1. Oil Prices

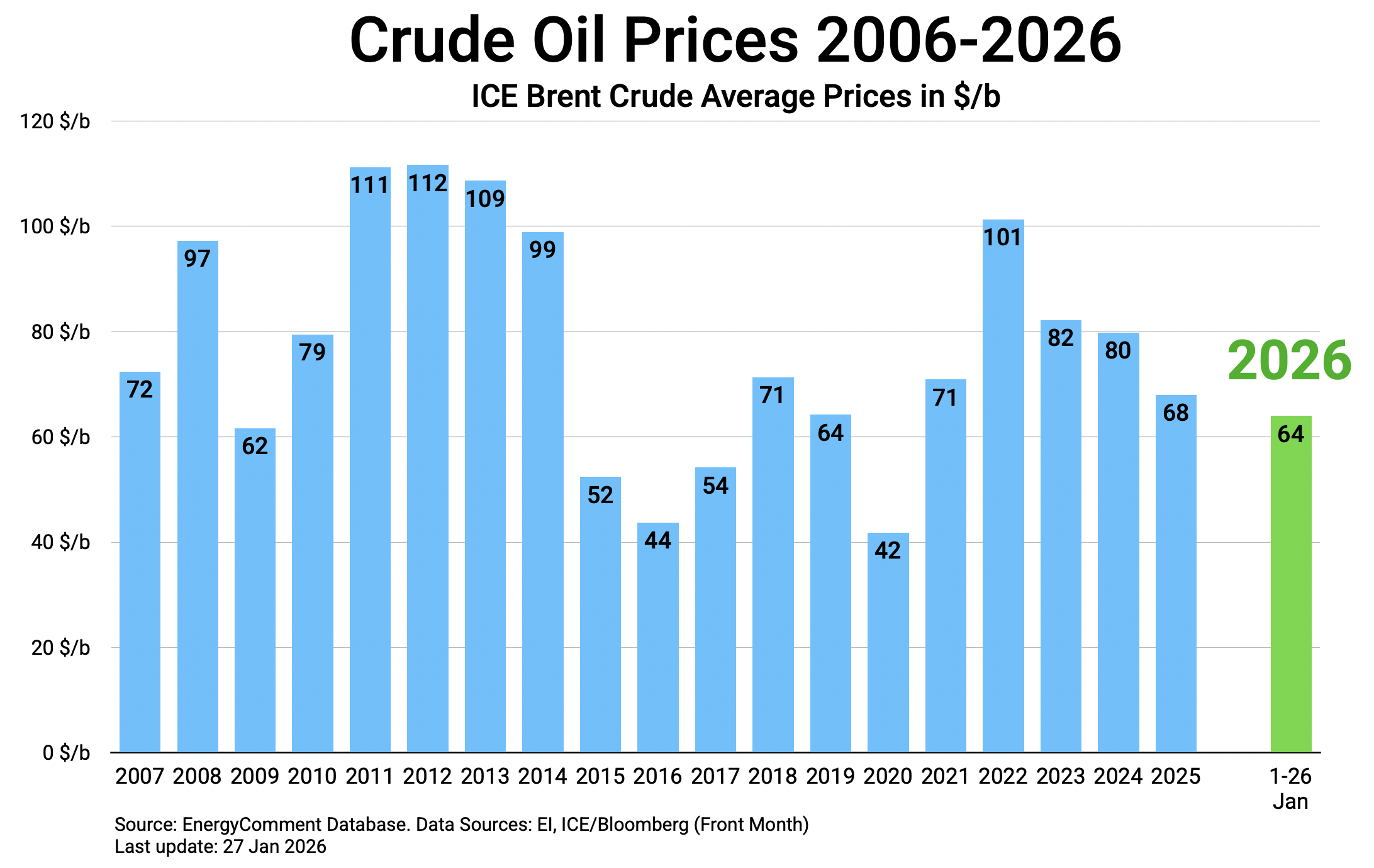

Despite ongoing crises in Venezuela, Iran and Russia/Ukraine, oil prices remain subdued. The average price for Brent crude stood at $68/bbl last year. In the opening weeks of this year, it has traded at $64/bbl (see chart). The supply surplus remains high despite various disruptions, leading to growing inventories in oil storage facilities and floating storage.

