Quick Summary

- Crude oil prices have remained close to their annual low since October, averaging just $64/bbl. However, extremely high refinery margins mean that product prices are only falling slightly.

- Short-term oil demand: Forecasts have remained virtually unchanged since the summer. Global oil demand is expected to rise by just under 0.8% in both 2025 and 2026.

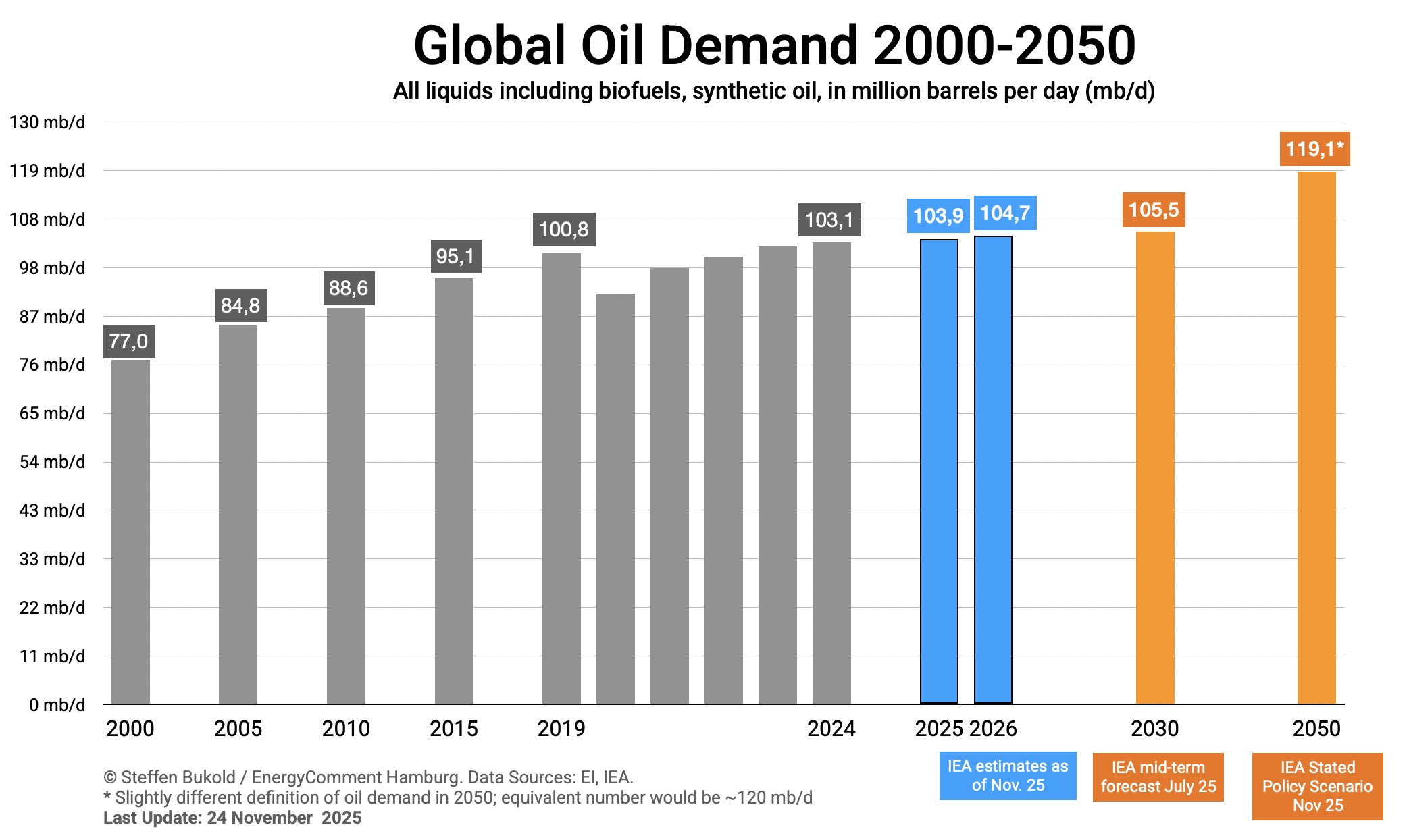

- Long-term oil demand: The energy and transport policy targets that have been adopted or planned are not sufficient to halt the rise in global oil consumption in the coming years.

