Summary

- Global passenger air traffic increased by 4.0% in July compared to last year, reaching a new all-time high. All major air traffic regions are growing.

- For the first seven months of this year IATA reports an average growth of 5.0% for passenger and 3.1% for cargo traffic.

- Jet fuel consumption is expected to grow by 2.1% this year, but remains slightly below the 2019 record level.

Information and Background

- Air Passenger Market

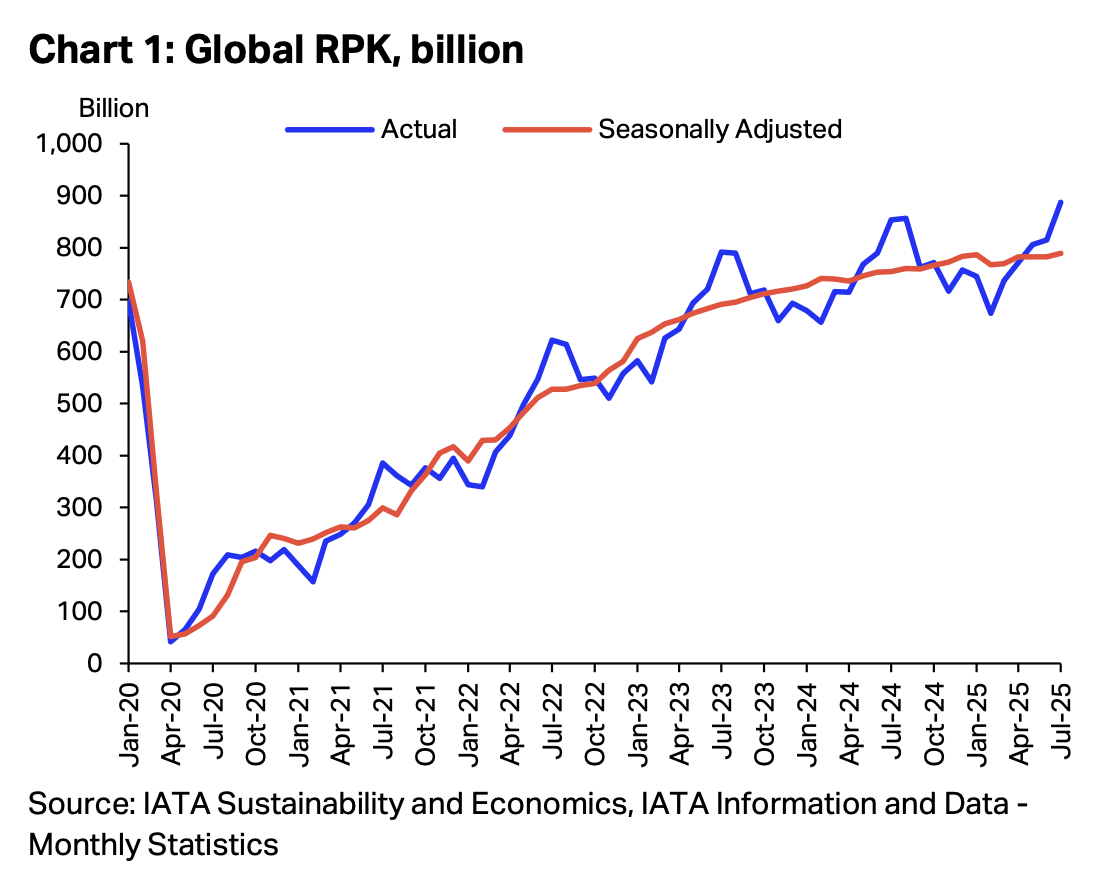

- New data from IATA: Passenger traffic rose by 4.0% in July compared to the same month last year (measured in RPK = Revenue Passenger Kilometres). Traffic climbed in all major regions.

- International traffic continues to be the main driver, climbing by 5.3%. Domestic air traffic grew by 1.9%, mainly due to weaker growth numbers in the United States.

- The July figures are slightly below the trend. In the first seven months of 2025, passenger air traffic expanded by an average of 5.0% (international: +6.9%).

- Air passenger transport is heading for a new all-time high this year, surpassing the pre-pandemic record year 2019.