🔷 This relaxed market environment is likely to continue for the whole year of 2026 and probably beyond. The IEA estimates that oil supply will rise by 2.5 mb/d this year, provided OPEC maintains its current course and no major additional supply disruptions materialize. Oil demand will lag far behind with a substantially smaller increase of 0.93 mb/d, according to the IEA’s latest projections.

2. Global Oil Demand

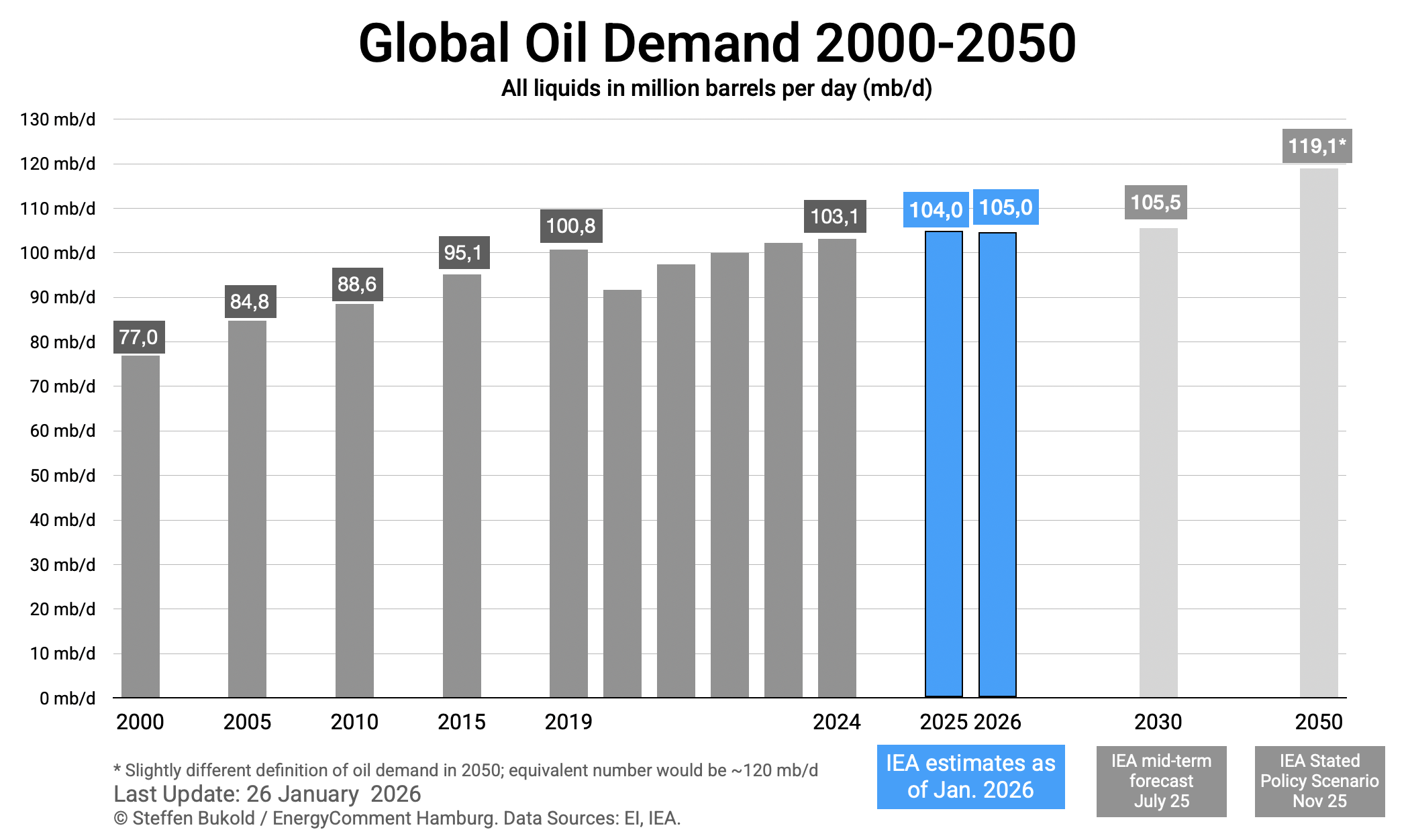

The peak in global oil demand is not in sight yet. According to current IEA forecasts, oil demand is set to grow even faster this year (2026) than last year.

