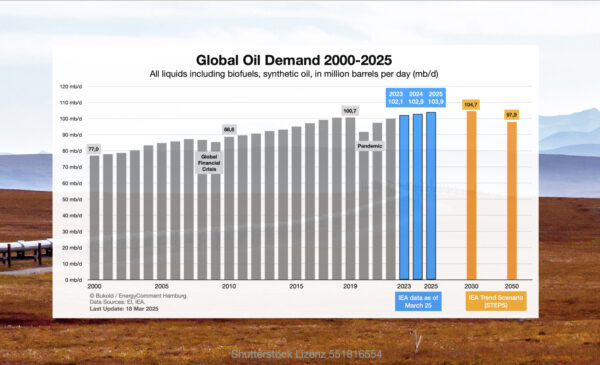

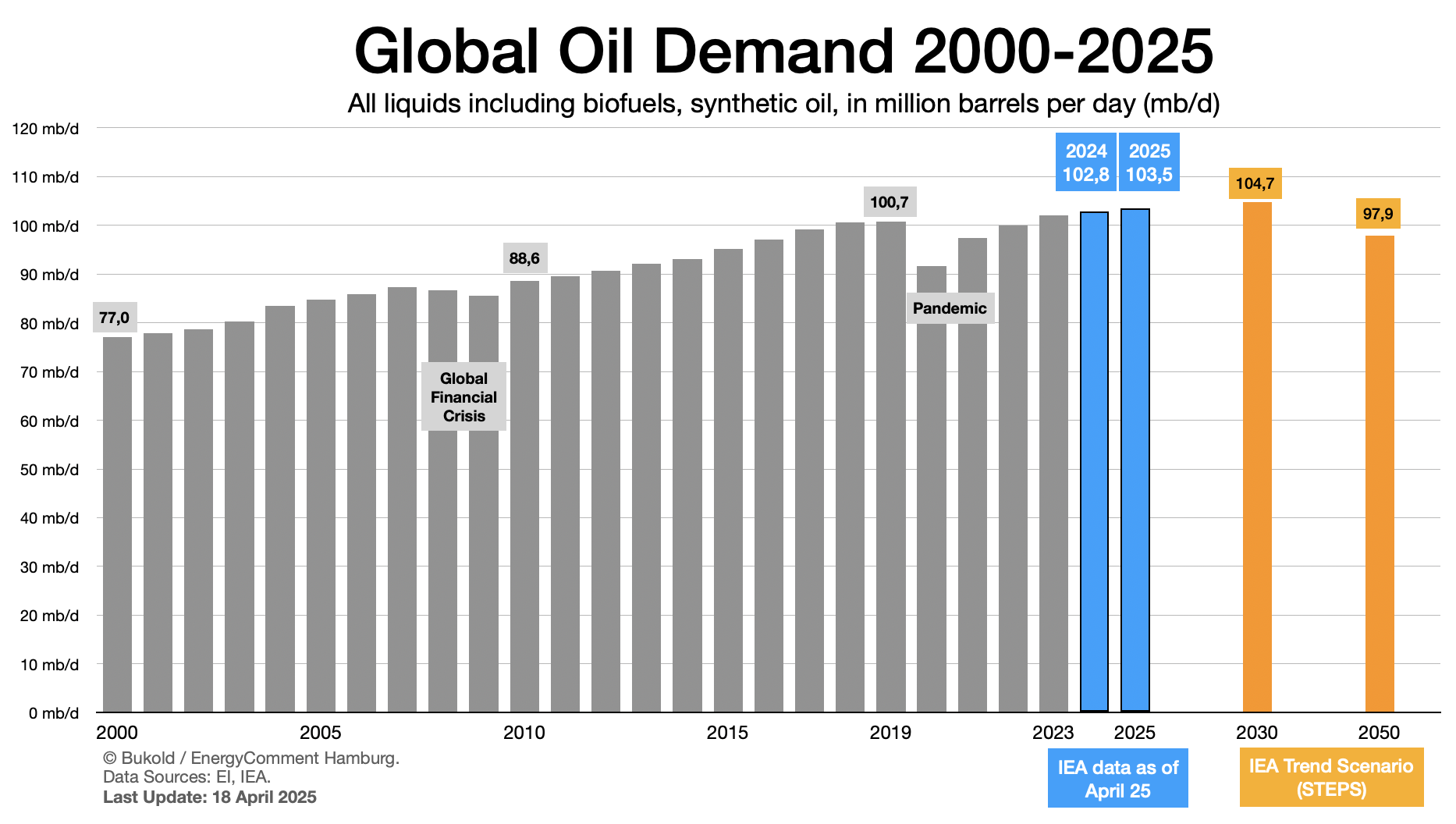

Tracking the global fuel transition in transport

Air • Sea • Road Fossil Fuels • Biofuels • eFuels • Batteries Pathways • Technologies • Innovators