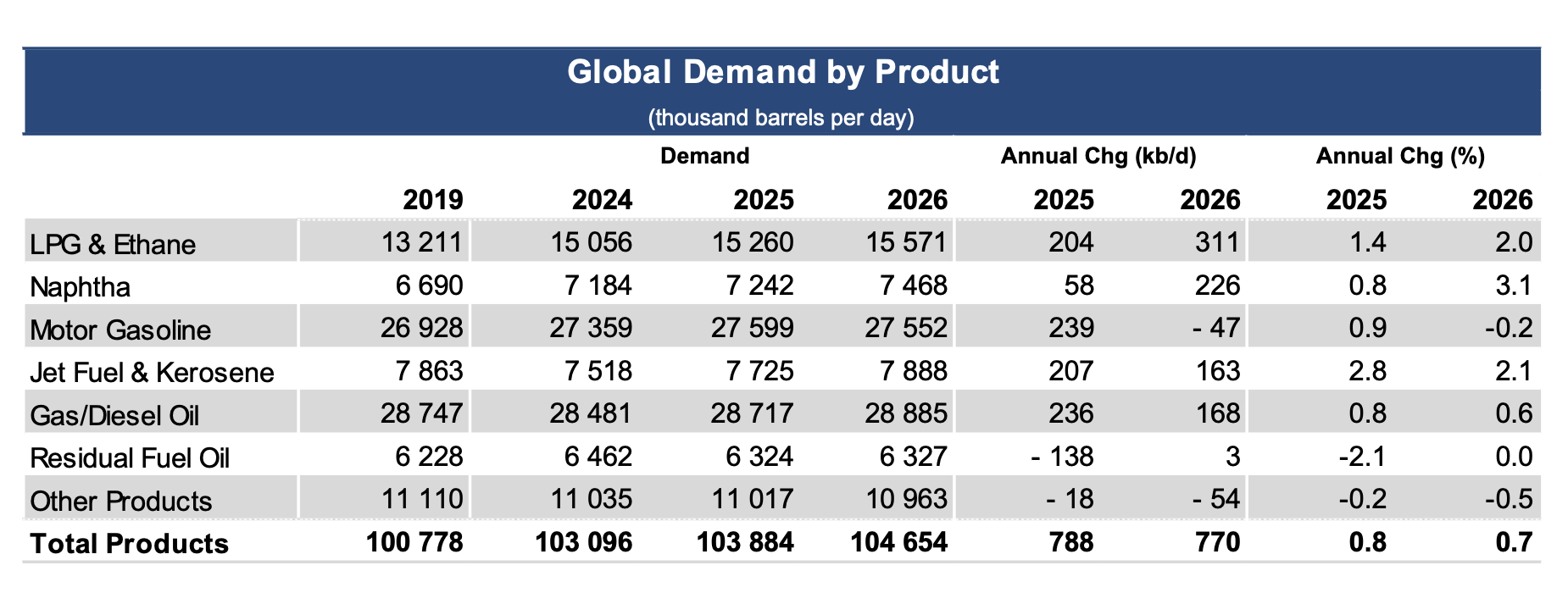

- Petrochemical feedstocks and transport fuels (jet fuel, motor gasoline, diesel) are driving the rise in global oil demand. Particularly in the transport sector, forecasts have been revised upwards since the summer.