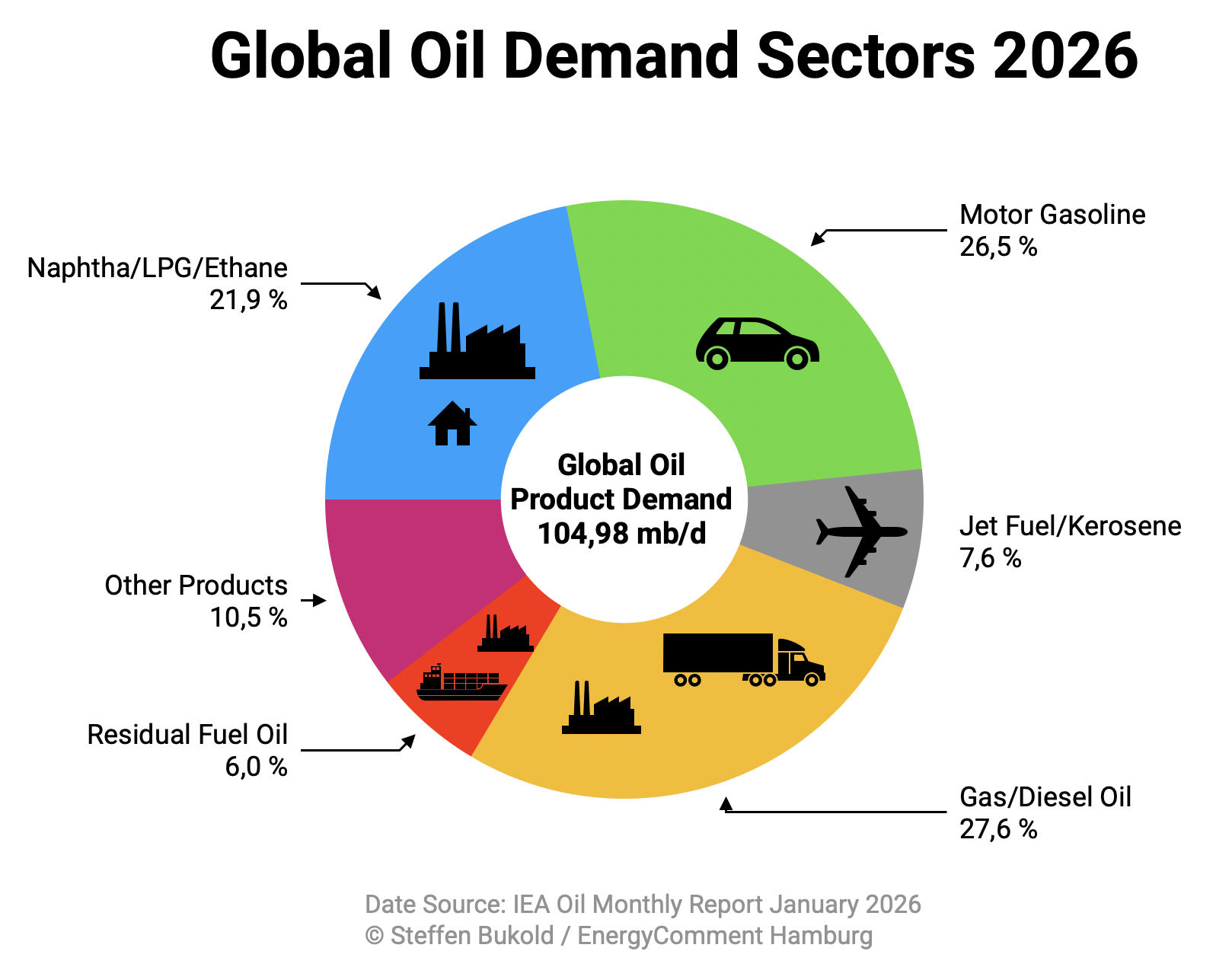

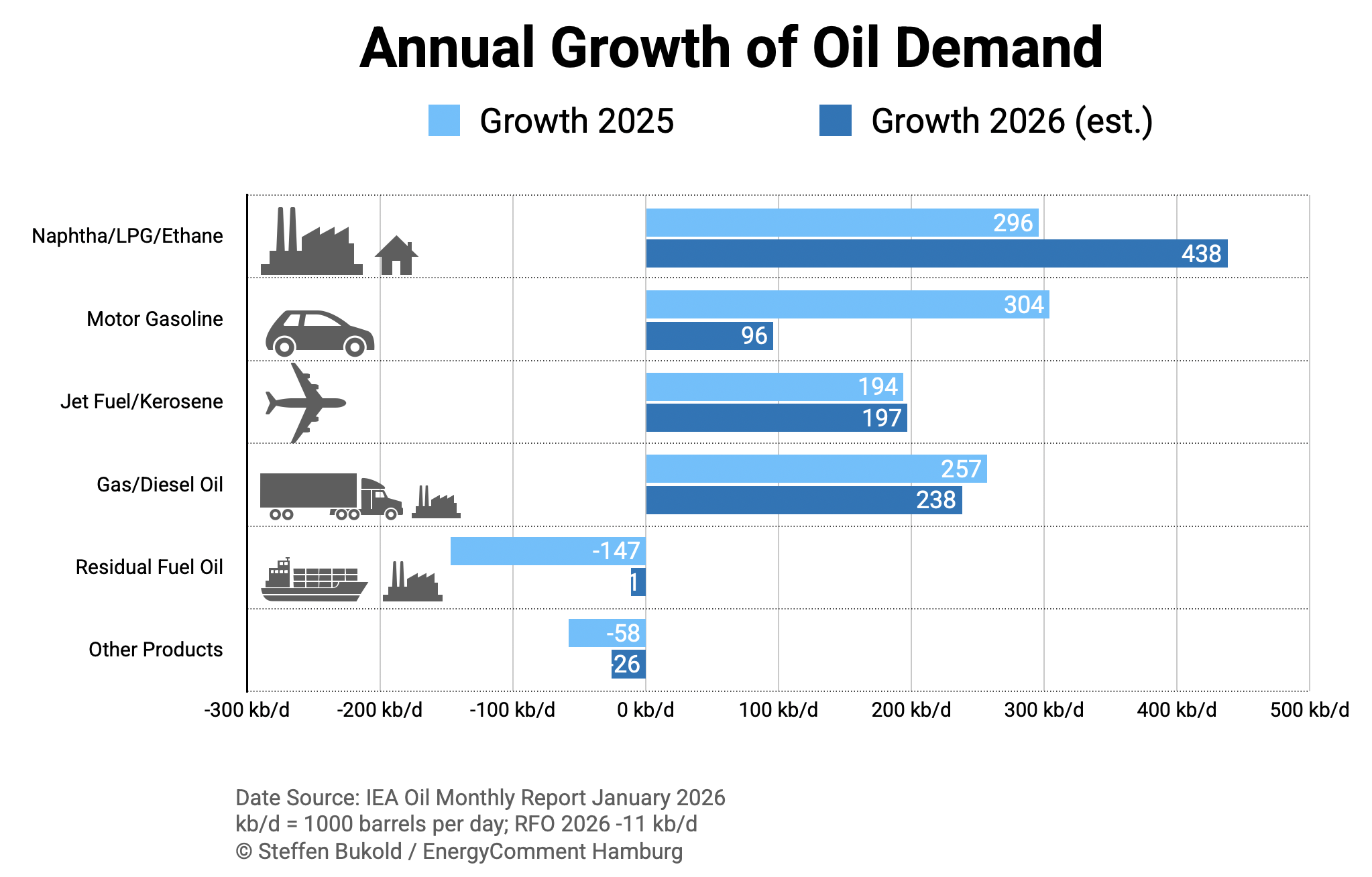

🔷 In its latest monthly report (January 2026), the IEA anticipates a gain of 932 kb/d for 2026 (kb/d = 1000 barrels per day), pushing global oil consumption to a new all-time high of 104.98 mb/d (see chart).

🔷 For 2025, it estimates growth retrospectively at 847 kb/d. Absent the tariff conflicts that particularly dampened China’s petrochemical sector, last year’s increase would have been higher.

