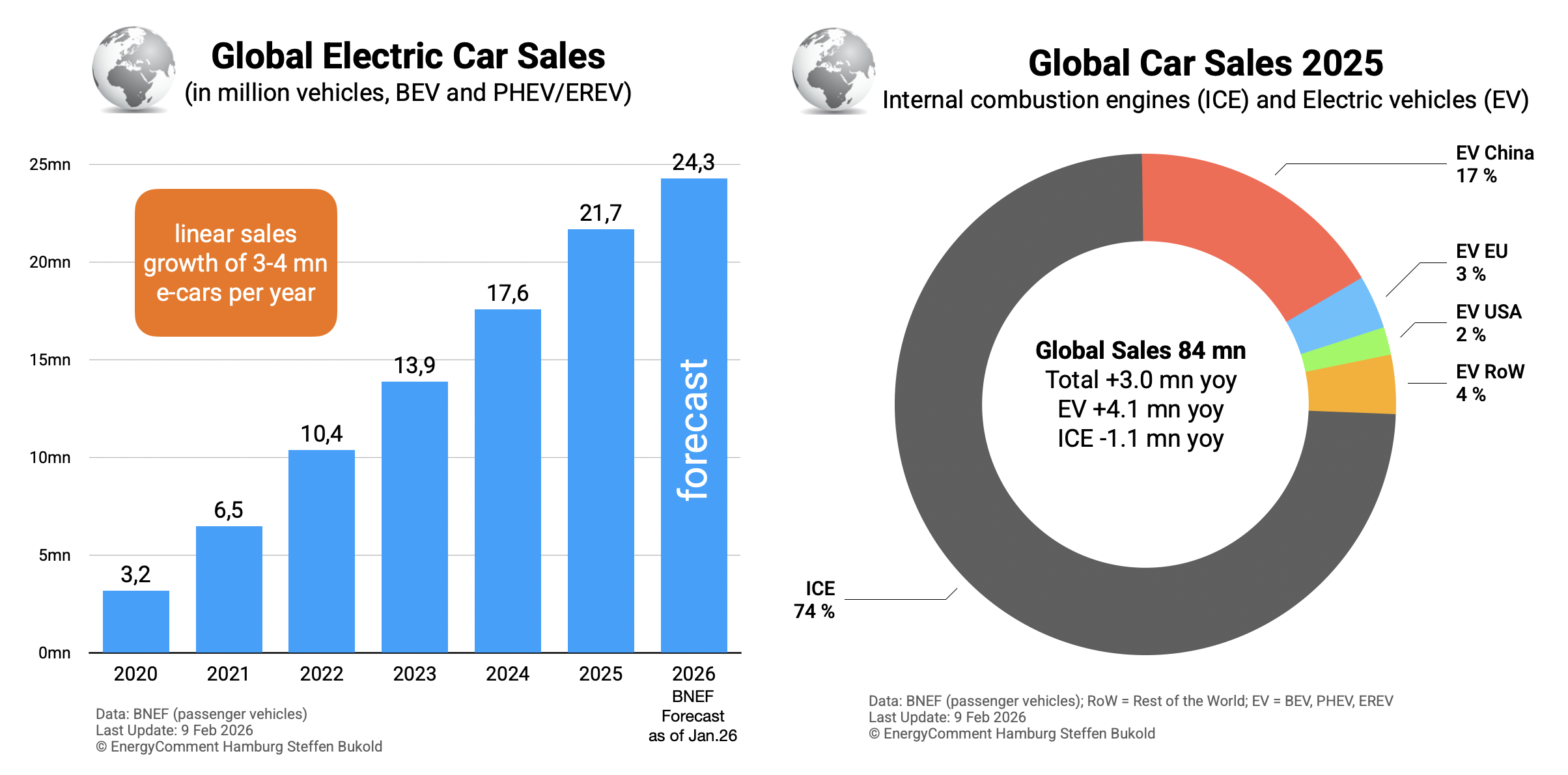

2025: Electric vehicle sales continued their robust growth last year. According to figures from BNEF, 21.7 million EVs were sold in 2025 which is 4.1 million more than in 2024. Other sources report lower numbers (cf. methodological note below).

The EV share of the global automotive market rose to 26% in 2025. Nearly two-thirds hereof (17%) occurred in China.

2026: Growth is expected to moderate in the current year. The market share could climb to 28%. Currently, an increase of approximately 2.6 million EVs is anticipated. This slowdown is primarily attributable to a politically driven collapse in US sales and a market cooling in China following the expiration of subsidies and scrappage schemes.

🔷 The trend is obvious: EV sales are rising linearly but show no signs of acceleration. Each year, 3-4 million new electric vehicles enter the market. Nearly all vehicles in the existing EV fleet are new, meaning net fleet additions are roughly equivalent to sales volumes.