Main Findings

Oil Prices

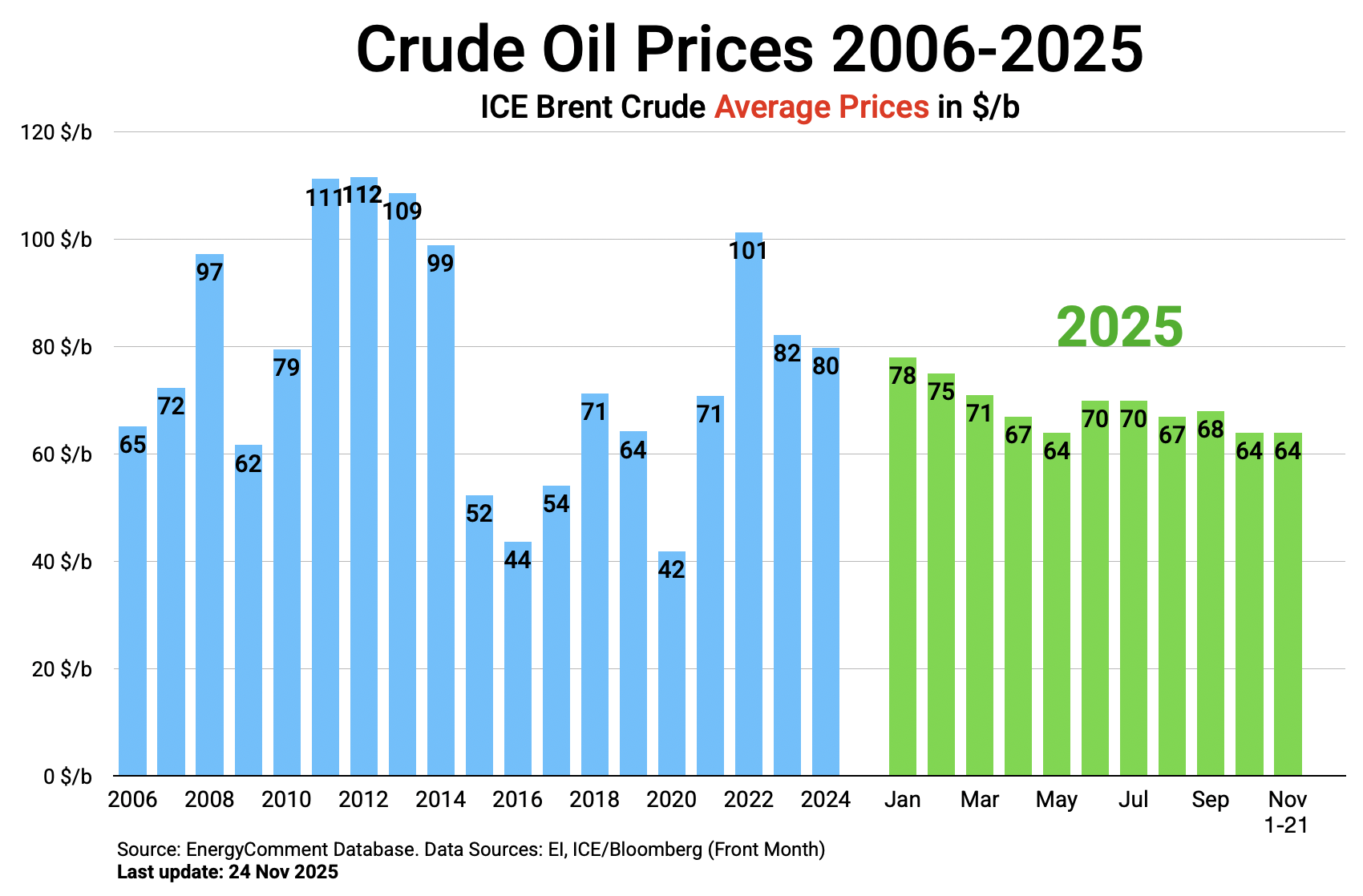

Crude oil prices remain under pressure. In October and November (1-24), they fell to an annual low of $64/bbl on a monthly average (see chart). Similarly low values were last seen in February 2021, during the Covid pandemic.

