 million tonnes (propane/ethane/butane), methanol 0.1 million tonnes, and ethanol 0.01 million tonnes.

🔴 Of these 12.9 million tonnes of LNG fuel, only 1.3 million tonnes were sold as bunker fuel in ports in the IMO database for 2023. The remainder was consumed by LNG carriers either as boil-off gas during transit and via bunkering at LNG export terminals.

For 2024, the IEA estimates the LNG fuel volume of LNG carriers at 800 PJ. Converted, this would be 15-16 million tonnes, thus a significant increase compared to the IMO figures for 2023. This volume also grew in 2025. However, statistical uncertainties are considerable.

🔹 Bioblends and B100

Biofuel blending (primarily FAME/UCOME) with a share of 24% (B24) or 30% (B30) enables partial decarbonization, especially when using waste fuels.

Bioblends provided 3.2% of marine fuels in our sample in 2025. The share of biofuels is thus approximately 1%.

Since 2025, Singapore has also recorded bunker sales of pure biofuels (B100), though these remain very small at 0.03% of total fuel volumes.

🔹 New Fuels: Methanol, Ammonia, Bio-LNG

🔴 Methanol volumes also remain very low so far (0.02%). Bio-LNG and ammonia volumes are currently in a barely measurable range or are still in the testing phase.

While shipping lines are already reporting larger ammonia or methanol volumes, this almost always involves mass balance calculations, meaning the fuels are deployed somewhere in the world and the shipping line pays for the allocation of climate benefits to their vessels.

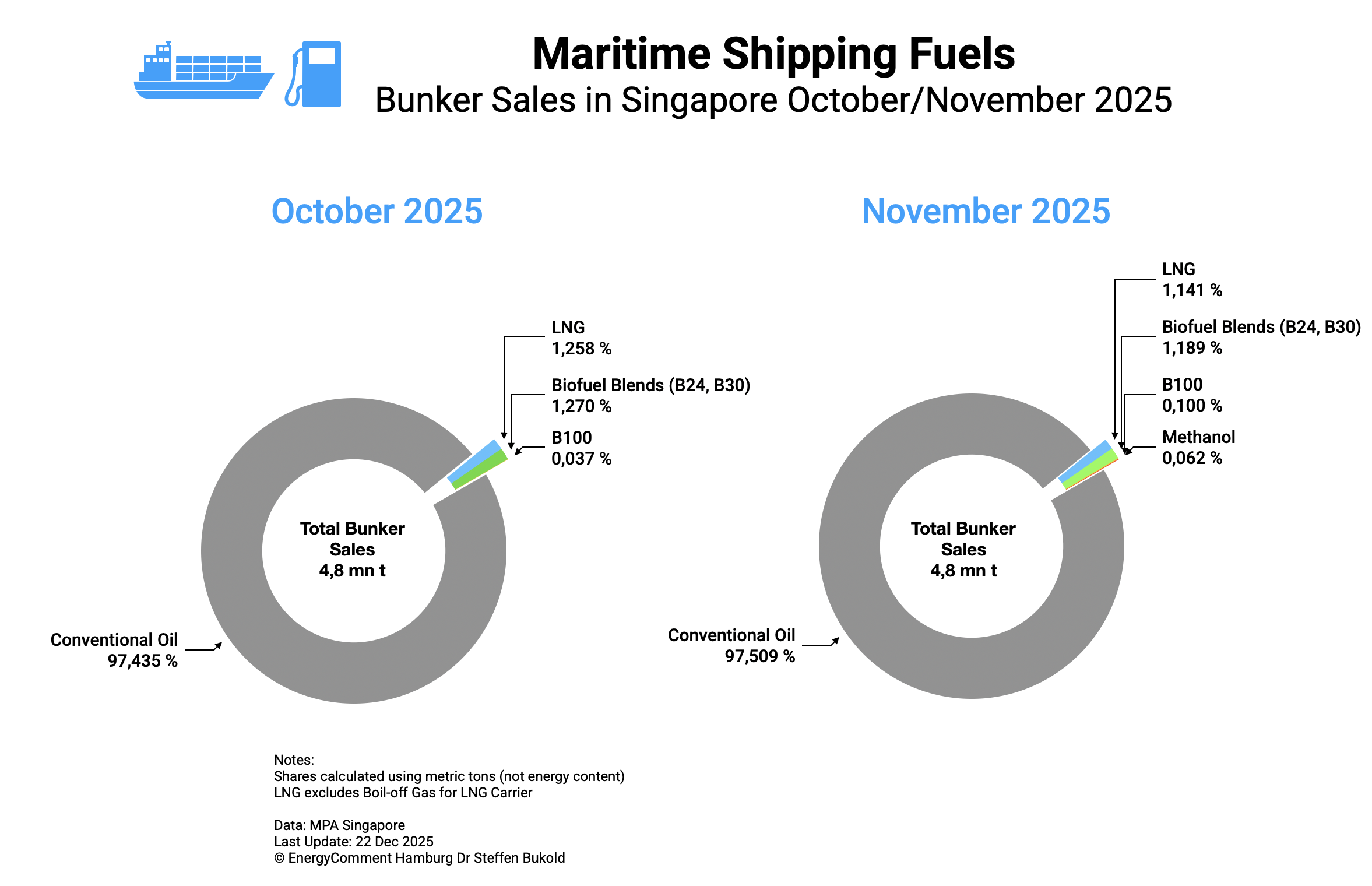

2.3 Fuel Mix in October and November 2025 (Singapore)

Singapore Port has already published data for October and November 2025. Two trends are visible here:

The share of LNG bunkering has declined unexpectedly compared to previous quarters. This could be due to temporarily higher prices.

Biofuel blends have also lost relevance, but pure biofuel bunkers (B100) were able to gain ground, albeit still at a very low level. In November, the share of B100 bunkers was 0.1% of total bunker sales.

Note:

The charts show distribution by tonnes. In energy terms, the share of low-carbon fuels is even somewhat lower. While fossil oil (HFO/VLSFO) provides approximately 40-41 GJ/t, biodiesel/UCOME provides only 37-38 GJ/t and methanol only 20 GJ/t (ammonia 18.6 GJ/t; LNG 48-50 GJ/t).

3. Decarbonization – Bottom Line

On balance, actual decarbonization of shipping fuels has been very limited so far and stands in clear contrast to the large number of dual-fuel vessels in operation or in the orderbook that could use methanol or ammonia.

🔴 🔴 From the 4.9% “alternative fuels” deployed in the three ports so far this year, actual decarbonization in 2025 amounts to approximately 0.7% of bunker sales when excluding LNG, and accounting for different energy contents and the CO₂ footprint of biofuels. In 2023, the share was approximately 0.4%. At this pace, net-zero shipping by 2050 is obviously out of reach.

All major shipping lines in the top 10 have the corporate goal of operating net-zero by 2050. It remains completely unclear in what mix and from what sources low-carbon fuels can be provided for this purpose.

Ship orderbooks and now also port infrastructure have already made advance investments. But without price alignment and better availability of low-carbon fuels, the transition will not succeed.

Your comment

- Please use our contact form

- Picture: Eric Bakker / Port of Rotterdam Pressroom