Übersicht

Der weltweite Fluggastverkehr legte im Mai 2025 um 5,0 Prozent gegenüber dem Vorjahresmonat zu. Er nähert sich damit einem neuen Allzeithoch. In der Luftfracht gab es ein Wachstum von 2,2 Prozent.

Die Nachfrage nach Jet fuel wird erst 2027 auf ein neues Allzeithoch steigen und dann voraussichtlich weiter wachsen.

Die langsame Modernisierung der Flotten und die zögerliche Einführung klimaschonender Treibstoffe (SAF) kann diesen Trend nur bremsen, aber bis auf weiteres nicht stoppen.

Neue Zahlen

- Passagierverkehr (Air Passenger Market)

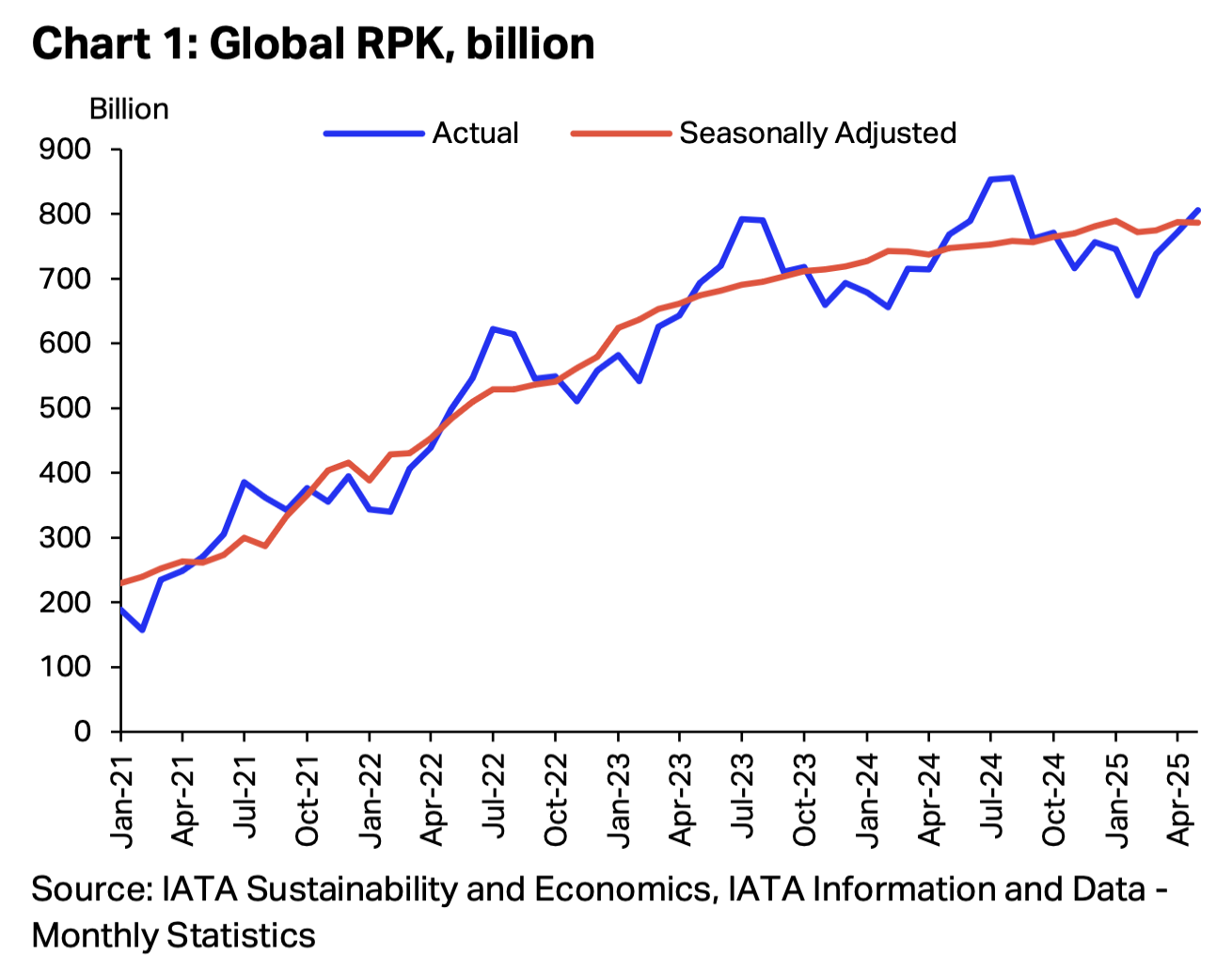

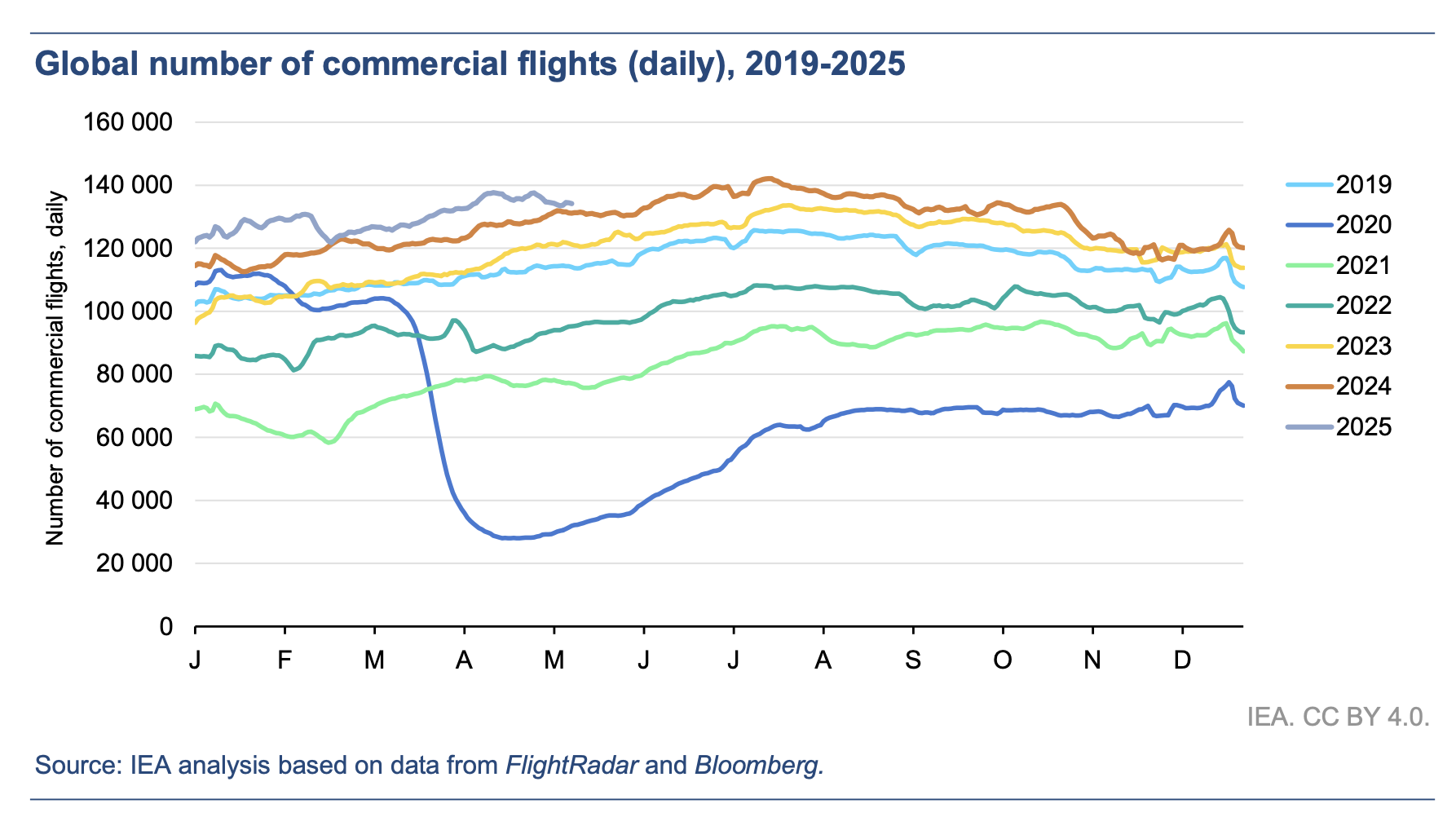

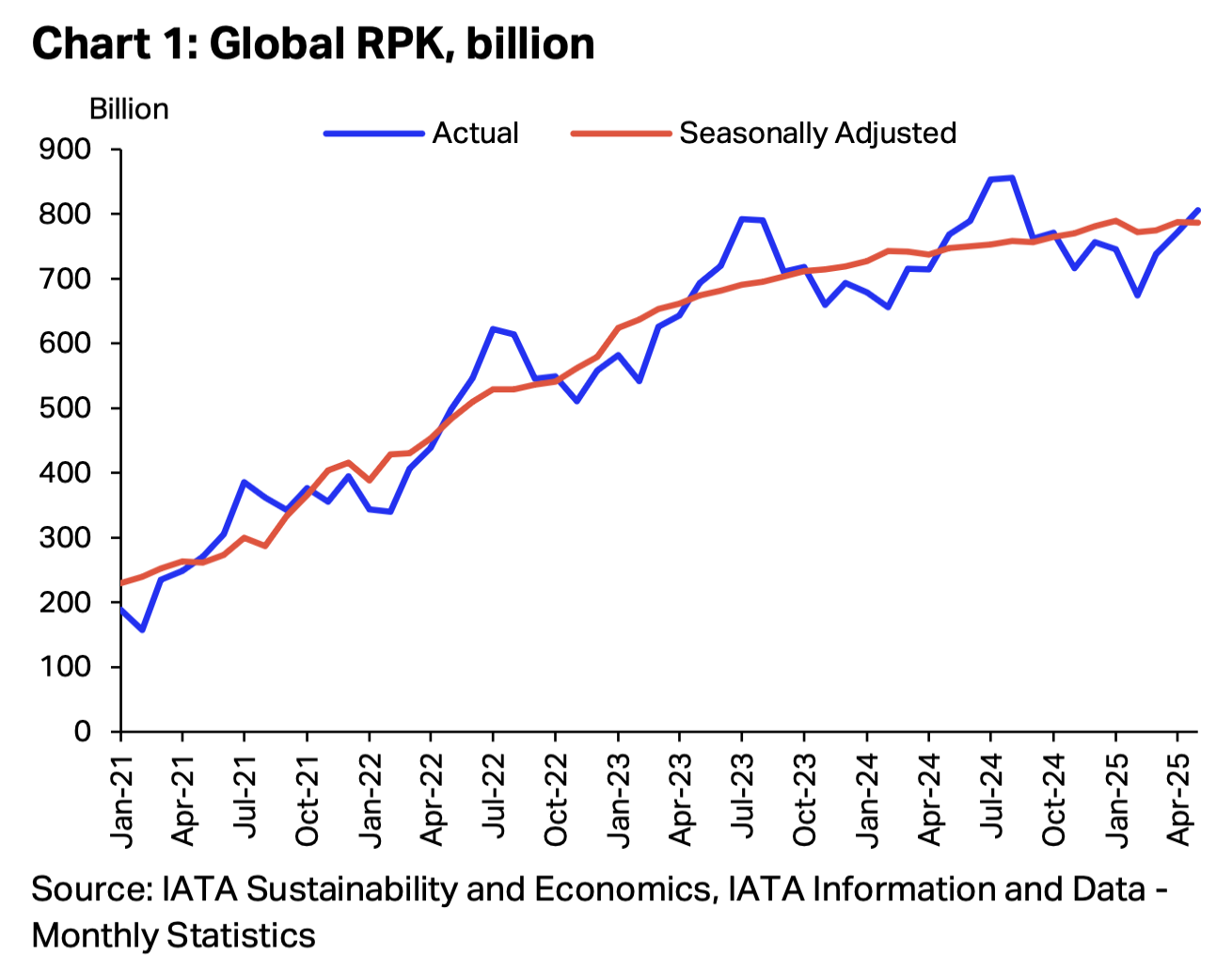

- Neue Daten von der IATA: Der Fluggastverkehr legte im Mai im Vergleich zum Vorjahresmonat um 5,0 % zu (RPK = Revenue Passenger Kilometres).

- Der internationale Luftverkehr wuchs sogar noch stärker um 6,7 %. Der nationale Fluggastverkehr legte nur um 2,1 % zu..

- Die Mai-Zahlen liegen ungefähr im Trend. In den ersten fünf Monaten des Jahres 2025 stieg die Zahl der Fluggastkilometer (RPK) um 5,8 % (international sogar um 8,1 %).

- Der Luftverkehr nähert sich damit einem neuen Allzeithoch, das über den bisherigen Rekordwerten aus dem Jahr 2019 liegt.

- Alle großen Weltregionen expandierten – mit einer Ausnahme: Nordamerika. Hier schrumpfte der Fluggastverkehr im Mai um 0,5 % gegenüber dem Vorjahresmonat.

- Luftfracht (Air Cargo)