Even without adjusting for inflation, crude oil is now as cheap as it was 20 years ago.

Market conditions have not changed in recent months: growing oversupply of crude oil, especially from the Americas (US, Canada, Brazil, Guyana), is meeting with demand that is growing only slowly.

A sharper price decline is slowed down primarily by export risks in Russia: New sanctions imposed by the USA and the EU, as well as damage to refineries and port facilities caused by Ukrainian drone attacks.

In addition, China is creating additional demand by expanding its national oil reserves. Approximately 150 million barrels have been put into storage between January and September.

However, the low prices for crude oil are hardly reaching end consumers. Refinery profit margins climbed to record levels in the autumn. Technical refinery outages, export problems for some oil products in Russia, hedging and speculative purchases by physical and financial traders are the main reasons for this. As a result, prices for gasoline, diesel and jet fuel fell only slightly.

Oil demand in 2025 and 2026

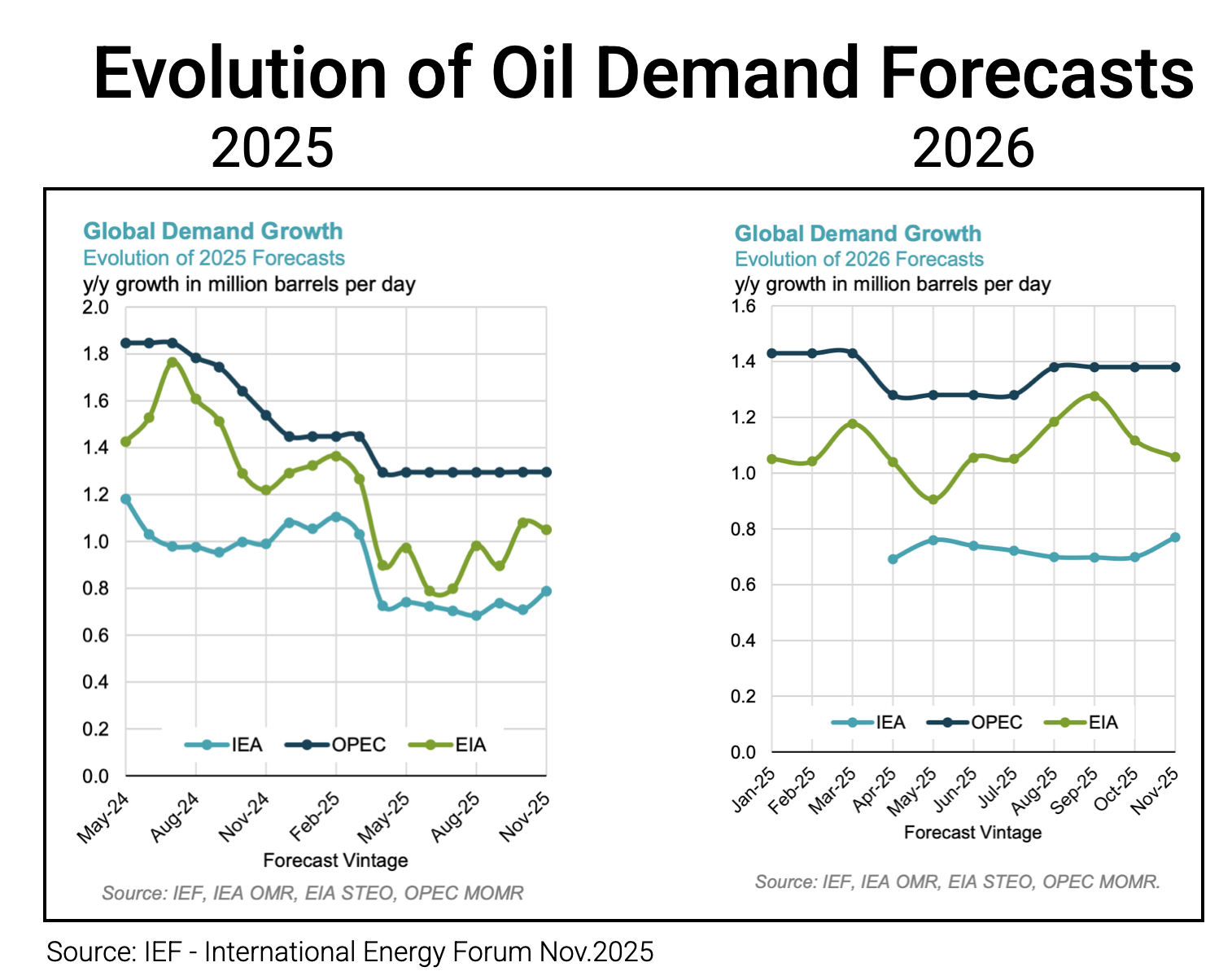

The forecasts of the IEA (International Energy Agency, Paris), EIA (US Department of Energy) and OPEC converged in the second half of the year (see chart).

