Takeaways

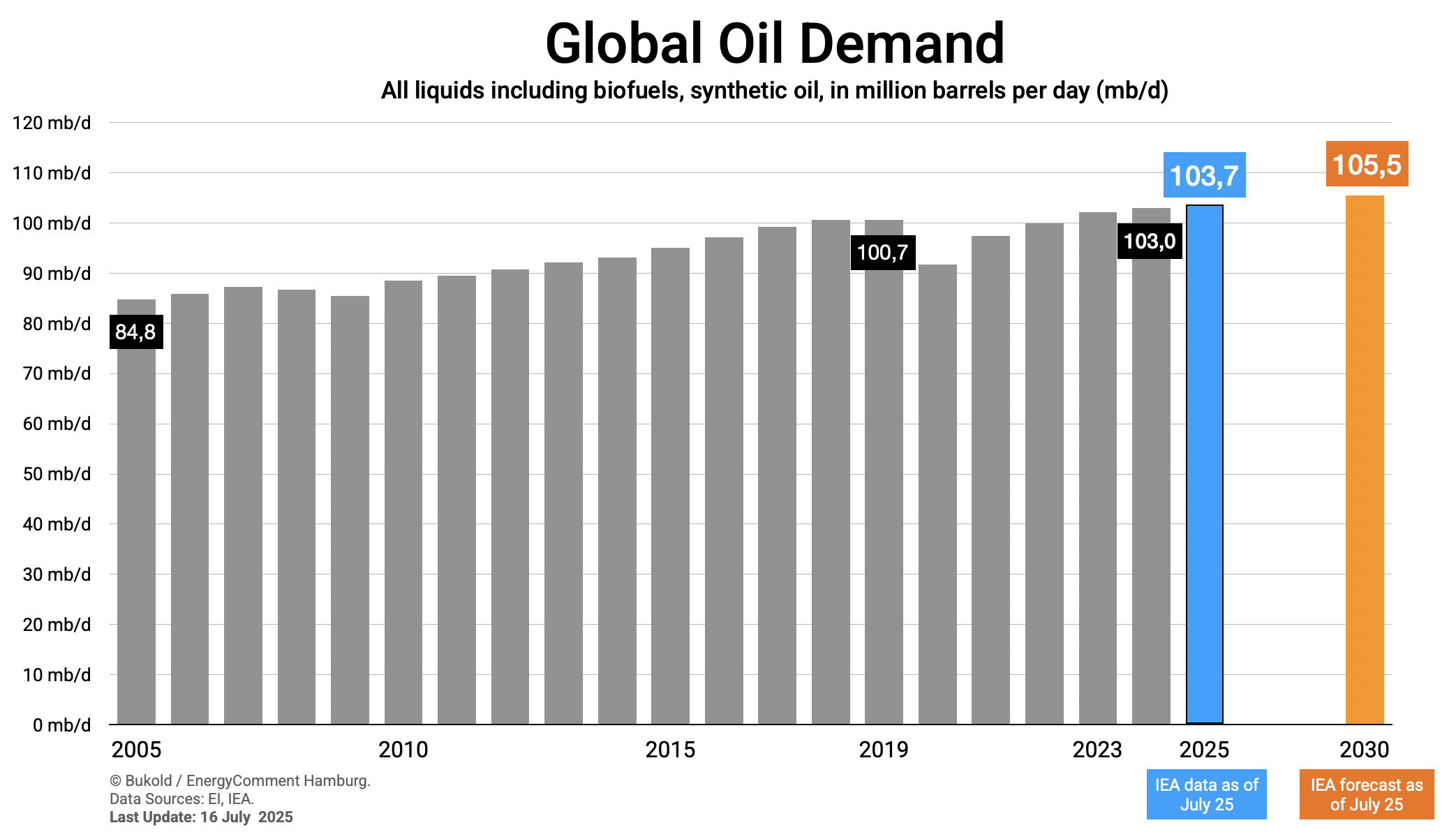

- Despite the turbulent global political situation in recent months, forecasts for oil demand and oil prices have remained largely unchanged. Global oil demand is expected to increase by 0.7 mb/d (0.7%), which is significantly below the long-term average.

- Oil prices remain under pressure. Following the seasonal consumption peak in the summer, a massive supply surplus is looming for the rest of the year.