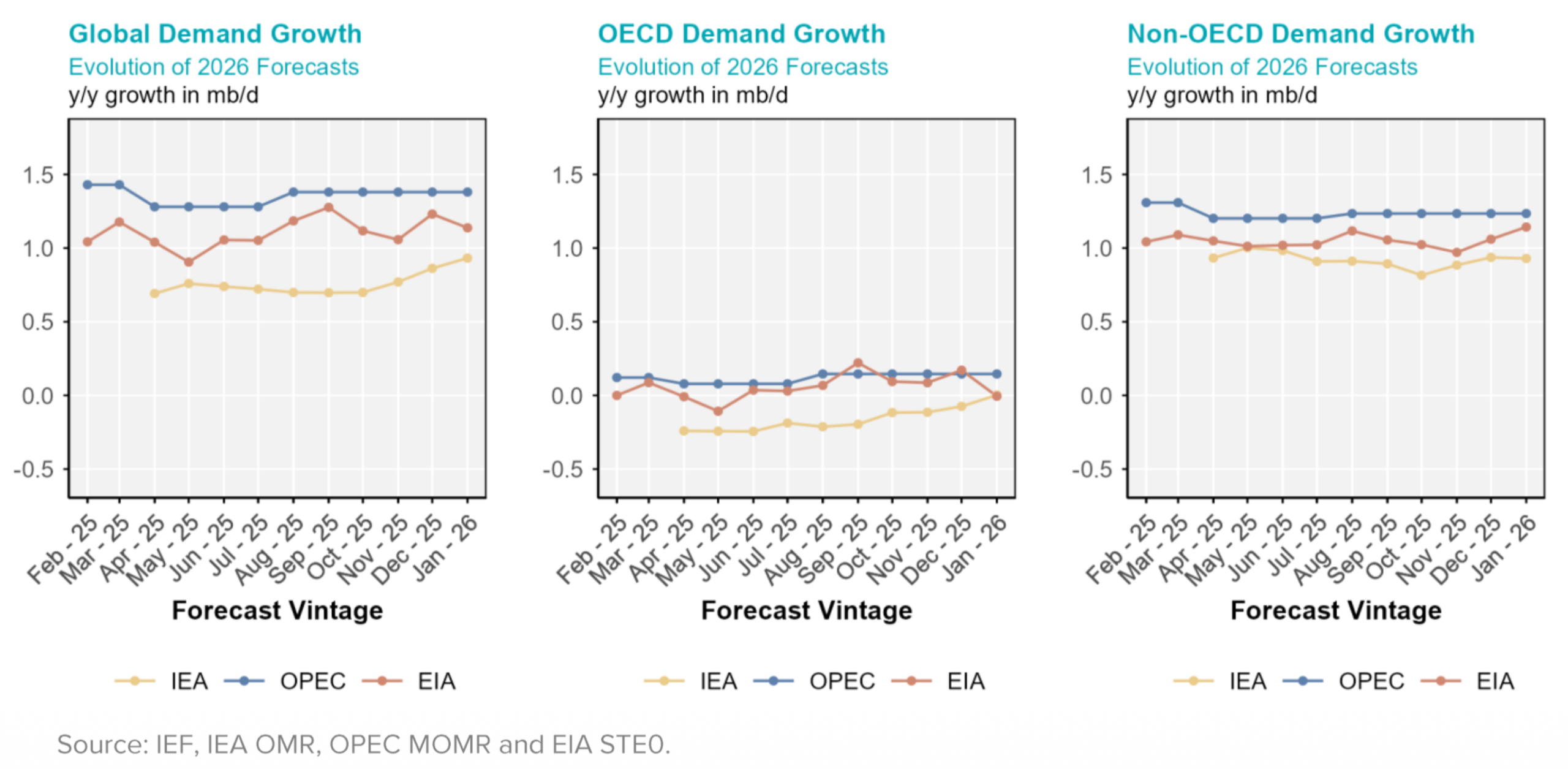

For this year, the forecasts from the IEA (International Agency, Paris), EIA (U.S. Energy Department), and OPEC are more closely aligned than last year, when the OPEC Secretariat predicted far too robust demand growth. Currently, OPEC expects oil demand to increase by 1.4 mb/d in 2026, the U.S. EIA projects 1.1 mb/d, and the IEA forecasts 0.9 mb/d (see chart).

The projections concur on regional distribution: stagnation in industrialized countries (OECD), robust growth in the rest of the world (non-OECD). As in 2024 and 2025, Asia remains the focal point of growth, accounting for nearly two-thirds of global incremental oil consumption. China, India, and Southeast Asia stand at the center of this expansion.

Source: IEF

3. Oil Demand in Transport

🔷 The petrochemical sector, with feedstocks naphtha and LPG/ethane, is recovering in 2026 following the tariff conflicts of 2025. It could contribute +438 kb/d, representing nearly 50% of oil demand growth this year.

For this reason, CO₂ emissions from oil consumption are rising somewhat more slowly than oil demand, as only a portion of these products (particularly LPG) is combusted. The remainder predominantly ends up in landfills, waste incineration plants, or the natural environment. In most landfills, climate-damaging methane emissions subsequently will emerge at a later stage.