As the OPEC figures appear increasingly politicised and the EIA tends to focus more on the situation in the US, we will limit ourselves to IEA data.

Since the summer, the IEA had to revise their expectations for 2025 and 2026 only slightly. Oil demand will rise from 103.1 to 103.9 mb/d (+788 kb/d yoy) in 2025, followed by an increase to 104.7 in 2026 (+770 kb/d yoy).

Transport Fuels

Apart from ‘bottom of the barrel’ (residual fuel oil), the increase this year will be driven by all major product groups:

- Petrochemical feedstocks +262 kb/d

- Jet/kerosene +207 kb/d

- Motor gasoline +239 kb/d in 2025

- Gas/diesel oil +236 kb/d (of which around 75% is diesel)

This means that transport remains the most important cause of the continuing rise in oil consumption. Moreover, when comparing the forecasts from July and November, there has been a sharp increase in expected consumption of transport fuels:

- Motor gasoline: from +115 (July) to +239 kb/d (November)

- Jet fuel: from +150 to +207 kb/d

- Gas/diesel oil: from +51 to +236 kb/d

Source: IEA: OMR November 2025, Paris 2025

Long-term oil demand outlook

This month saw the publication of the IEA’s new World Energy Outlook, the ‘bible of energy policy’ for policymakers around the world. Two findings are particularly interesting in our context.