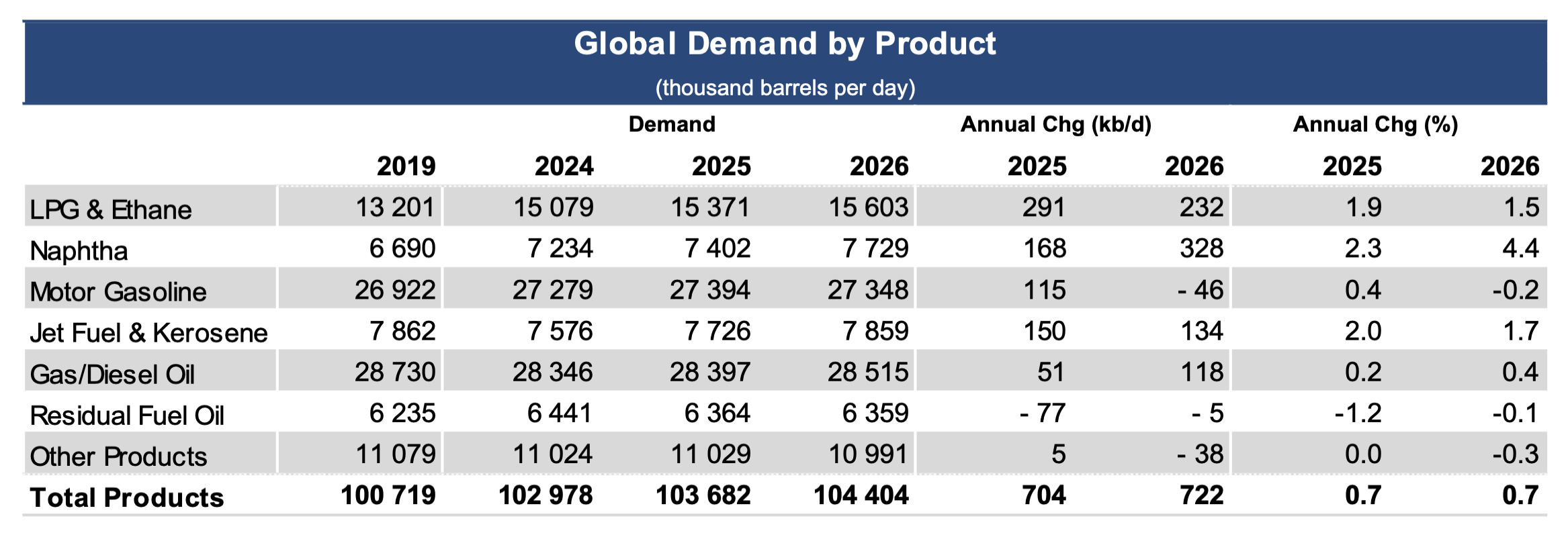

- Demand is rising in the petrochemical, jet fuel and motor gasoline sectors. In the mixed category of gas oil/diesel, however, demand is hardly changing.

Main Points

- What has changed in the oil market since our overview in April? Surprisingly little.

- Despite the military conflicts in the Persian Gulf, the chaos in American trade policy and the change of course at OPEC, the outlook has remained largely unchanged since our last update in April.