Chart: Air Passenger Traffic (IATA)

- Air Cargo Market

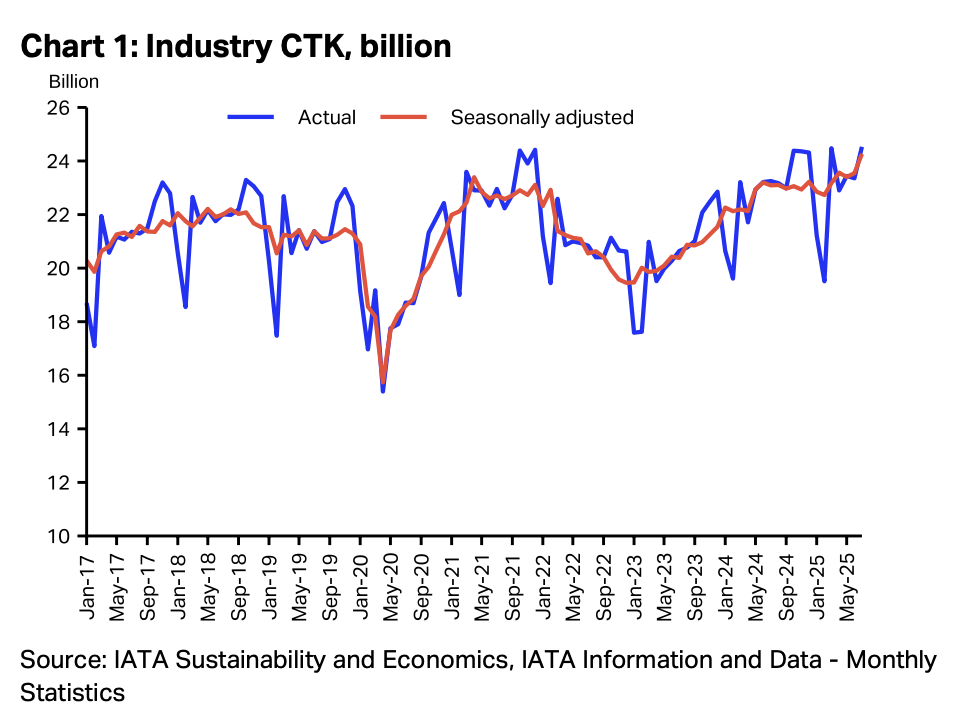

- Air cargo demand expanded by 5.5% in July compared to last year.

- Monthly numbers tend to fluctuate heavily mainly due to U.S. trade policy gyrations.

- In the first seven months of 2025 demand grew by an average 3.1%.

Chart: Air Cargo Traffic (IATA)