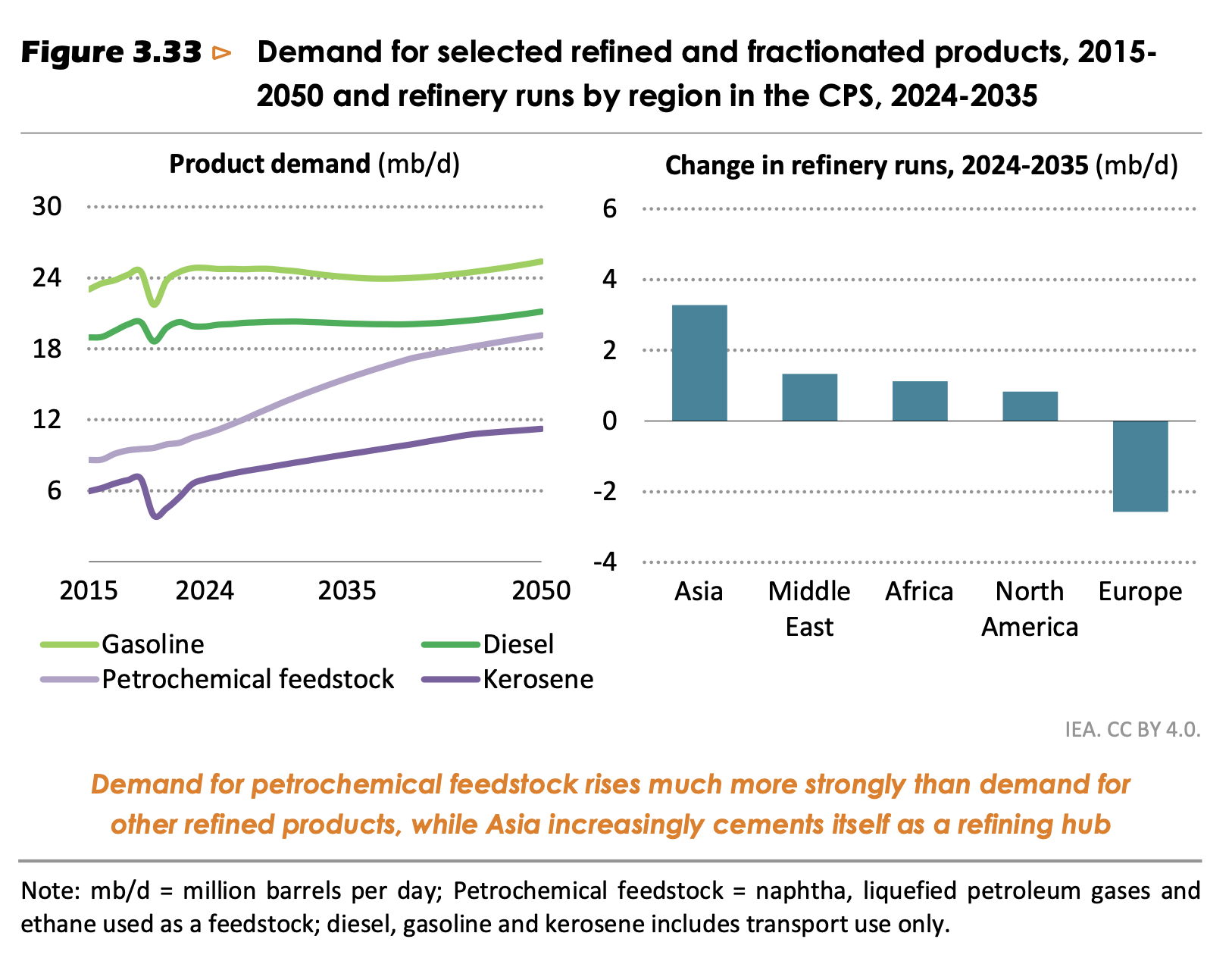

🔹 In the Current Policy Scenario (CPS), the authors estimate future oil demand based only on regulations that have already been adopted.

In this case, oil demand will continue to rise in the coming decades to 113 mb/d (crude oil) and 119 mb/d (liquids) in 2050. A global ‘peak oil demand’ would therefore be a long way off.

Demand for oil will rise in the coming years, particularly in the petrochemical and aviation sectors. In road transport, it will remain at current levels until at least 2035.