🔷 The net balance is sobering. Total vehicle sales (ICE and EV) worldwide increased by 3 million units to 84 million cars. Consequently, sales of new internal combustion engine vehicles (ICE) declined by only 1.1 million units. This year’s net balance may prove similarly modest.

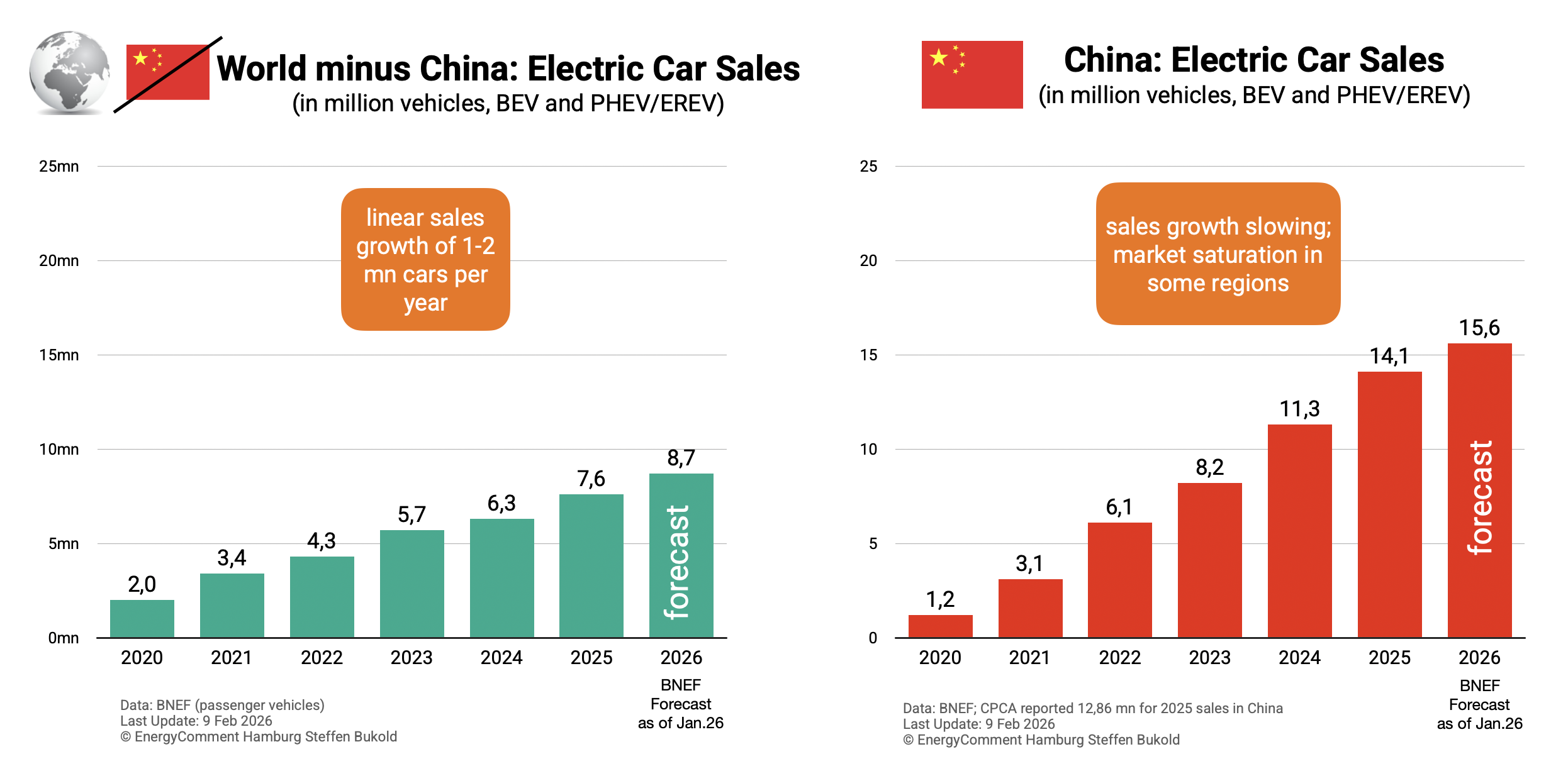

The sluggish pace of the transition becomes even more apparent when Chinese EV sales are excluded from the equation. What remains is an electric fleet growing by merely 1-2 million vehicles annually.

Within a few years, China will cease to function as the driving force of car electrification, as more and more regions approach market saturation. The EV market share in China has already exceeded the 50% threshold. With financial support being scaled back, 2026 sales are expected to grow by only approximately 10% to 15.6 million electric cars.