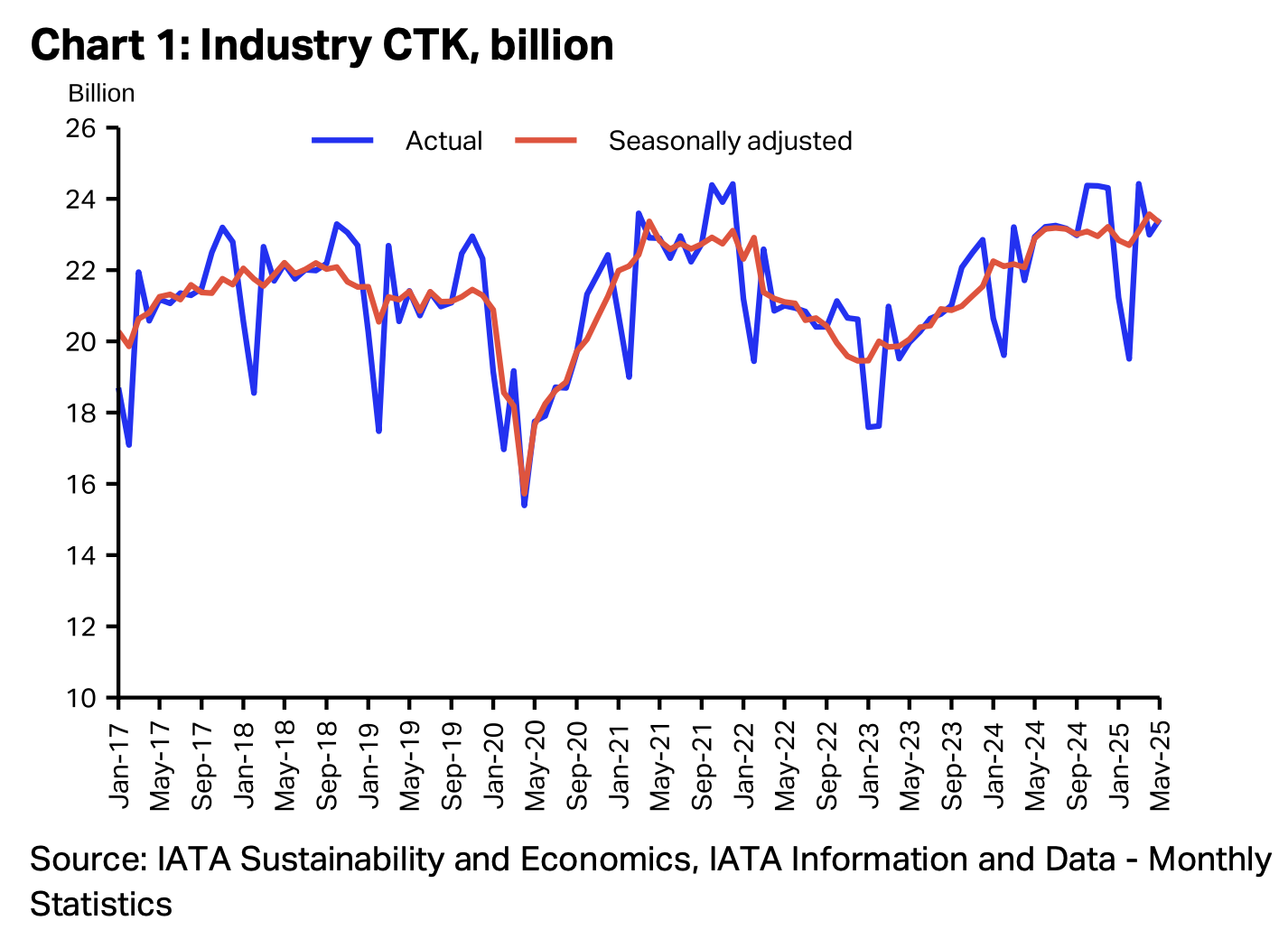

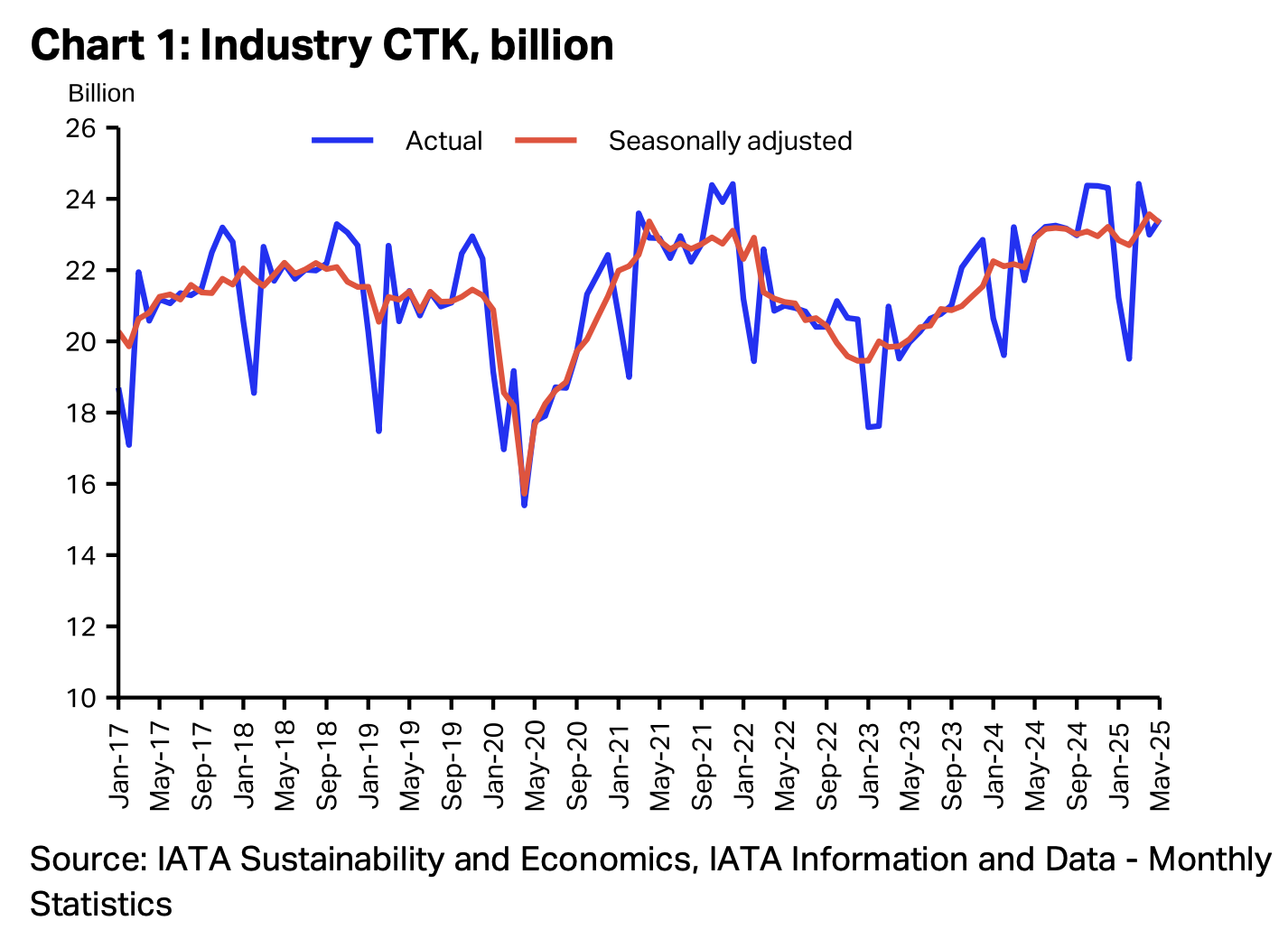

- Der Markt für Luftfracht wuchs im Mai um 2,2% gegenüber dem Vorjahr, etwas stärker als erwartet. Nordamerika fällt hier aus dem Rahmen. Der wichtige Luftfrachtkorridor Asien-Nordamerika schrumpfte im Mai um 10,7% gegenüber dem Vorjahr.

- Noch immer sind hier die Folgen der neuen Importzölle in den USA spürbar. Viele Sendungen wurden auf den April vorgezogen (+5.8% gegenüber dem Vorjahr).

- In den ersten fünf Monaten des Jahres (Januar bis Mai) stiegen die Luftfrachtmengen um durchschnittlich 3,2 Prozent gegenüber dem entsprechenden Vorjahreszeitraum.

- Jet Fuel Nachfrage

- Die Modernisierung der Aircraft-Flotten und die Einführung von Low-Carbon Fuels (SAF = Sustainable Aviation Fuels) findet zu langsam statt, um den Anstieg der Nachfrage nach Jet Fuel nicht nur zu bremsen, sondern vollständig zu stoppen.