Source: IEA: World Energy Outlook 2025, Paris 2025

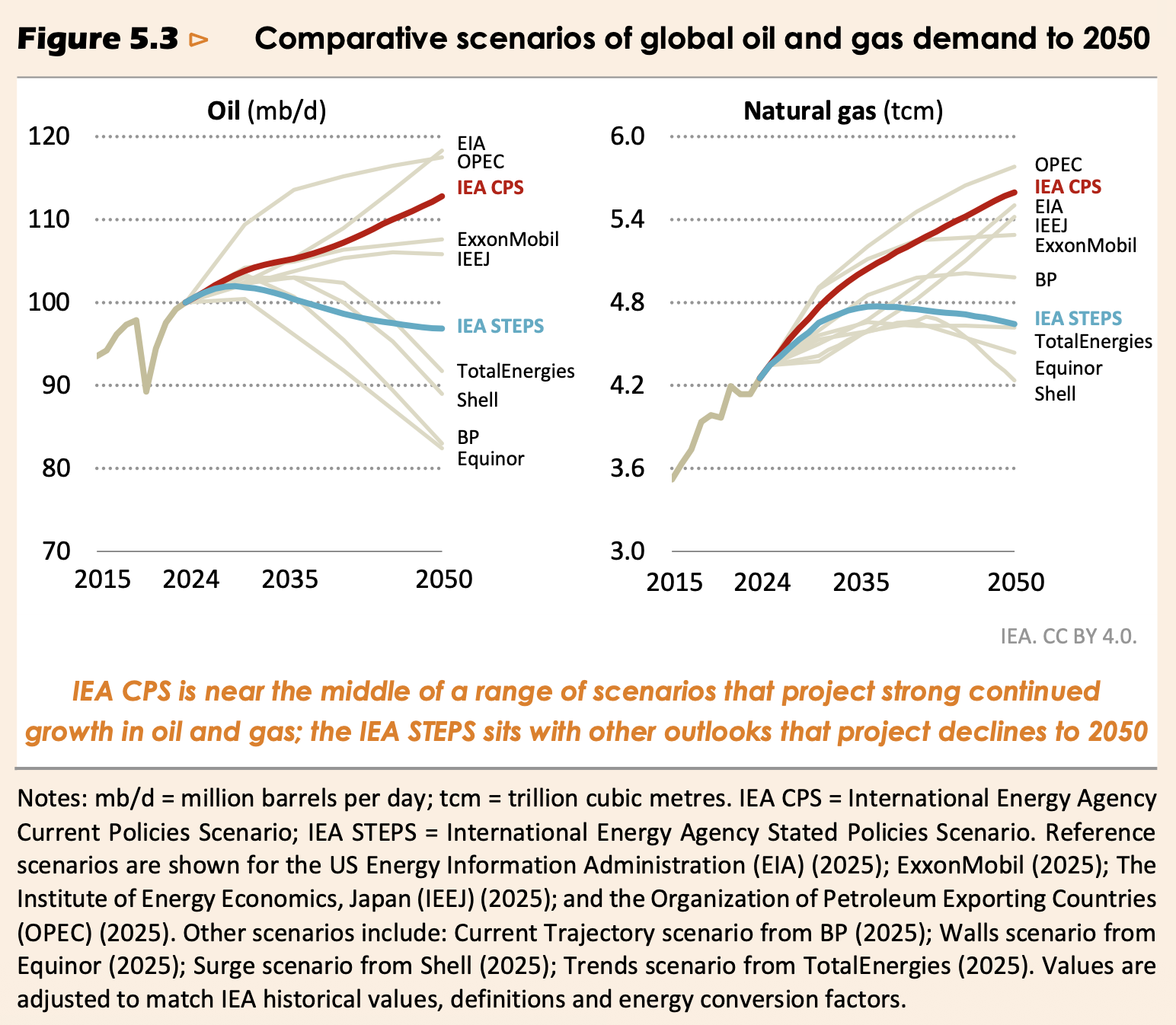

🔹 In the STEPS scenario (Stated Policies Scenario), all planned or announced policy targets are also adopted in regulation and implemented.

In this case, global oil demand will plateau in a few years and then decline from the 2030s onwards. However, even in 2050, it will be not far below today’s level.

The following chart shows that these scenarios are well within the range of current forecasts.

Source: IEA: World Energy Outlook 2025, Paris 2025

Your comment

- Please use our contact form

Sources and additional information

- IEA: OMR November 2025, Paris 2025 (https://www.iea.org/reports/oil-market-report-november-2025)

- IEF: Comparative Analysis of Monthly Oil Market Reports, Riyadh November 2025 (https://www.ief.org/data/comparative-analysis)

- IEA: Oil 2025, Paris 2025 (https://www.iea.org/reports/oil-2025)

- IEA: World Energy Outlook 2025, Paris 2025 (https://www.iea.org/reports/world-energy-outlook-2025)

- Featured Image (Top): BFL Flux Image Generator