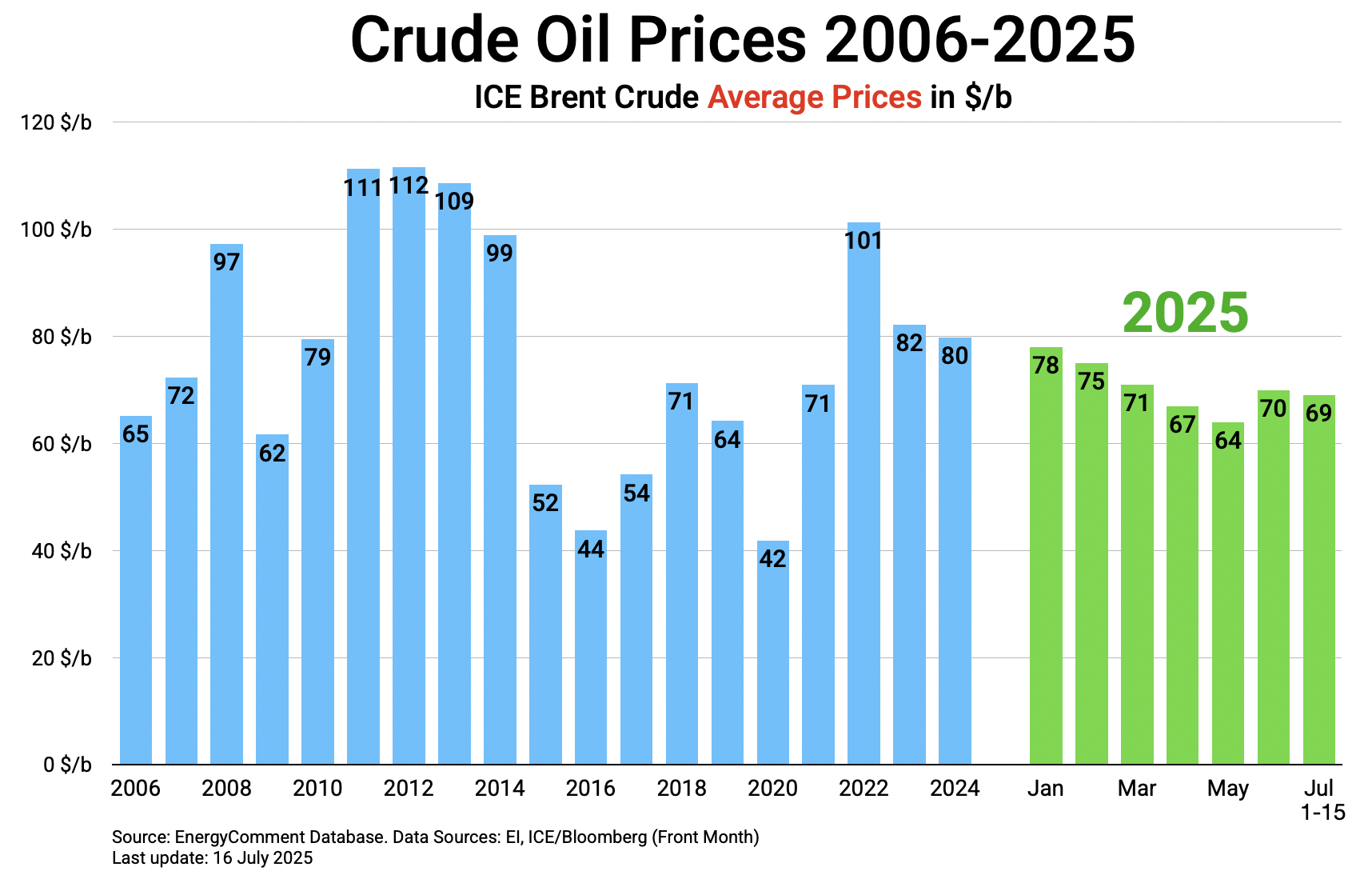

- Oil prices: In April, the average price was $67/bbl. In July, it has been $69/bbl so far. This is a price level we saw already 20 years ago. Adjusted for inflation, oil prices have actually fallen sharply since then – an important stimulus for the continuing rise in oil demand.

- Almost all experts are cautious about the price outlook. After the seasonally strong summer demand, there is a threat of a massive supply surplus in the autumn, which will put pressure on prices.

- Oil demand: The IEA’s demand forecasts have not changed much since April. Back then, they expected annual demand growth to be well below average at +0.73 mb/d (2025) and +0.69 mb/d (2026).

- Now, in July, the IEA expects a virtually unchanged growth of +0.70 mb/d (2025) and +0.72 mb/d (2026).

- In its June medium-term outlook, the IEA expects oil demand to rise slightly, at least until the end of the decade. It is expected to rise from 103.8 mb/d this year to 105.5 mb/d in 2030, peaking in the period 2029/2030.

- However, this is a moving target. Just a few months ago, the IEA was forecasting only 104.7 mb/d by 2030.