🔷 Transport fuels constitute the second pillar: consumption of jet fuel/kerosene, gasoline, and gas/diesel oil is projected by the IEA to increase by a total of +531 kb/d.

Jet fuel/kerosene in particular could post another significant gain this year of nearly +200 kb/d, or +2.5% (for the distinction between jet fuel and kerosene uses, see here). This growth is ten times larger than the increase in SAF (sustainable aviation fuels) consumption anticipated by IATA.

Beyond heightened demand and the sluggish growth of SAF supply, delivery constraints for modern aircraft continue to manifest themselves. As a result, additional air traffic cannot be offset by improved fuel efficiency.

Gasoline consumption is also expanding, albeit considerably more modestly than last year. The growing fleet of electric vehicles is gradually making its presence felt.

In Europe (OECD Europe), the transportation sector has kept oil demand stable for several years. Gasoline and jet fuel serve as the primary pillars, while diesel/gas oil demand is contracting slightly.

Your comment

- Please use our contact form

Sources

- IEA: OMR January 2026, Paris 2026

- IEF: Comparative Analysis of Monthly Oil Market Reports, Riyadh January 2026

- IEA: Oil 2025, Paris 2025

- IEA: World Energy Outlook 2025, Paris 2025

- Featured Image (Top): BFL Flux Image Generator