- Jet fuel demand

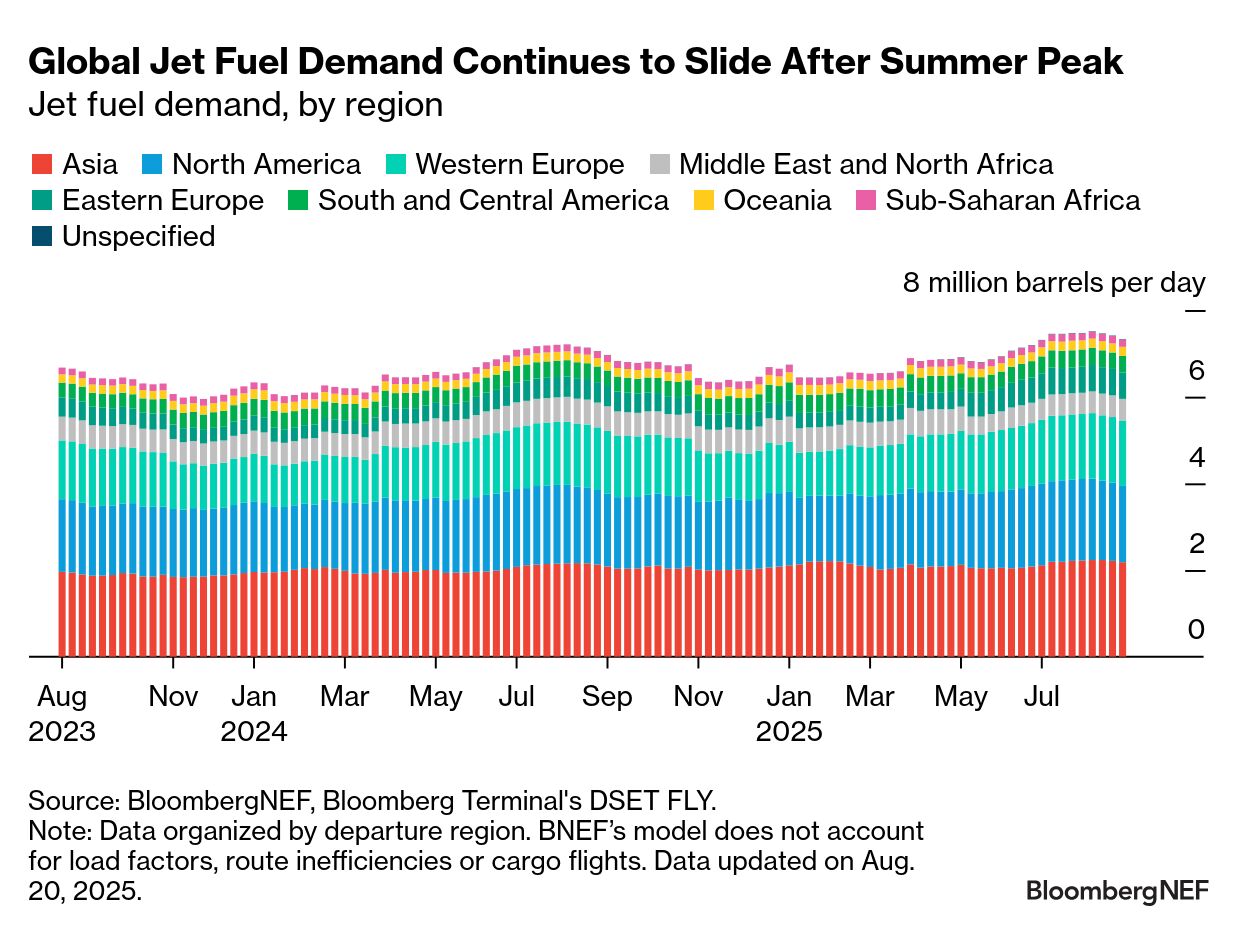

- Efficiency gains and the introduction of low-carbon fuels are too sluggish to stop the rise in jet fuel demand. Global crude oil prices in 2025 have remained about 10% lower than last year further slowing down the pressure to save fuel.

- BNEF (Bloomberg) expects jet fuel consumption to grow this year. For the last week of August, jet fuel demand in passenger air transport is estimated at 7.32 mb/d (excluding cargo flights). This figure is 3.8% higher than last year.

- The International Energy Agency (IEA) expects global jet/kerosene demand to grow by 2.1% this year (+0.16 mb/d). That would be a level of 7.68 mb/d, which is about 0.18 mb/d below the previous record year of 2019.

- The gap between air traffic and jet fuel consumption can be explained by two factors. Aircraft are becoming increasingly efficient and kerosene consumption in other areas (cooking/heating; approx. 0.7 mb/d in total) is steadily declining.

- Note: The Jet Fuel & Kerosene product group largely (90%), but not entirely, corresponds to jet fuel consumption in aviation. Kerosene is used for cooking and in small quantities for heating in some regions. However, these markets are relatively small (0.7-0.8 mb/d) and shrinking. Kerosene is gradually being replaced by LPG or electricity.

- Bottom Line

- Air transport remains the problem child of transport fuel decarbonisation. While it consumes “only” 7.5% of global oil supplies, it is the only rapidly growing oil demand segment alongside petrochemicals.

- The climate effects of contrails at high altitudes even double, on average, the GHG effect.

- Unlike other transportation sectors, aviation has no viable fuel alternatives on the horizon until new aircraft designs (hydrogen, fuel cells, batteries) become reality.

Chart: Passenger Jet Fuel Demand (BNEF)

Your comment

- Please use our contact form

Sources and additional information

- Image 1: IATA

- Image 2: IATA

- Image 3: Bloomberg (Energy Daily)

- Featured Image (Top): BFL Flux Image Generator