Older Posts → Blog

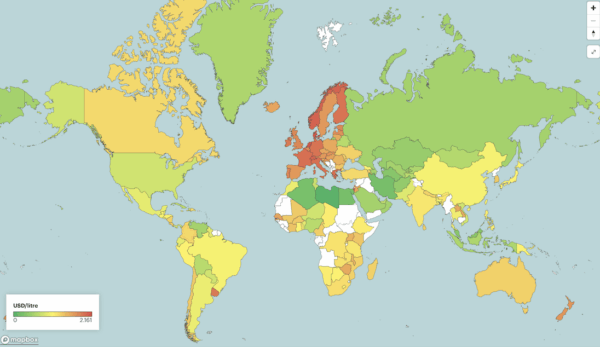

Global gasoline prices 2024

(image links to interactive IEA source)

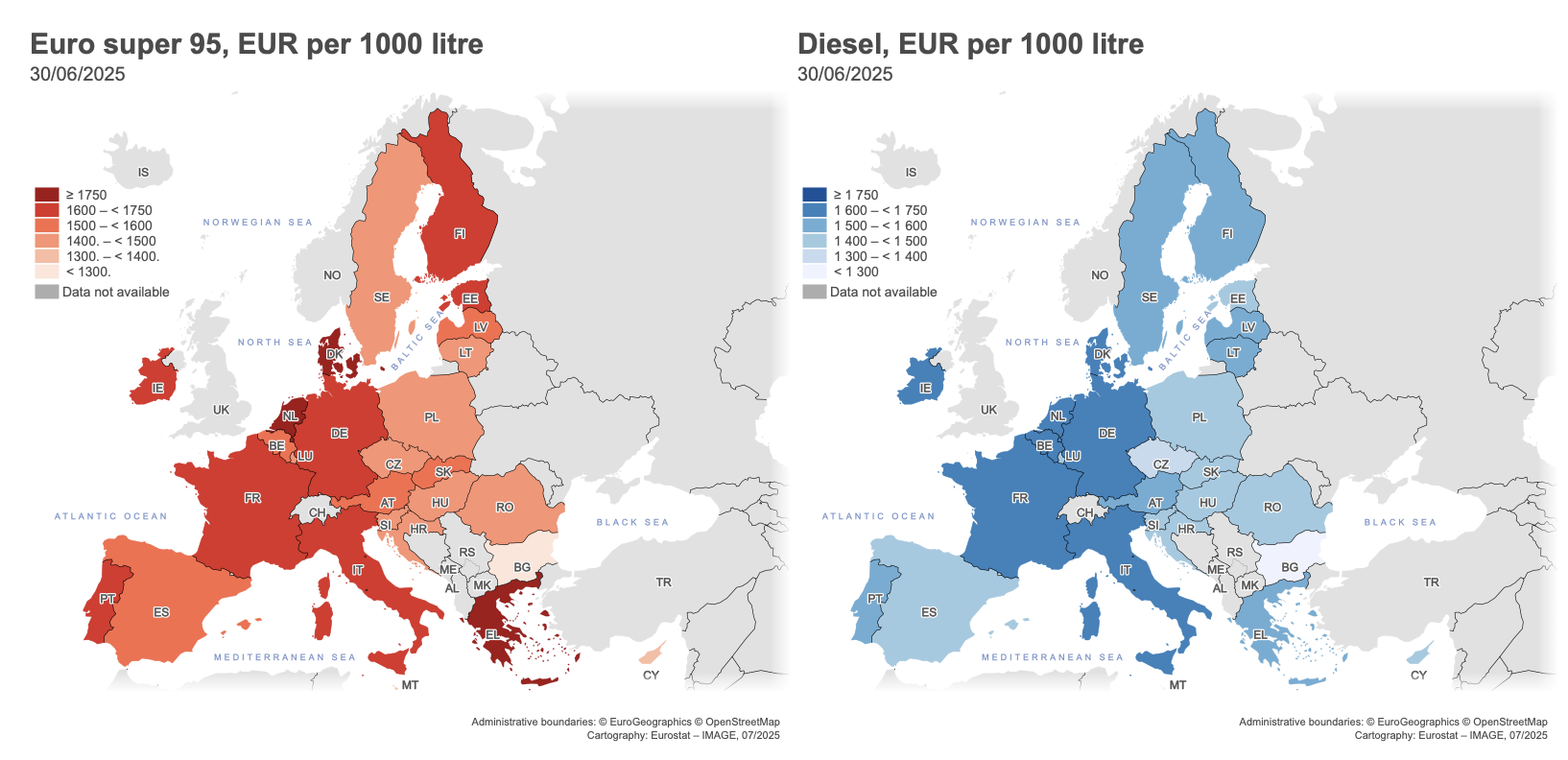

EU diesel & gasoline prices 2025

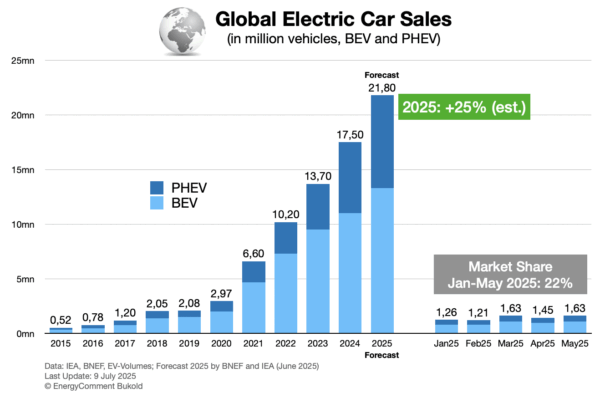