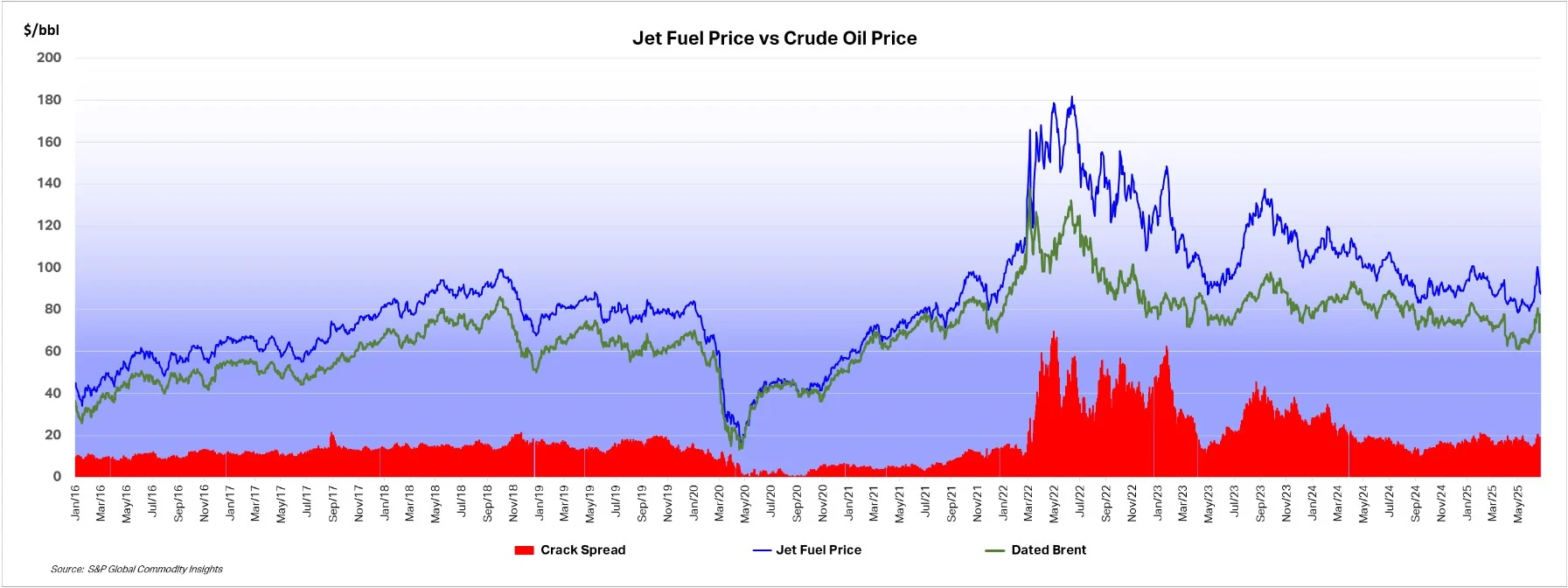

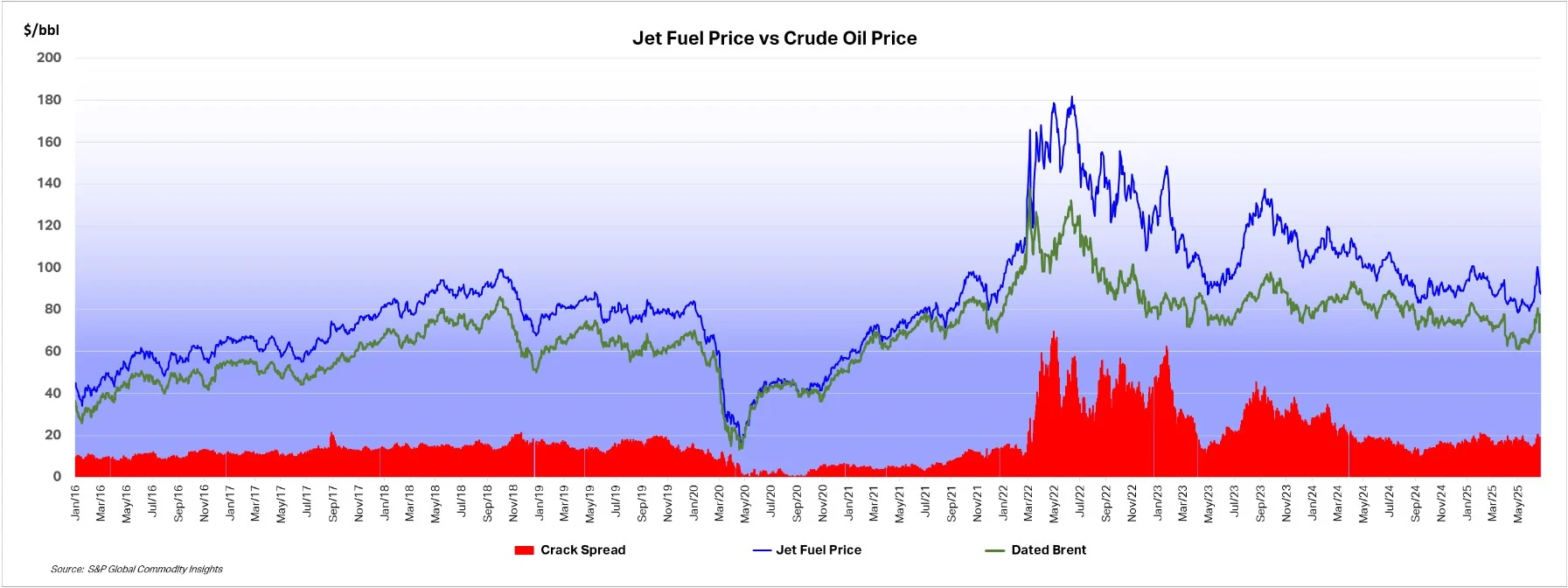

- Hinzu kommt das Problem anhaltend niedriger Ölpreise. Ende Juni kostet Jet Fuel um die 90 Dollar je Barrel ($/b) bzw. 708 Dollar jet Tonne. Dieser Preis liegt 10 Prozent unter dem Vorjahr und auf einem ähnlichen Niveau wie in den Jahren 2018 und 2019.