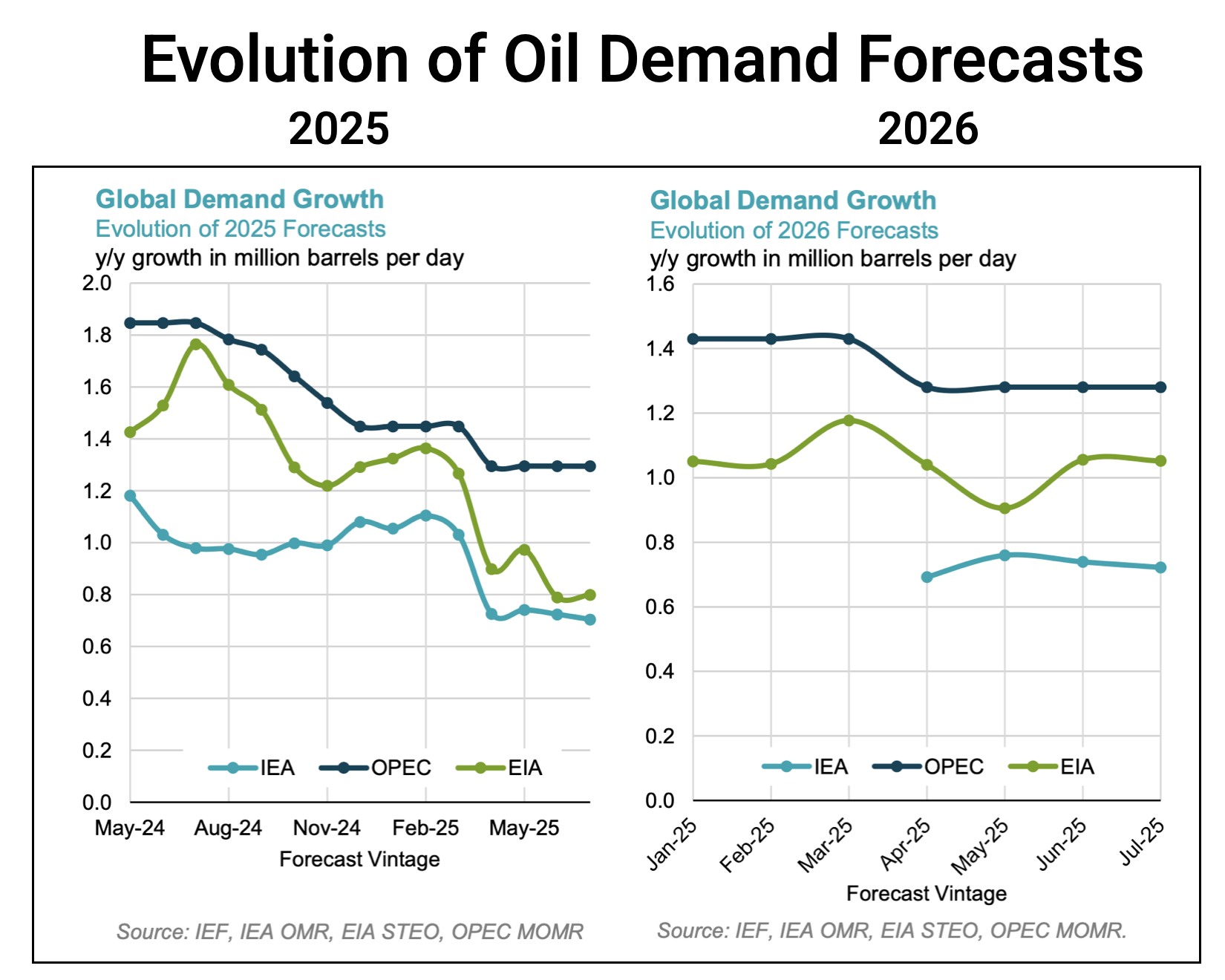

- The development of demand forecasts since last year (see chart) shows that the US Energy Information Administration (EIA) has moved closer to the IEA’s figures for 2025.

- The OPEC Secretariat was already way off the mark last year (without making any subsequent corrections). Even now, the figures appear to be politically biased and far removed from reality.

Source: IEF

- Back to the IEA analysis: The already weak growth in demand this year is heavily concentrated in the petrochemical industry. According to the IEA’s July report, this sector accounts for two-thirds of the increase this year. However, forecasts have been lowered slightly compared to April.

- The situation is quite different for jet fuel/kerosene, where forecasts rose from 107 kb/d in April to 150 kb/d now. Total consumption this year will range above 7,7 mb/d.

- Gasoline demand is also expected to rise. Here, an almost unchanged +115 kb/d is expected.

- Gas/diesel oil has gone from a slight decline to a slight increase. However, this is a diverse product category, so no direct conclusions can be drawn about the transport sector.

- Here the numbers of the most important categories for transport fuels in 2025:

- 27.4 mb/d motor gasoline (road transport)

- 28.4 mb/d gas/diesel oil (largely road transport and off-road vehicles, e.g. construction, agriculture)

- 7.7 mb/d jet fuel & kerosene (mostly air transport, some heating/cooking)

- 6.4 mb/d residual fuel oil (shipping and many other sectors)

Source: IEA

Sources

- IEA: OMR July 2025, Paris 2025

- EIA: STEO July 2025, Washington D.C., 2025

- OPEC: MOMR July 2025, Vienna 2025

- IEF: Comparative Analysis of Monthly Oil Market Reports, Riyadh July 2025

- IEA: Oil 2025, Paris 2025

Your Comment

- Please use our contact form

Schreibe einen Kommentar