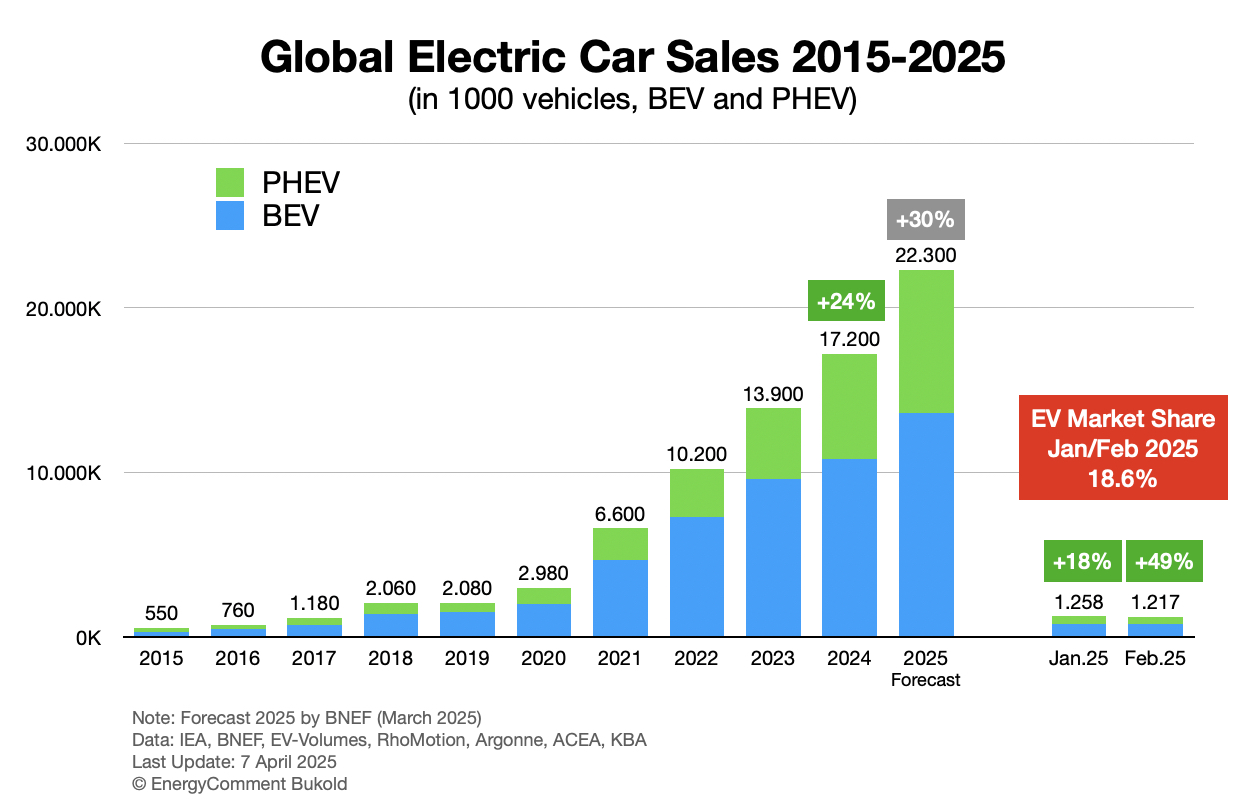

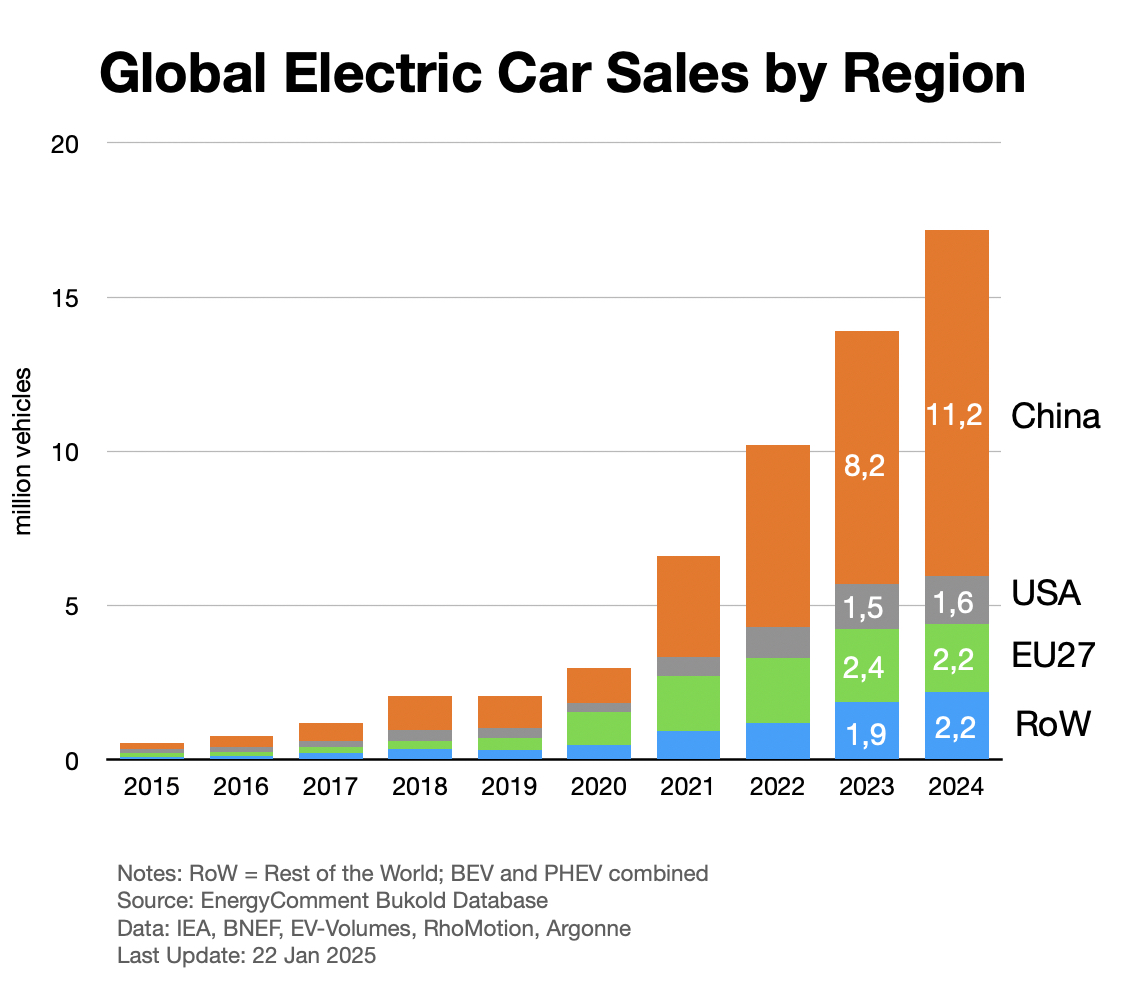

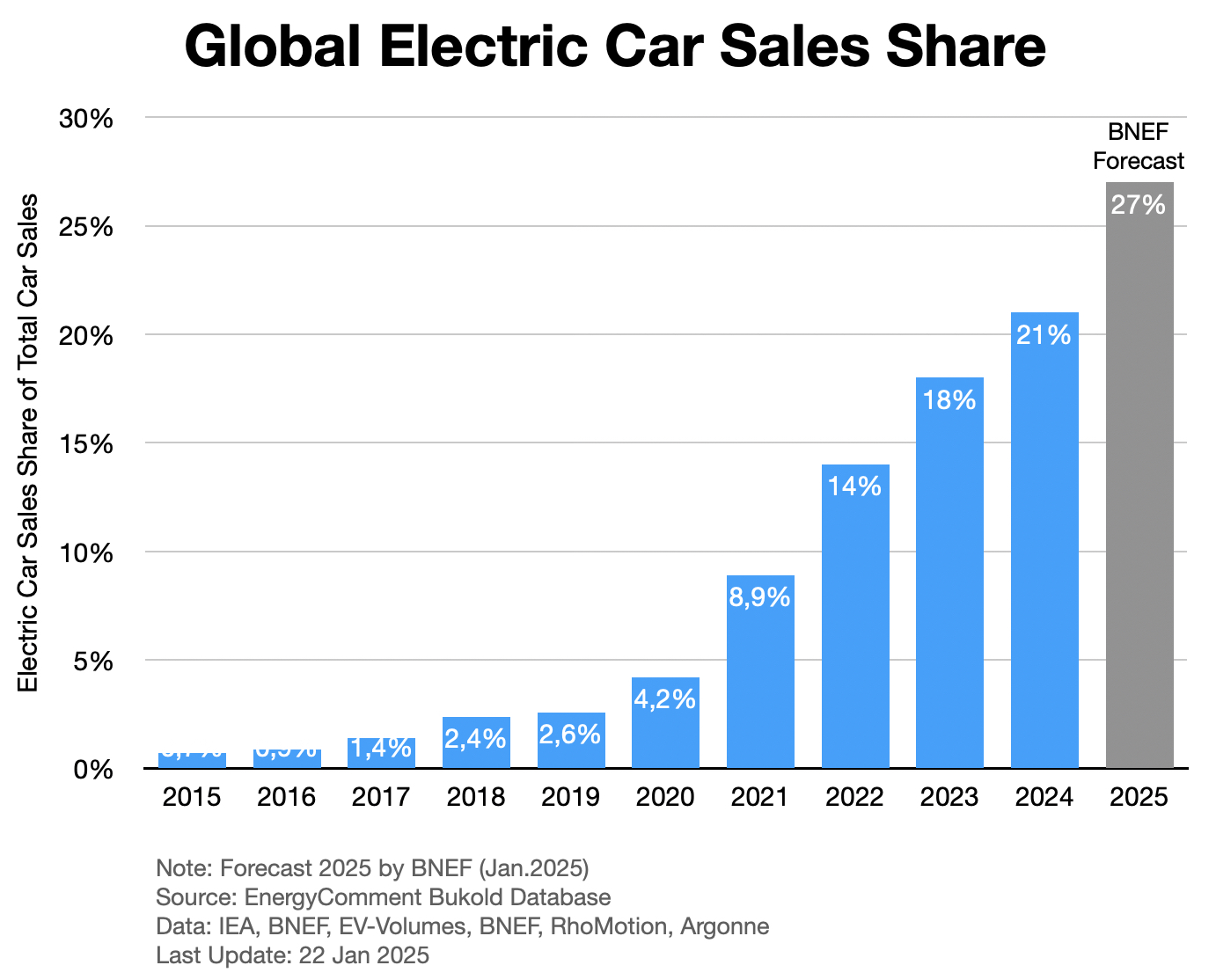

Electric Vehicles (BEV/PHEV)

About this web service

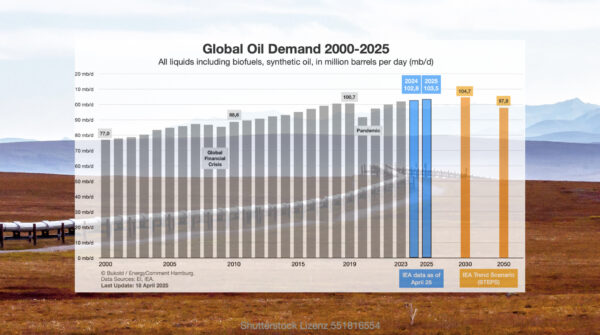

Our focus is on the intersection of fuels, transportation, and decarbonization.

We address the corporate and NGO sectors, media and policy-making.

Effective climate policy is not possible without a fuel transition in transportation.

But how? The pathways are controversial and differ from sector to sector, and often from region to region.

Starting on 2 July 2025, this website will report on news and trends. Over time, analysis as well as industry and technology overviews will play an increasingly important role.

You want to know more? Contact us (🇩🇪🇬🇧) or read more about us.