- Die IEA erwartet in diesem Jahr einen Anstieg des Jet Fuel Verbrauchs um 0,13 mb/d auf 7,7 mb/d (Mio. Barrel pro Tag).

- Anmerkung: Die Produktgruppe „Jet Fuel & Kerosene“ (vgl. Tabelle) deckt sich weitgehend, aber nicht völlig mit dem Verbrauch in der Luftfahrt. Kerosin wird nach wie vor in einigen Regionen der Welt zum Kochen oder zum Heizen in privaten Haushalten verwendet. Diese Märkte sind jedoch relativ klein und verlieren immer mehr an Relevanz zugunsten von LPG oder Strom.

Kontext & Kommentar

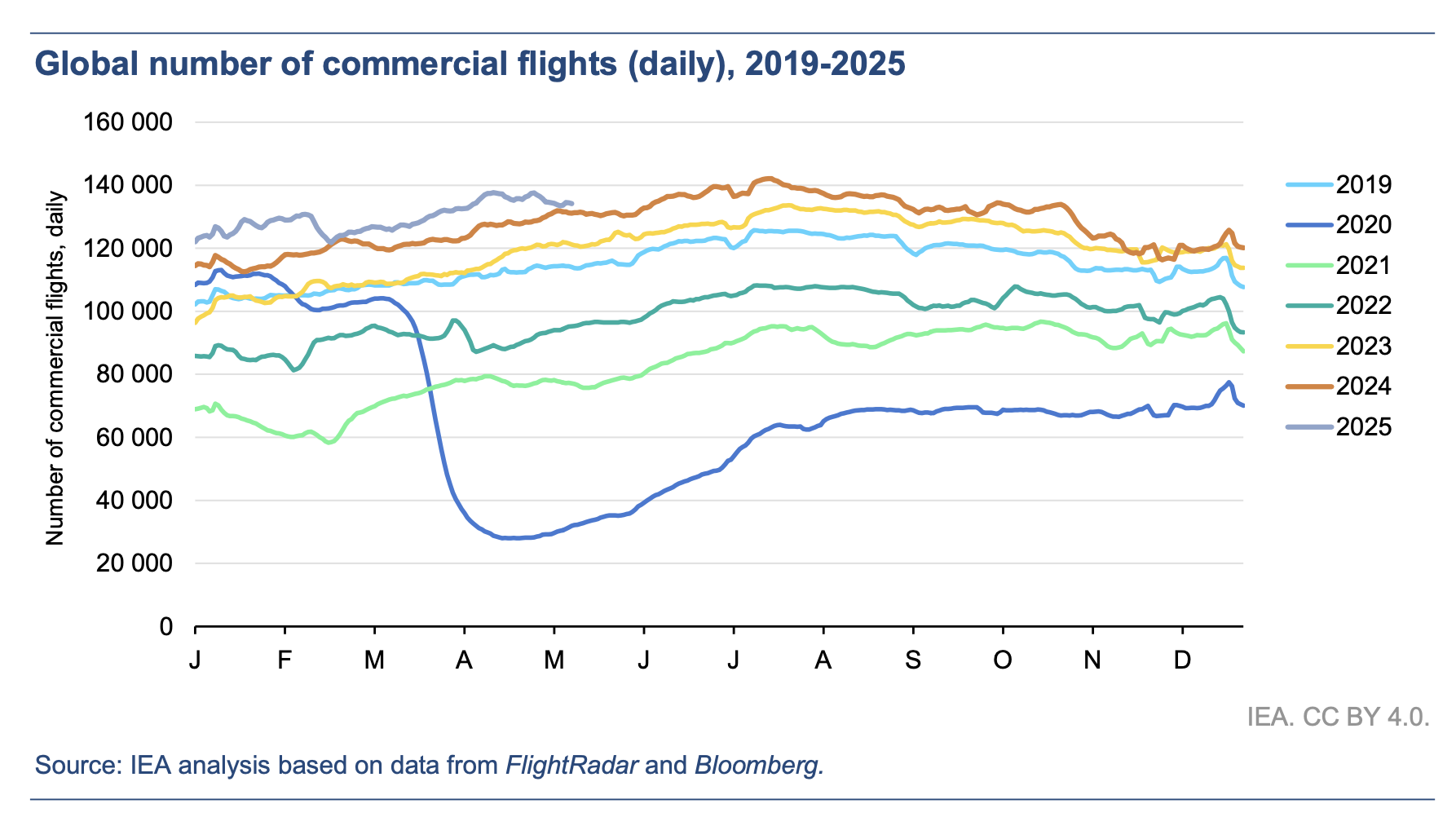

- Der globale Jet Fuel Verbrauch liegt noch unter dem Rekordniveau von 2019. Sie werden auf Basis der neuen IEA-Schätzungen wohl erst 2027 überboten. Ein weiterer Anstieg ist aus heutiger Sicht wahrscheinlich.