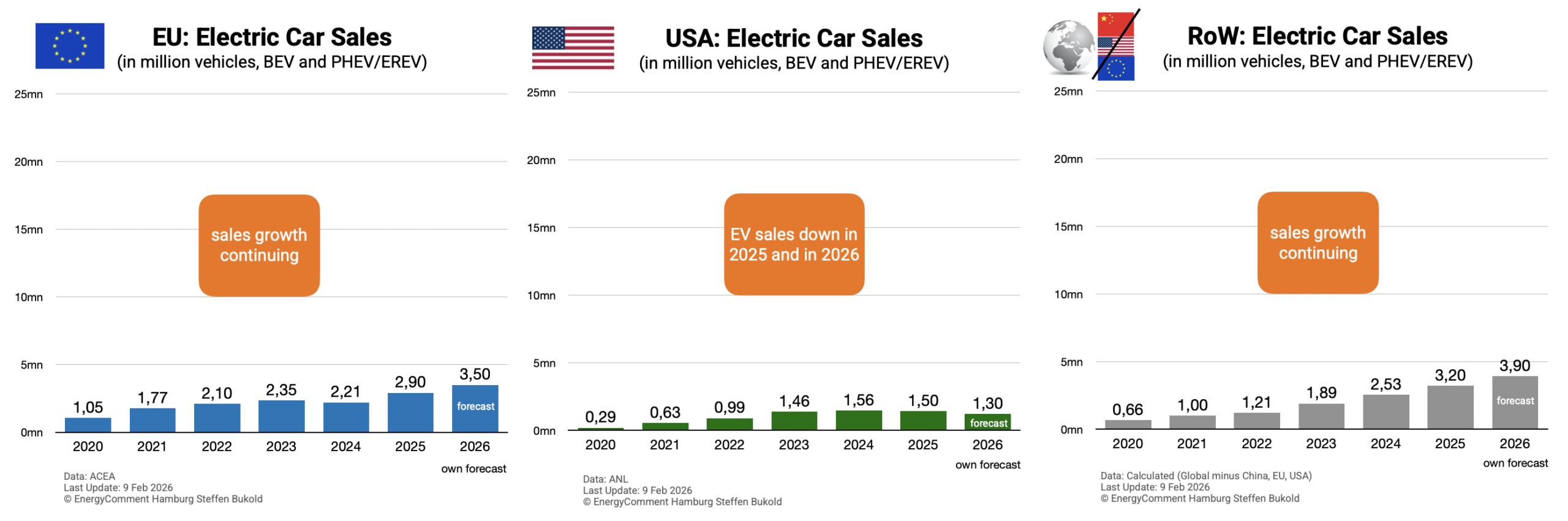

Outside China, however, bright spots emerge. The EU market has overcome its 2024 sales crisis. Another growth year exceeding +20% is anticipated for the current year, reaching 3.5 million electric vehicles.

The US trend diverges sharply. Strong headwinds from Washington caused sales to contract slightly last year. This year, the market will likely decline by more than 10% to 1.3 million new electric vehicles — equivalent to just 8-9% of Chinese sales figures.

The hope now rests on RoW, the “rest of the world“, i.e. nations outside the major economic blocs of China, US, and EU. Here, numerous bright spots span from Vietnam to the UK to Uruguay. Growth rates exceeding 20% are likely in RoW, driven primarily by export offensives from Chinese manufacturers facing mounting sales challenges in their home market.

🔴 The bottom line is cautious: Yes, EVs will gradually establish themselves in the global automotive market, but the white spots on the world map are unmistakable. The US, Japan, the Middle East, Russia/Eastern Europe, and many others are currently pursuing their own pathways. The Chinese market is approaching saturation.

🔴 Should the growth dynamics of the global EV fleet remain unchanged – while the total automobile fleet expands as many expect – complete electrification of the global car fleet will be pushed back to the years 2070-2080.

Methodological note

EV include BEV, PHEV and EREV: pure battery electric vehicles, plug-in hybrid vehicles, and extended-range electric vehicles.

BNEF (Bloomberg) is regarded globally as a reliable source and has been tracking the EV market for many years. Since definitions and data collection methods vary nationally and are occasionally unreliable, BNEF regularly harmonizes the figures.

For China’s 2025 figures, however, there is an unusually large discrepancy between BNEF (14.1 million EVs) and the Chinese car association CPCA, which reported retail sales of 12.9 million passenger EV in China.

For consistency, we nevertheless use BNEF figures for global volumes and Chinese sales figures. For the EU and US, we employ statistics from ACEA and Argonne National Laboratory (ANL), respectively.

Cover image: BFL Flux 2.0

Your comment

- Please use our contact form