- Die Klimaschäden durch den Luftverkehr werden daher immer weiter steigen, ohne dass eine Lösung in Sicht wäre. Zwar verbrauchen Flugzeuge „nur“ etwa 7,5 % des globalen Ölangebots, aber es ist der einzige rasch wachsende Sektor neben der Petrochemie. Die Klimaschäden sind insgesamt sogar noch höher, da die Contrails (Kondensstreifen) in großer Höhe den Treibhausgaseffekt von Jet Fuel noch vergrößern.

- Ein Technologiesprung wie im Straßenverkehr (Elektroautos) ist im Flugverkehr nach wie vor unwahrscheinlich. Ganz im Gegenteil: Innovative Konzepte wurden von Airbus und Boeing zuletzt sogar verschoben.

Ihr Kommentar

- Bitte nutzen Sie unser Kontaktformular

Quellen

- Bild 1: IATA

- Bild 2: IATA

- Bild 3: IATA based on S&P Global Data

- Bild 4: IEA: Oil 2025, Paris June 2025

- Titelbild: © Cathay Pacific

ENGLISH VERSION

English Version

Summary

Global passenger air traffic increased by 5.0% in May, approaching a new all-time high in 2025. Demand for air cargo climbed by 2.2%.

All major air traffic regions are growing, except for North America.

Jet fuel consumption is expected to reach a new all-time high in 2027 due to sluggish fleet modernization and minimal adoption of sustainable aviation fuel (SAF).

What is new?

- Air Passenger Market

- New data from IATA: Passenger traffic rose by 5.0% in May compared to the same month last year (measured in RPK = Revenue Passenger Kilometres).

- International passenger air traffic grew even more strongly, by 6.7%. Domestic air traffic grew by 2.1%.

- These figures are roughly in line with the trend. In the first five months of 2025, passenger air traffic expanded by an average of 5.8% (international +8.1%).

- Air transport is heading for a new all-time high, surpassing the previous pre-pandemic records set in 2019.

- All regions saw strong growth – with one exception: North America. Here, air traffic declined by 0.5% in May.

- Air Cargo Market

- Air cargo demand also expanded in May, growing by 2.2% year-on-year, which was stronger than expected.

- However, the slump following the announcement of new US import tariffs in April is still noticeable. Many shipments were brought forward to April (+5.8%).

- So far, growth in the period from January to May 2025 averages +3.2% compared to the previous year.

- North America is also an outlier in the cargo segment. The important Asia-North America corridor lost 10.7% year over year in May.

- Jet fuel demand

- The modernisation of aircraft fleets and the introduction of low-carbon fuels (SAF) is too sluggish to stop the rise in jet fuel demand.

- In addition to that, low oil prices are slowing down the pressure to invest. At the end of June, jet fuel prices stood at 90 $/b (708 $/t). This is about 10% less than a year ago and at a similar level to 2018 and 2019.

- This year jet fuel consumption is expected to rise by 0.13 mb/d to 7.7 mb/d, according to the latest IEA forecast.

- Note: The „Jet Fuel & Kerosene“ product group largely, but not entirely, corresponds to jet fuel consumption in aviation. Kerosene is used for cooking in private households in some regions, and in small quantities for heating. However, these markets are relatively small and shrinking as kerosene is gradually being replaced by LPG or electricity.

Context & Comment

- Global jet fuel consumption is still below the record levels of 2019, according to new IEA estimates. However, the old highs of just under 7.9 mb/d are expected to be exceeded from 2027 onwards. A reversal of this trend is not yet in sight.

- Air transport remains the problem child of transport fuel decarbonisation. While it consumes „only“ 7.5% of global oil supplies, it is the only rapidly growing sector alongside petrochemicals. The climate effects of contrails at high altitudes even double the GHG effect.

- The medium-term outlook is not encouraging either. For all major segments of fossil oil consumption, solutions are at least in sight in principle.

- Unlike other transportation sectors, aviation has no viable fuel alternatives on the horizon until new aircraft designs (hydrogen, fuel cells, batteries) become reality.

Your comment

- Please use our contact form

Sources and additional information

- Image 1: IATA

- Image 2: IATA

- Image 3: IATA based on S&P Global Data

- Image 4: IEA: Oil 2025, Paris June 2025

- Featured Image (Top): © Cathay Pacific